Blockchain Use Cases

Blockchain for Decentralized Finance (DeFi)

Millions of people across the globe are using the Ethereum blockchain to build and participate in a new economic system that is powered by code and setting new standards for financial access, opportunity, and trust. Here’s your complete guide to the exciting new world of DeFi.

What Is Decentralized Finance (DeFi)?

Decentralized finance—often called DeFi—refers to the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. From lending and borrowing platforms to stablecoins and tokenized BTC, the DeFi ecosystem has launched an expansive network of integrated protocols and financial instruments. Now with over $13 billion worth of value locked in Ethereum smart contracts, decentralized finance has emerged as the most active sector in the blockchain space, with a wide range of use cases for individuals, developers, and institutions.

“We are a stone’s throw away from the global financial industry running on a common software infrastructure.”

–Lex Sokolin, Global Fintech Co-Head of Consensys

Whereas our traditional financial system runs on centralized infrastructure that is managed by central authorities, institutions, and intermediaries, decentralized finance is powered by code that is running on the decentralized infrastructure of the Ethereum blockchain. By deploying immutable smart contracts on Ethereum, DeFi developers can launch financial protocols and platforms that run exactly as programmed and that are available to anyone with an Internet connection.

The breakthrough of DeFi is that crypto assets can now be put to use in ways not possible with fiat or “real world” assets. Decentralized exchanges, synthetic assets, and flash loans are completely novel applications that can only exist on blockchains. This paradigm shift in financial infrastructure presents a number of advantages with regard to risk, trust, and opportunity.

What Are the Benefits of Decentralized Finance?

Decentralized finance leverages key principles of the Ethereum blockchain to increase financial security and transparency, unlock liquidity and growth opportunities, and support an integrated and standardized economic system.

Programmability.

Highly programmable smart contracts automate execution and enable the creation of new financial instruments and digital assets.

Immutability.

Tamper-proof data coordination across a blockchain’s decentralized architecture increases security and auditability.

Interoperability.

Ethereum’s composable software stack ensures that DeFi protocols and applications are built to integrate and complement one another. With DeFi, developers and product teams have the flexibility to build on top of existing protocols, customize interfaces, and integrate third-party applications. For this reason, people often call DeFi protocols “money legos.”

Transparency.

On the public Ethereum blockchain, every transaction is broadcast to and verified by other users on the network (note: Ethereum addresses are encrypted keys that are pseudo-anonymous). This level of transparency around transaction data not only allows for rich data analysis but also ensures that network activity is available to any user. Ethereum and the DeFi protocols running on it are also built with open source code that is available for anyone to view, audit, and build upon.

Permissionless.

Unlike traditional finance, DeFi is defined by its open, permissionless access: anyone with a crypto wallet and an Internet connection, regardless of their geography and often without any minimum amount of funds required, can access DeFi applications built on Ethereum.

Self-Custody.

By using Web3 wallets like

to interact with permissionless financial applications and protocols, DeFi market participants always keep custody of their assets and control of their personal data.

What Are the Use Cases for Decentralized Finance?

From DAOs to synthetic assets, decentralized finance protocols have unlocked a world of new economic activity and opportunity for users across the globe. The comprehensive list of use cases below is proof that DeFi is much more than an emerging ecosystem of projects. Rather, it’s a wholesale and integrated effort to build a parallel financial system on Ethereum that rivals centralized services because it is profoundly more accessible, resilient, and transparent.

Asset management

With DeFi protocols, you are the custodian of your own crypto funds. Crypto wallets like MetaMask, Gnosis Safe, and Argent help you easily and securely interact with decentralized applications to do everything from buying, selling, and transferring crypto to earning interest on your digital assets. In the DeFi space, you own your data: MetaMask, for example, stores your seed phrase, passwords, and private keys in an encrypted format locally on your device so that only you have access to your accounts and data.

The game changes for organizations that have heightened institutional-grade requirements for allocation capital into DeFi. For these organizations, wallets like MetaMask Institutional facilitate cryptoeconomic research, pre- and post-trade compliance, best trade execution, reporting, and of course, crypto custody.

Compliance and KYT

In traditional finance, compliance around anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) relies on know-your-customer (KYC) guidelines. In the DeFi space, Ethereum’s decentralized infrastructure enables next-generation compliance analysis around the behavior of participating addresses rather than participant identity. These know-your-transaction (KYT), such as those provided by MetaMask Institutional, help assess risk in real-time and protect against fraud and financial crimes.

DAOs

A DAO is a decentralized autonomous organization that cooperates according to transparent rules encoded on the Ethereum blockchain, eliminating the need for a centralized, administrative entity. Several popular protocols in the DeFi space, such Maker and Compound, have launched DAOs to fundraise, manage financial operations, and decentralize governance to the community.

Data and analytics

Because of their unprecedented transparency around transaction data and network activity, DeFi protocols offer unique advantages for data discovery, analysis, and decision-making around financial opportunities and risk management. The explosive growth of new DeFi applications has spurred the development of numerous tools and dashboards, such as DeFi Pulse, that help users track the value locked in DeFi protocols, assess platform risk, and compare yield and liquidity.

Derivatives

Ethereum-based smart contracts enable the creation of tokenized derivatives whose value is derived from the performance of an underlying asset and in which counterparty agreements are hardwired in code. DeFi derivatives can represent real-world assets such as fiat currencies, bonds, and commodities, as well as cryptocurrencies.

Developer and infrastructure tooling

One of the core design principles of DeFi protocols is composability, meaning different components of a system can easily connect and interoperate. As seen from the wide variety of integrated DeFi applications, composable code has created a powerful network effect in which the community continues to build upon what others have built. Many liken the process of DeFi development to building with legos—hence the increasingly popular nickname “money legos.” From Truffle’s smart contract libraries to Infura’s API suite to Diligence’s security tools, Ethereum developers and product teams are now able to build and launch DeFi protocols with the full-stack tooling and security integrations that they need.

DEXs

Decentralized exchanges (DEXs) are cryptocurrency exchanges that operate without a central authority, allowing users to transact peer-to-peer and maintain control of their funds. DEXs reduce the risk of price manipulation, as well as hacking and theft, because crypto assets are never in the custody of the exchange itself.

DEXs also give token projects access to liquidity that often rivals centralized exchanges and without any listing fees. Just a few years ago, projects would pay millions of dollars to get a token listed on a centralized exchange.

Some exchanges implement degrees of decentralization, in which centralized servers might host order books and other features but do not hold users’ private keys. Popular DEXs in the DeFi space currently include AirSwap, Liquality, Mesa, Oasis, and Uniswap. Aggregators of DeFi liquidity data, such as MetaMask Swaps, optimize trading experiences by providing DeFi users with unparalleled insight, enabling them to identify the best price quote, coupled with optimal gas prices for the given quote, the lowest failure rates.

Gaming

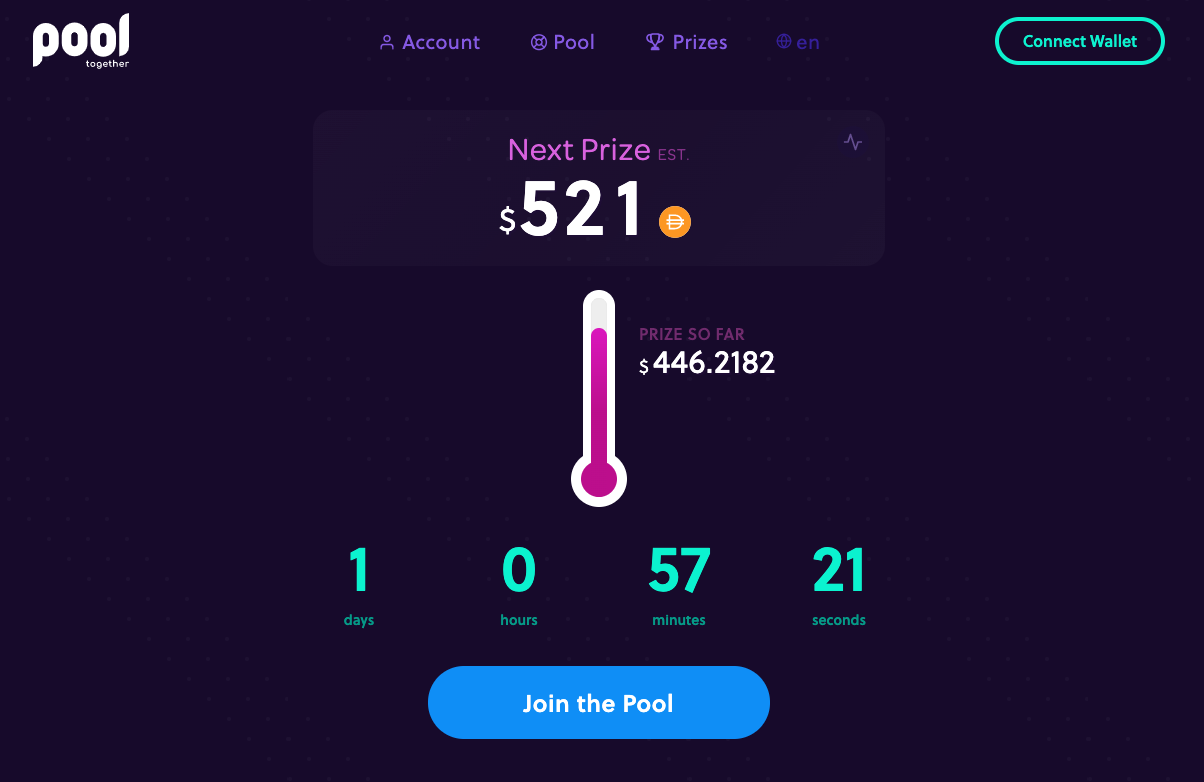

The composability of DeFi has unlocked opportunities for product developers to build DeFi protocols directly into platforms across a variety of verticals. Ethereum-based games have become a popular use case for decentralized finance because of their built-in economies and innovative incentive models. PoolTogether, for example, is a no-loss audited savings lottery that enables users to purchase digital tickets by depositing the DAI stablecoin, which is then pooled together and lent to the Compound money market protocol to earn interest.

PoolTogether is a no-loss, audited savings game powered by Ethereum.

Identity

Decentralized finance protocols paired with blockchain-based identity systems are an opportunity to help previously locked-out users access a truly global economic system. DeFi solutions can reduce the collateralization requirements for people who do not have extra funds and help assess users’ creditworthiness via attributes around reputation and financial activity, instead of traditional data points such as home ownership and income. The DeFi space prizes data privacy around personal identifying information, as well as open access. Anyone with an Internet connection can access DeFi applications while maintaining control of their data and assets.

Insurance

DeFi is still an emerging space with attendant risks around smart contract bugs and breaches. A number of innovative insurance alternatives have come to market to help users buy coverage and protect their holdings. Solutions like Nexus Mutual, for example, provide a Smart Contract Cover that protects against unintended uses of smart contract code.

Lending and borrowing

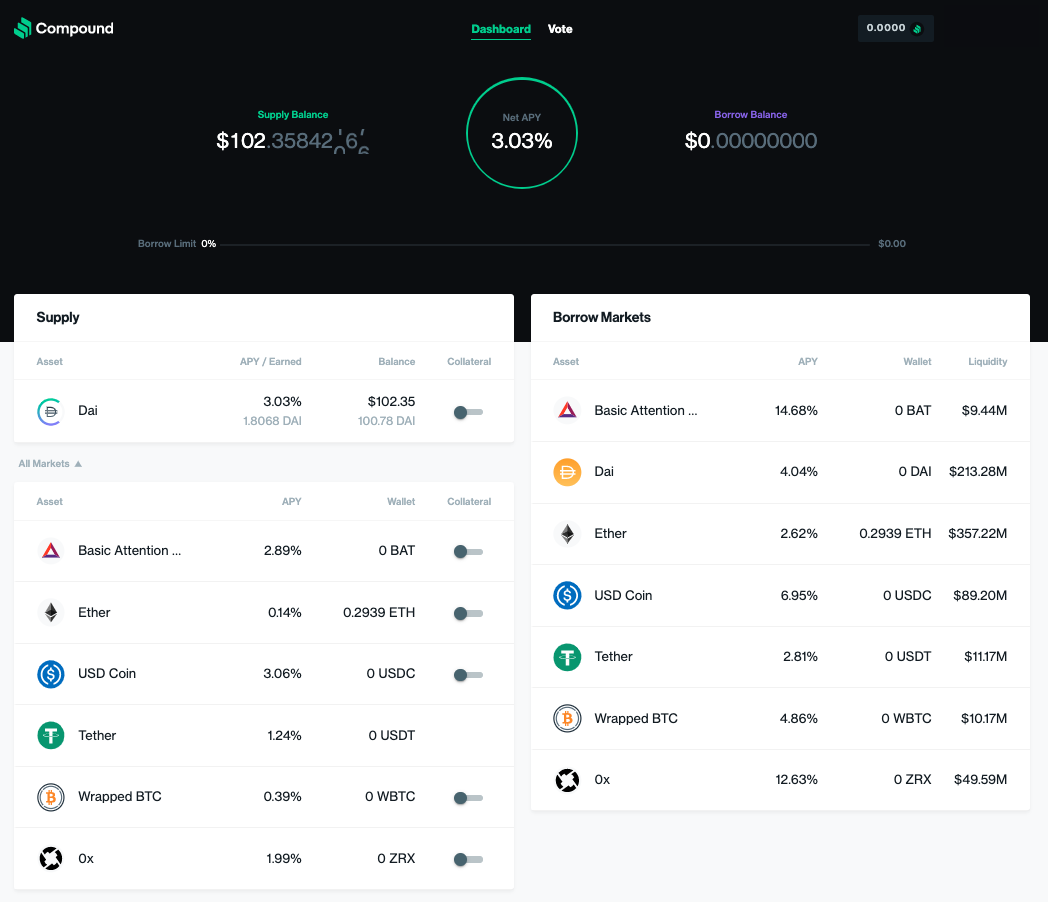

Peer-to-peer lending and borrowing protocols are some of the most widely used applications in the DeFi ecosystem. Compound, for example, is an algorithmic, autonomous interest rate protocol that integrates with and underlies a long list of DeFi platforms, including PoolTogether, Argent, and Dharma. By providing interest rate markets on Ethereum, Compound allows users to earn interest on crypto that they’ve supplied to the lending pool. The Compound smart contract automatically matches borrowers and lenders and calculates interest rate based on the ratio of borrowed to supplied assets. Compound is a compelling example of the exponential opportunity of the DeFi space: as more products integrate the Compound protocol, more and more crypto assets will be able to earn interest, even when idle.

Compound is an algorithmic, autonomous interest rate protocol.

Margin trading

Whereas margin traders in traditional finance can leverage their trades by borrowing funds from a broker (which then forms the collateral for a loan), DeFi margin trading is powered by decentralized, non-custodial lending protocols, such as Compound and dYdX. Because smart contracts automate traditional brokerage activity, some have begun referring to the rise of “autonomous money markets” in the DeFi ecosystem.

Marketplaces

DeFi protocols are supporting an array of online marketplaces that allow users to exchange products and services globally and peer-to-peer—everything from freelance coding gigs to digital collectibles to real-world jewelry and apparel.

Payments

Peer-to-peer payment is arguably the foundational use case of the DeFi space and of the blockchain ecosystem at large. Blockchain technology is architected so that users can exchange cryptocurrency securely and directly with one another, without middlemen. DeFi payment solutions are creating a more open economic system for underbanked and unbanked populations and also helping large financial institutions streamline market infrastructure and better serve wholesale and retail customers.

Prediction markets

Blockchain-based prediction markets harness the wisdom of the crowd and enable users to vote and trade value on the outcome of events. Market prices then become crowdsourced indicators of the likelihood of an event. Augur, a popular DeFi betting platform, features prediction markets around election results, sports games, economic events, and more.

Savings

By plugging into lending pool protocols like Compound, many DeFi apps offer interest-bearing accounts that can earn exponentially more than traditional savings accounts, depending on a dynamic interest rate tied to supply and demand. Popular savings apps include Argent, Dharma, and PoolTogether, a no-loss savings game in which participants get all their money back, whether or not they win.

One DeFi activity that has exploded around these innovative savings mechanisms is “yield farming.” Yield farming refers to users moving their idle crypto assets around in different liquidity protocols to maximize returns. The frenzy of excitement around DeFi yield farming has inspired no shortage of memes 🍠

Stablecoins

A stablecoin is any cryptocurrency that is pegged to a stable asset or basket of assets, such as fiat, gold, or other cryptocurrencies. Stablecoins were originally developed to reduce the volatile prices of cryptocurrency and make blockchains a viable payment solution. They are now implemented across the DeFi space for remittance payments, lending and borrowing platforms, and even institutional use cases like central bank digital currency (CBDC).

Staking

As the Ethereum network transitions to a Proof of Stake consensus algorithm with Ethereum 2.0, users will have the opportunity to stake their ETH and earn rewards, either as validators or through staking providers. Staking on Eth2 is analogous to an interest-bearing savings account: stakers receive interest (rewards) for validating blocks on the Ethereum protocol.

Synthetic assets

Related to stablecoins, synthetic assets are crypto assets that provide exposure to other assets such as gold, fiat currencies, and cryptocurrencies. They are collateralized by tokens locked into Ethereum-based smart contracts, with built-in agreements and incentive mechanisms. The Synthetix protocol, for example, implements a 750% collateralization ratio, which helps the network absorb price shocks.

Tokenization

Tokenization is one of the cornerstones of decentralized finance and a native functionality of the Ethereum blockchain. Tokens not only fuel the network but also unlock a variety of economic possibilities. Simply speaking, a token is a digital asset that is created, issued, and managed on a blockchain. Tokens are designed to be secure and instantly transferable, and they can be programmed with a range of built-in functionalities. From real estate security tokens that represent fractionalized properties to platform-specific tokens that incentivize the use of a particular application, Ethereum-based tokens have emerged as a secure and digital alternative for users across the world to access, trade, and store value.

Trading

Trading in the DeFi space encompasses a range of activities, from derivatives trading to margin trading to token swaps, and happens across an ever-growing and integrated network of exchanges, liquidity pools, and marketplaces. Crypto traders on decentralized exchanges benefit from lower exchange fees, faster transaction settlement, and full custody of their assets.

Resources

Find the latest DeFi and Web3 reports here.

Webinars

: A walkthrough the DeFi principles, and how to get started on popular DeFi protocols.

The Future of Finance: Digital Assets and DeFi: Discover the macro financial and technological trends that are sparking the exponential growth of decentralized finance.

Articles

A crypto wallet and gateway to blockchain apps

The DeFi wallet and Web3 gateway for crypto funds, market makers, and trading desks

NFT experiences and digital collectibles

The blockchain application suite powering commerce and finance.

Instant, scalable API access to the Ethereum and IPFS networks.