1 Executive Summary

This report presents the results of our engagement with the GLIF team to review a new Filecoin leasing protocol for Filecoin Storage Providers called GLIF Pools. The goal of the Protocol is to make possible the deployment of multiple Filecoin leasing pools, allowing a single Agent (representing a Filecoin Storage Provider) to lease FIL for use as pledge collateral on the Filecoin blockchain. This audit focused on the underlying Protocol code, as well as the Infinity Pool implementation as the first leasing pool built on the Protocol.

The review was conducted over three weeks, from April 10th, 2023 to April 28th, 2023, by Chingiz Mardanov and Sergii Kravchenko. A total of 5 person-weeks were spent. The fixes were reviewed over 3 days, from May 3d, 2023 to May 5th, 2023.

Prior to this review, a 10 person-weeks, informal protocol review occurred, after which the code was significantly changed. We are happy to mention that the code size, quality and business logic were drastically improved, making it easier to understand and audit the codebase. While this is the case, we still have identified several major issues that needed to be addressed. We also would like to mention that given the short time alloted for the audit and several trust assumptions the Protocol has to be used cautiously.

The GLIF Pools protocol has a large potential feature set and surface area, so the following assumptions were made about the state of the system in order to conduct an audit in a reasonable amount of time:

- The system contains only 1 leasing pool.

- The Agent Data Oracle is controlled solely by the GLIF team.

- All owner and operator keys with control over important parts of the Protocol are multisig wallets controlled by the GLIF team.

- The Filecoin precompiles used throughout the Protocol to interact with Filecoin’s built-in Minor Actor have already been audited.

Any changes to the protocol code, such as upgrades, adding off-ramp or adding additional pools, must undergo additional audits.

The security of this Protocol relies heavily on the centralization nature of its current state and any decrease in the centralization must be carefully evaluated and audited. Users must understand that the GLIF Pools Protocol is centralized and controlled by the GLIF team. We also talk about this in Trust Model section. All the issues were addressed by the GLIF team, the details of which can be found in the Findings section.

2 Scope

Our review focused on the commit hash bf28b412e0e13c87b1dfdcf4cb6ee2707bbe44f8. The list of files in scope can be found in the Appendix.

The fixes were presented on the commit hash 070dae7820c9299eb610f3300b0ae5e35b139913.

2.1 Objectives

Together with the GLIF team, we identified the following priorities for our review:

- Correctness of the implementation, consistent with the intended functionality and without unintended edge cases.

- Identify known vulnerabilities particular to smart contract systems, as outlined in our Smart Contract Best Practices, and the Smart Contract Weakness Classification Registry.

3 Security Specification

This section describes, from a security perspective, the expected behavior of the system under audit. It is not a substitute for documentation. The purpose of this section is to identify specific security properties that were validated by the audit team.

3.1 Actors

In the current system we can identify a few key actors. In order to simplify things we will do that from two different levels: external and internal relative the protocol.

On external level we have 3 main actors:

- Depositors - users who are willing to provide capital depending on the terms of the specific pool. From their perspective they are interacting with an ERC4626 vault that will have withdrawals done via a queuing system.

- Filecoin Storage Providers - are the once that will borrow the capital provided by the depositors. Those funds can either be withdrawn, when correct computerization checks are passed or used to further expand the storage provision operation.

- GLIF Protocol - acts as a place where depositors and borrowers can be matched based on the deals they would like to support.

- Oracle - is used to get the miners information of the storage provider is initially controlled by the GLIF team. Values that are passed using this oracle are crucial to the correct operation of the protocol.

On the internal level things are a bit more complex. Now we will outline the main participants that build up the main protocol.

InfinityPool - is an actor where the main actions of the protocol would happen. This pools is where depositors can deposit their funds wFIL and FIL in the current iteration and Agents can later borrow those funds.

Agent - is the contract that represents the borrower in the context of the protocol. Agent will obtain control over all of the storage provider’s miners. Transferring the ownership over the miners to the Agent contract is what prevents the borrower from running away with the borrowed funds. Agent can be though of as borrowers bank account and only funds that are not used as collateral can be withdrawn from that account.

AgentPolice - is a contract that will be controlled by the GLIF team from launch. AgentPolice verifies actions that are taking place on chain as well as oversee processes such as putting an Agent in administration or liquidating and Agent in default.

3.2 Trust Model

After thoroughly reviewing the codebase we would like to highlight that it heavily relies on a strong trust assumption that the development team will not only act with integrity and good faith but also exercise a high level of caution when making any future code changes. While we understand that trust is a fundamental aspect of any collaborative project, it is important to acknowledge that this trust assumption presents a significant risk to the security and reliability of the system. Such trust assumption include but are not limited to:

- Upgradeability of the majority of the contract such as

PoolRegistry,MinerRegistry,Agente.t.c. - Since upgradeability is done in a rather complex manner of redeploying contracts with previously non-empty state any upgrades should be done extremely carefully after an extensive testing and verification.

- For proper operation all actions that borrowers can take rely on the data submitted by a centralized oracle operated by the GLIF team. If that oracle starts reporting incorrect values the entire protocol security will be jeopardized.

- Entire concept of administration as well as the fact that AgentPolice controlled by the GLIF team, means that there are several ways in which the GLIF team could hijack the users funds. This applies to both borrowers and depositors.

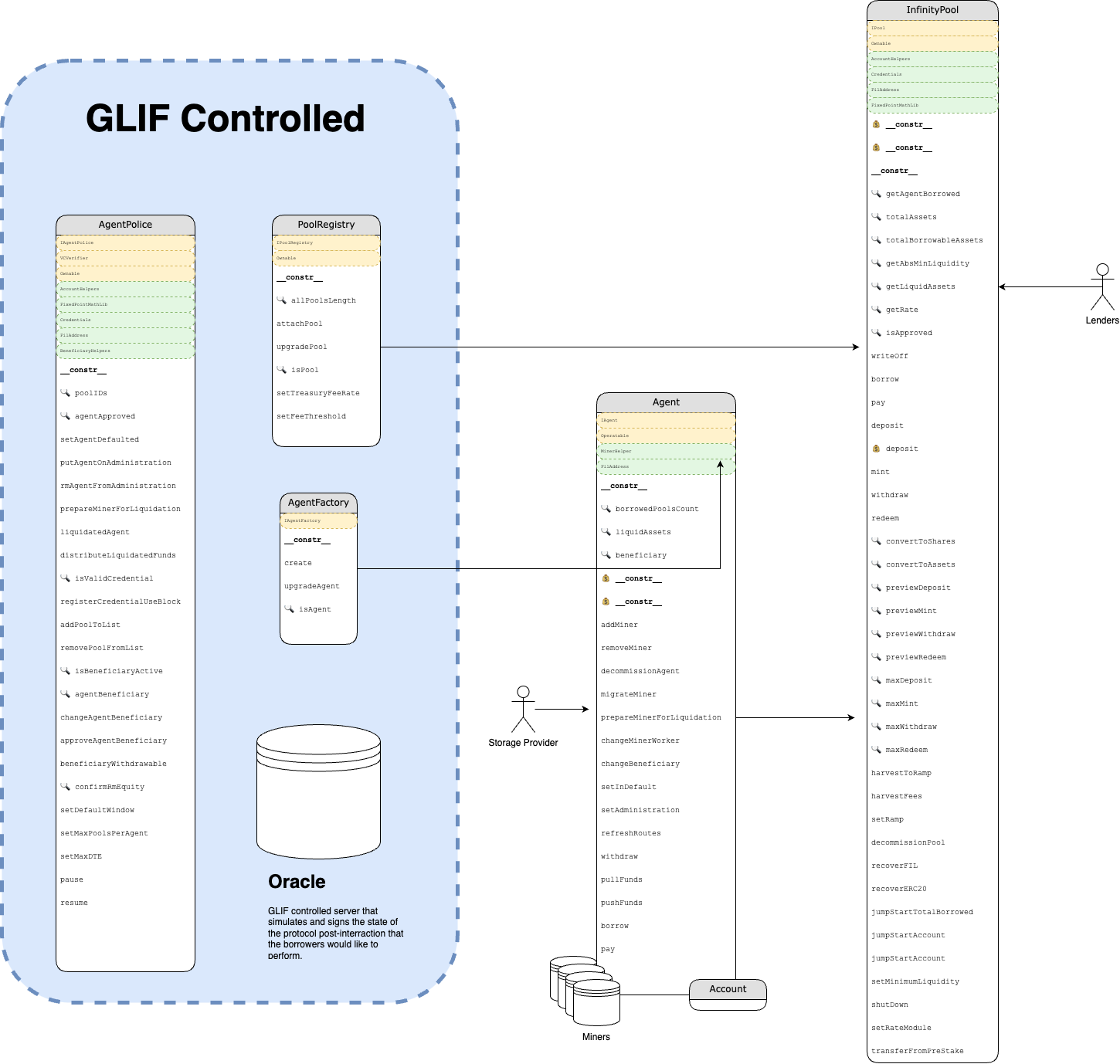

4 System Overview

-

PoolRegistry - A contract that keeps track of all the leasing pools. At launch there will be only one pool called InfinityPool. We operated under assumption that given code base will only work with one leasing pool.

-

InfinityPool - Main contract where most of the borrowing and leasing logic is contained.

-

PoolToken:Share - Contract that will represent the share of the depositor in a particular pool.

-

PoolToken:iou - Token that represents the debt of the pool in front of the depositor. You can also think of this as a ticket in a withdraw queue.

-

Agent - A contract that will control the storage providers miners or any funds that can not be withdrawn. All the actions that the storage providers would like to perform will be done via the Agent contract.

-

Account - A new struct that is created every time a lessor’s Agent opens a borrow position in a new pool.

-

AgentPolice - Contract controlled by the GLIF team that allows them to take control over agents and perform liquidations.

-

Centralized Oracle - A server that reports the signed on chain data to the Agent. This information is required to make sure that Agent can not enter bad state such as over-collateralized state for example.

5 Findings

Each issue has an assigned severity:

- Minor issues are subjective in nature. They are typically suggestions around best practices or readability. Code maintainers should use their own judgment as to whether to address such issues.

- Medium issues are objective in nature but are not security vulnerabilities. These should be addressed unless there is a clear reason not to.

- Major issues are security vulnerabilities that may not be directly exploitable or may require certain conditions in order to be exploited. All major issues should be addressed.

- Critical issues are directly exploitable security vulnerabilities that need to be fixed.

5.1 InfinityPool Contract Authorization Bypass Attack Critical ✓ Fixed

Resolution

vc.subject to be zero.

Description

An attacker could create their own credential and set the Agent ID to 0, which would bypass the subjectIsAgentCaller modifier. The attacker could use this attack to borrow funds from the pool, draining any available liquidity. For example, only an Agent should be able to borrow funds from the pool and call the borrow function:

src/Pool/InfinityPool.sol:L302-L325

function borrow(VerifiableCredential memory vc) external isOpen subjectIsAgentCaller(vc) {

// 1e18 => 1 FIL, can't borrow less than 1 FIL

if (vc.value < WAD) revert InvalidParams();

// can't borrow more than the pool has

if (totalBorrowableAssets() < vc.value) revert InsufficientLiquidity();

Account memory account = _getAccount(vc.subject);

// fresh account, set start epoch and epochsPaid to beginning of current window

if (account.principal == 0) {

uint256 currentEpoch = block.number;

account.startEpoch = currentEpoch;

account.epochsPaid = currentEpoch;

GetRoute.agentPolice(router).addPoolToList(vc.subject, id);

}

account.principal += vc.value;

account.save(router, vc.subject, id);

totalBorrowed += vc.value;

emit Borrow(vc.subject, vc.value);

// interact - here `msg.sender` must be the Agent bc of the `subjectIsAgentCaller` modifier

asset.transfer(msg.sender, vc.value);

}

The following modifier checks that the caller is an Agent:

src/Pool/InfinityPool.sol:L96-L101

modifier subjectIsAgentCaller(VerifiableCredential memory vc) {

if (

GetRoute.agentFactory(router).agents(msg.sender) != vc.subject

) revert Unauthorized();

_;

}

But if the caller is not an Agent, the GetRoute.agentFactory(router).agents(msg.sender) will return 0. And if the vc.subject is also zero, the check will be successful with any msg.sender. The attacker can also pass an arbitrary vc.value as the parameter and steal all the funds from the pool.

Recommendation

Ensure only an Agent can call borrow and pass the subjectIsAgentCaller modifier.

5.2 Agent Data Oracle Signed Credential Front-Running Attack Major ✓ Fixed

Resolution

Agent to request credentials.

Description

For almost every action as an Agent, the owner of the Agent is supposed to request SignedCredential data that contains all the relevant current info about the “off-chain” state of the Agent. New credentials can only be requested when the old one for this Agent is used or expired. Anyone can request these credentials, containing all the data about the call. So if the attacker consistently requests the credentials with the function and parameters that the actual Agent wouldn’t want to call, the Agent won’t be able to generate the credentials that are needed.

Recommendation

Ensure an Agent can always have new credentials that are needed. One solution would be to allow only an Agent’s owner to request the credentials. The problem is that the beneficiary is also supposed to do that, but the beneficiary may also be a contract.

5.3 Wrong Accounting for totalBorrowed in the InfinityPool.writeOff Function Major ✓ Fixed

Resolution

Description

Here is a part of the InfinityPool.writeOff function:

src/Pool/InfinityPool.sol:L271-L287

// transfer the assets into the pool

// whatever we couldn't pay back

uint256 lostAmt = principalOwed > recoveredFunds ? principalOwed - recoveredFunds : 0;

uint256 totalOwed = interestPaid + principalOwed;

asset.transferFrom(

msg.sender,

address(this),

totalOwed > recoveredFunds ? recoveredFunds : totalOwed

);

// write off only what we lost

totalBorrowed -= lostAmt;

// set the account with the funds the pool lost

account.principal = lostAmt;

account.save(router, agentID, id);

The totalBorrowed is decreased by the lostAmt value. Instead, it should be decreased by the original account.principal value to acknowledge the loss.

5.4 Wrong Accounting for totalBorrowed in the InfinityPool.pay Function Major ✓ Fixed

Description

If the Agent pays more than the current interest debt, the remaining payment will be accounted as repayment of the principal debt:

src/Pool/InfinityPool.sol:L382-L401

// pay interest and principal

principalPaid = vc.value - interestOwed;

// the fee basis only applies to the interest payment

feeBasis = interestOwed;

// protect against underflow

totalBorrowed -= (principalPaid > totalBorrowed) ? 0 : principalPaid;

// fully paid off

if (principalPaid >= account.principal) {

// remove the account from the pool's list of accounts

GetRoute.agentPolice(router).removePoolFromList(vc.subject, id);

// return the amount of funds overpaid

refund = principalPaid - account.principal;

// reset the account

account.reset();

} else {

// interest and partial principal payment

account.principal -= principalPaid;

// move the `epochsPaid` cursor to mark the account as "current"

account.epochsPaid = block.number;

}

Let’s focus on the totalBorrowed changes:

src/Pool/InfinityPool.sol:L387

totalBorrowed -= (principalPaid > totalBorrowed) ? 0 : principalPaid;

This value is supposed to be decreased by the principal that is repaid. So there are 2 mistakes in the calculation:

- Should be

totalBorrowedinstead of0. - The

principalPaidcannot be larger than theaccount.principalin that calculation.

5.5 The beneficiaryWithdrawable Function Can Be Called by Anyone Major ✓ Fixed

Resolution

Description

The beneficiaryWithdrawable function is supposed to be called by the Agent when a beneficiary is trying to withdraw funds:

src/Agent/AgentPolice.sol:L320-L341

function beneficiaryWithdrawable(

address recipient,

address sender,

uint256 agentID,

uint256 proposedAmount

) external returns (

uint256 amount

) {

AgentBeneficiary memory beneficiary = _agentBeneficiaries[agentID];

address benneficiaryAddress = beneficiary.active.beneficiary;

// If the sender is not the owner of the Agent or the beneficiary, revert

if(

!(benneficiaryAddress == sender || (IAuth(msg.sender).owner() == sender && recipient == benneficiaryAddress) )) {

revert Unauthorized();

}

(

beneficiary,

amount

) = beneficiary.withdraw(proposedAmount);

// update the beneficiary in storage

_agentBeneficiaries[agentID] = beneficiary;

}

This function reduces the quota that is supposed to be transferred during the withdraw call:

src/Agent/Agent.sol:L343-L352

sendAmount = agentPolice.beneficiaryWithdrawable(receiver, msg.sender, id, sendAmount);

}

else if (msg.sender != owner()) {

revert Unauthorized();

}

// unwrap any wfil needed to withdraw

_poolFundsInFIL(sendAmount);

// transfer funds

payable(receiver).sendValue(sendAmount);

The issue is that anyone can call this function directly, and the quota will be reduced without funds being transferred.

Recommendation

Ensure only the Agent can call this function.

5.6 An Agent Can Borrow Even With Existing Debt in Interest Payments Medium ✓ Fixed

Resolution

Description

To borrow funds, an Agent has to call the borrow function of the pool:

src/Pool/InfinityPool.sol:L302-L325

function borrow(VerifiableCredential memory vc) external isOpen subjectIsAgentCaller(vc) {

// 1e18 => 1 FIL, can't borrow less than 1 FIL

if (vc.value < WAD) revert InvalidParams();

// can't borrow more than the pool has

if (totalBorrowableAssets() < vc.value) revert InsufficientLiquidity();

Account memory account = _getAccount(vc.subject);

// fresh account, set start epoch and epochsPaid to beginning of current window

if (account.principal == 0) {

uint256 currentEpoch = block.number;

account.startEpoch = currentEpoch;

account.epochsPaid = currentEpoch;

GetRoute.agentPolice(router).addPoolToList(vc.subject, id);

}

account.principal += vc.value;

account.save(router, vc.subject, id);

totalBorrowed += vc.value;

emit Borrow(vc.subject, vc.value);

// interact - here `msg.sender` must be the Agent bc of the `subjectIsAgentCaller` modifier

asset.transfer(msg.sender, vc.value);

}

Let’s assume that the Agent already had some funds borrowed. During this function execution, the current debt status is not checked. The principal debt increases after borrowing, but account.epochsPaid remains the same. So the pending debt will instantly increase as if the borrowing happened on account.epochsPaid.

Recommendation

Ensure the debt is paid when borrowing more funds.

5.7 The AgentPolice.distributeLiquidatedFunds() Function Can Have Undistributed Residual Funds Medium ✓ Fixed

Resolution

wFil to the Agent’s owner. The only trick here is that the Agent’s owner should be able to manage these funds.

Description

When an Agent is liquidated, the liquidator (owner of the protocol) is supposed to try to redeem as many funds as possible and re-distribute them to the pools:

src/Agent/AgentPolice.sol:L185-L191

function distributeLiquidatedFunds(uint256 agentID, uint256 amount) external {

if (!liquidated[agentID]) revert Unauthorized();

// transfer the assets into the pool

GetRoute.wFIL(router).transferFrom(msg.sender, address(this), amount);

_writeOffPools(agentID, amount);

}

The problem is that in the pool, it’s accounted that the amount of funds can be larger than the debt. In that case, the pool won’t transfer more funds than the pool needs:

src/Pool/InfinityPool.sol:L275-L289

uint256 totalOwed = interestPaid + principalOwed;

asset.transferFrom(

msg.sender,

address(this),

totalOwed > recoveredFunds ? recoveredFunds : totalOwed

);

// write off only what we lost

totalBorrowed -= lostAmt;

// set the account with the funds the pool lost

account.principal = lostAmt;

account.save(router, agentID, id);

emit WriteOff(agentID, recoveredFunds, lostAmt, interestPaid);

If that happens, the remaining funds will be stuck in the AgentPolice contract.

Recommendation

Return the residual funds to the Agent’s owner or process them in some way so they are not lost.

5.8 An Agent Can Be Upgraded Even if There Is No New Implementation Medium ✓ Fixed

Resolution

Description

Agents can be upgraded to a new implementation, and only the Agent’s owner can call the upgrade function:

src/Agent/AgentFactory.sol:L51-L72

function upgradeAgent(

address agent

) external returns (address newAgent) {

IAgent oldAgent = IAgent(agent);

address owner = IAuth(address(oldAgent)).owner();

uint256 agentId = agents[agent];

// only the Agent's owner can upgrade, and only a registered agent can be upgraded

if (owner != msg.sender || agentId == 0) revert Unauthorized();

// deploy a new instance of Agent with the same ID and auth

newAgent = GetRoute.agentDeployer(router).deploy(

router,

agentId,

owner,

IAuth(address(oldAgent)).operator()

);

// Register the new agent and unregister the old agent

agents[newAgent] = agentId;

// transfer funds from old agent to new agent and mark old agent as decommissioning

oldAgent.decommissionAgent(newAgent);

// delete the old agent from the registry

agents[agent] = 0;

}

The issue is that the owner can trigger the upgrade even if no new implementation exists. Multiple possible problems derive from it.

- Upgrading to the current implementation of the Agent will break the logic because the current version is not calling the

migrateMinerfunction, so all the miners will stay with the old Agent, and their funds will be lost. - The owner can accidentally trigger multiple upgrades simultaneously, leading to a loss of funds (https://github.com/ConsenSysDiligence/glif-audit-2023-04/issues/2).

The owner also has no control over the new version of the Agent. To increase decentralization, it’s better to pass the deployer’s address as a parameter additionally.

Recommendation

Ensure the upgrades can only happen when there is a new version of an Agent, and the owner controls this version.

5.9 Potential Re-Entrancy Issues When Upgrading the Contracts Minor ✓ Fixed

Resolution

Description

The protocol doesn’t have any built-in re-entrancy protection mechanisms. That mainly explains by using the wFIL token, which is not supposed to give that opportunity. And also by carefully using FIL transfers.

However, there are some places in the code where things may go wrong in the future. For example, when upgrading an Agent:

src/Agent/AgentFactory.sol:L51-L72

function upgradeAgent(

address agent

) external returns (address newAgent) {

IAgent oldAgent = IAgent(agent);

address owner = IAuth(address(oldAgent)).owner();

uint256 agentId = agents[agent];

// only the Agent's owner can upgrade, and only a registered agent can be upgraded

if (owner != msg.sender || agentId == 0) revert Unauthorized();

// deploy a new instance of Agent with the same ID and auth

newAgent = GetRoute.agentDeployer(router).deploy(

router,

agentId,

owner,

IAuth(address(oldAgent)).operator()

);

// Register the new agent and unregister the old agent

agents[newAgent] = agentId;

// transfer funds from old agent to new agent and mark old agent as decommissioning

oldAgent.decommissionAgent(newAgent);

// delete the old agent from the registry

agents[agent] = 0;

}

Here, we see the oldAgent.decommissionAgent(newAgent); call happens before the oldAgent is deleted. Inside this function, we see:

src/Agent/Agent.sol:L200-L212

function decommissionAgent(address _newAgent) external {

// only the agent factory can decommission an agent

AuthController.onlyAgentFactory(router, msg.sender);

// if the newAgent has a mismatching ID, revert

if(IAgent(_newAgent).id() != id) revert Unauthorized();

// set the newAgent in storage, which marks the upgrade process as starting

newAgent = _newAgent;

uint256 _liquidAssets = liquidAssets();

// Withdraw all liquid funds from the Agent to the newAgent

_poolFundsInFIL(_liquidAssets);

// transfer funds to new agent

payable(_newAgent).sendValue(_liquidAssets);

}

Here, the FIL is transferred to a new contract which is currently unimplemented and unknown. Potentially, the fallback function of this contract could trigger a re-entrancy attack. If that’s the case, during the execution of this function, there will be two contracts that are active agents with the same ID, and the attacker can try to use that maliciously.

Recommendation

Be very cautious with further implementations of agents and pools. Also, consider using reentrancy protection in public functions.

5.10 InfinityPool Is Subject to a Donation With Inflation Attack if Emtied. Minor ✓ Fixed

Resolution

Description

Since InfinityPool is an implementation of the ERC4626 vault, it is too susceptible to inflation attacks. An attacker could front-run the first deposit and inflate the share price to an extent where the following deposit will be less than the value of 1 wei of share resulting in 0 shares minted. The attacker could conduct the inflation by means of self-destructing of another contract. In the case of GLIF this attack is less likely on the first pool since GLIF team accepts predeposits so some amount of shares was already minted. We do suggest fixing this issue before the next pool is deployed and no pre-stake is generated.

Examples

src/Pool/InfinityPool.sol:L491-L516

/*//////////////////////////////////////////////////////////////

4626 LOGIC

//////////////////////////////////////////////////////////////*/

/**

* @dev Converts `assets` to shares

* @param assets The amount of assets to convert

* @return shares - The amount of shares converted from assets

*/

function convertToShares(uint256 assets) public view returns (uint256) {

uint256 supply = liquidStakingToken.totalSupply(); // Saves an extra SLOAD if totalSupply is non-zero.

return supply == 0 ? assets : assets * supply / totalAssets();

}

/**

* @dev Converts `shares` to assets

* @param shares The amount of shares to convert

* @return assets - The amount of assets converted from shares

*/

function convertToAssets(uint256 shares) public view returns (uint256) {

uint256 supply = liquidStakingToken.totalSupply(); // Saves an extra SLOAD if totalSupply is non-zero.

return supply == 0 ? shares : shares * totalAssets() / supply;

}

Recommendation

Since the pool does not need to accept donations, the easiest way to handle this case is to use virtual price, where the balance of the contract is duplicated in a separate variable.

5.11 MaxWithdraw Should Potentially Account for the Funds Available in the Ramp. Minor ✓ Fixed

Resolution

Description

Since InfinityPool is ERC4626 it should also support the MaxWithdraw method. According to the EIP it should include any withdrawal limitation that the participant could encounter. At the moment the MaxWithdraw function returns the maximum amount of IOU tokens rather than WFIL. Since IOU token is not the asset token of the vault, this behavior is not ideal.

Examples

src/Pool/InfinityPool.sol:L569-L571

function maxWithdraw(address owner) public view returns (uint256) {

return convertToAssets(liquidStakingToken.balanceOf(owner));

}

Recommendation

We suggest considering returning the maximum amount of WFIL withdrawal which should account for Ramp balance.

5.12 The Upgradeability of MinerRegistry, AgentPolice, and Agent Is Overcomplicated and Has a Hight Chance of Errors. Minor Acknowledged

Description

During the engagement, we have identified a few places that signify that the Agent, MinerRegistry and AgentPolice can be upgraded, for example:

- Ability to migrate the miner from one version of the Agent to another inside the

migrateMiner. - Ability to

refreshRoutesthat would update theAgentPoliceandMinerRegistryaddresses for a given Agent. - Ability to

decommissionpool. We believe that this functionality is present it is not very well thought through. For example, bothMinerRegistryandAgentPoliceare not upgradable but have mappings inside of them.

src/Agent/AgentPolice.sol:L51-L60

mapping(uint256 => bool) public liquidated;

/// @notice `_poolIDs` maps agentID to the pools they have actively borrowed from

mapping(uint256 => uint256[]) private _poolIDs;

/// @notice `_credentialUseBlock` maps signature bytes to when a credential was used

mapping(bytes32 => uint256) private _credentialUseBlock;

/// @notice `_agentBeneficiaries` maps an Agent ID to its Beneficiary struct

mapping(uint256 => AgentBeneficiary) private _agentBeneficiaries;

src/Agent/MinerRegistry.sol:L18-L20

mapping(bytes32 => bool) private _minerRegistered;

mapping(uint256 => uint64[]) private _minersByAgent;

That means that any time these contracts would need to be upgraded, the contents of those mappings will need to be somehow recreated in the new contract. That is not trivial since it is not easy to obtain all values of a mapping. This will also require an additional protocol-controlled setter ala kickstart mapping functions that are not ideal.

In the case of Agent if the contract was upgradable there would be no need for a process of migrating miners that can be tedious and opens possibilities for errors. Since protocol has a lot of centralization and trust assumptions already, having upgradability will not contribute to it a lot.

We also believe that during the upgrade of the pool, the PoolToken will stay the same in the new pool. That means that the minting and burning permissions of the share tokens have to be carefully updated or checked in a manner that does not require the address of the pool to be constant. Since we did not have access to this file, we can not check if that is done correctly.

Recommendation

Consider using upgradable contracts or have a solid upgrade plan that is well-tested before an emergency situation occurs.

5.13 Mint Function in the Infinity Pool Will Emit the Incorrect Value. Minor ✓ Fixed

Resolution

Description

In the InifinityPool file the mint function recomputes the amount of the assets before emitting the event. While this is fine in a lot of cases, that will not always be true. The result of previewMint and convertToAssets will only be equal while the totalAssets and totalSupply are equal. For example, this assumption will break after the first liquidation.

Examples

src/Pool/InfinityPool.sol:L449-L457

function mint(uint256 shares, address receiver) public isOpen returns (uint256 assets) {

if(shares == 0) revert InvalidParams();

// These transfers need to happen before the mint, and this is forcing a higher degree of coupling than is ideal

assets = previewMint(shares);

asset.transferFrom(msg.sender, address(this), assets);

liquidStakingToken.mint(receiver, shares);

assets = convertToAssets(shares);

emit Deposit(msg.sender, receiver, assets, shares);

}

Recommendation

Use the assets value computed by the previewMint when emitting the event.

5.14 Incorrect Operator Used Minor ✓ Fixed

Resolution

Description

Minor typo in the InfinityPool where the -= should be replaced with -.

Examples

src/Pool/InfinityPool.sol:L200

return balance -= feesCollected;

5.15 Potential Overpayment Due to Rounding Imprecision Minor Won't Fix

Resolution

Description

Inside the InifintyPool the pay function might accept unaccounted files. Imagine a situation where an Agent is trying to repay only the fees portion of the debt. In that case, the following branch will be executed:

src/Pool/InfinityPool.sol:L373-L381

if (vc.value <= interestOwed) {

// compute the amount of epochs this payment covers

// vc.value is not WAD yet, so divWadDown cancels the extra WAD in interestPerEpoch

uint256 epochsForward = vc.value.divWadDown(interestPerEpoch);

// update the account's `epochsPaid` cursor

account.epochsPaid += epochsForward;

// since the entire payment is interest, the entire payment is used to compute the fee (principal payments are fee-free)

feeBasis = vc.value;

} else {

The issue is if the value does not divide by the interestPerEpoch exactly, any remainder will remain in the InfinityPool.

src/Pool/InfinityPool.sol:L376

uint256 epochsForward = vc.value.divWadDown(interestPerEpoch);

Recommendation

Since the remainder will most likely not be too large this is not critical, but ideally, those remaining funds would be included in the refund variable.

5.16 jumpStartAccount Should Be Subject to the Same Approval Checks as Regular Borrow. Minor ✓ Fixed

Resolution

Description

InfinityPool contract has the ability to kick start an account that will have a debt position in this pool.

Examples

src/Pool/InfinityPool.sol:L673-L689

function jumpStartAccount(address receiver, uint256 agentID, uint256 accountPrincipal) external onlyOwner {

Account memory account = _getAccount(agentID);

// if the account is already initialized, revert

if (account.principal != 0) revert InvalidState();

// create the account

account.principal = accountPrincipal;

account.startEpoch = block.number;

account.epochsPaid = block.number;

// save the account

account.save(router, agentID, id);

// add the pool to the agent's list of borrowed pools

GetRoute.agentPolice(router).addPoolToList(agentID, id);

// mint the iFIL to the receiver, using principal as the deposit amount

liquidStakingToken.mint(receiver, convertToShares(accountPrincipal));

// account for the new principal in the total borrowed of the pool

totalBorrowed += accountPrincipal;

}

Recommendation

We suggest that this action is subject to the same rules as the standard borrow action. Thus checks on DTE, LTV and DTI should be done if possible.

5.17 No Miner Migration Is Happening in the Current Implementation of the Agent Acknowledged

Description

All miners should be transferred from the old Agent to a new one when upgrading an Agent. To do so, the new Agent is supposed to call the migrateMiner function for every miner:

src/Agent/Agent.sol:L219-L235

function migrateMiner(uint64 miner) external {

if (newAgent != msg.sender) revert Unauthorized();

uint256 newId = IAgent(newAgent).id();

if (

// first check to make sure the agentFactory knows about this "agent"

GetRoute.agentFactory(router).agents(newAgent) != newId ||

// then make sure this is the same agent, just upgraded

newId != id ||

// check to ensure this miner was registered to the original agent

!minerRegistry.minerRegistered(id, miner)

) revert Unauthorized();

// propose an ownership change (must be accepted in v2 agent)

miner.changeOwnerAddress(newAgent);

emit MigrateMiner(msg.sender, newAgent, miner);

}

The problem is that this function is not called in the current Agent implementation. Since it’s just the first version of an Agent contract, it’s not a big issue. There is only one edge case where this may be a vulnerability. That may happen if the owner of an Agent decides to upgrade the contract to the same version. It is possible to do, and in that case, the miners’ funds will be lost.

Recommendation

It’s important to remember to call migrateMiner in a new version and not allow upgrading to the same implementation.

Appendix 1 - Files in Scope

This audit covered the following files:

| File | SHA-1 hash |

|---|---|

| code/src/Router/GetRoute.sol | 6daec127e02969538f425c58e6ca9ecef9bc4db5 |

| code/src/Router/Router.sol | 0685f3bf844c53bb0e659d97863776cd93232ab8 |

| code/src/Credentials/CredParser.sol | b2a63105b1e9d661191e0c66c9edca7571bbeb88 |

| code/src/Pool/RateModule.sol | 9b1440a9a162e83a2842592d6396d27c14c03f5d |

| code/src/Pool/InfinityPool.sol | 5b0774d40a66d267cd61a4c37c66039c7b7d0f5b |

| code/src/Pool/Account.sol | 51dceec029f4cff019324a24af2e601754ac1a4e |

| code/src/Pool/PoolRegistry.sol | cdddeadd14f0a06789574834866b1f9fee98c3d3 |

| code/src/OffRamp/OffRamp.sol | 762ffaf1e056971cd6ec28e20034f9d26ada7d14 |

| code/src/Ping.sol | 722e3a96f7bd2c95a5222c6d71a1e3e1805849a2 |

| code/src/Agent/AgentDeployer.sol | 5955c1baf1d4a4a4033af6f6aef4d7d9e8aac22a |

| code/src/Agent/AgentFactory.sol | 3f6409e8539aea04a3470892d8e6ebe565c9cfd8 |

| code/src/Agent/AgentPolice.sol | d97389ef65f7454b2f07f55977b97a127ea9ce0b |

| code/src/Agent/MinerRegistry.sol | 2694498172c5bf7437b15639c6a8c117c5721795 |

| code/src/Agent/Agent.sol | 60615e447a530d7c75e00ed6555b49a1cc2d8067 |

| code/src/Constants/Epochs.sol | 18a0ec65da645d7d05815d53e8aace210b4131a0 |

| code/src/Constants/Routes.sol | 8048a5a27d3c15c7c900a460ae7679df1b1c1efe |

| code/src/Auth/Operatable.sol | bc7dd5c1e38d44a00edea5eecd03d6782681dcc9 |

| code/src/VCVerifier/VCVerifier.sol | 779b4b371db9eaea011fdfc76c372e3f4b119a39 |

| code/src/Auth/AuthController.sol | 16832e4269494bf27e76f3378ed600554a042ea0 |

| code/src/Auth/Ownable.sol | 5d19f86e7d61d2ef5372000a39bca6c3c4cfebfe |

| code/src/Types/Interfaces/IRouter.sol | 4b7f9c9c3ba75a492826e4bdd3892c4d706e93ad |

| code/src/Types/Interfaces/IPoolDeployer.sol | 621e6fbc2784b5c62b415b953d9a7cde7b983462 |

| code/src/Types/Interfaces/IERC4626.sol | d0e4c0bd84830bebebfb5edfc80e7c986063a850 |

| code/src/Types/Interfaces/IPoolToken.sol | 7947c77739d58e18d3951b91489ee990f20770ab |

| code/src/Types/Interfaces/IWFIL.sol | 5f1126c9c67d9b37911e87c89f1960b55e35e81b |

| code/src/Types/Interfaces/IPool.sol | a3a134716825a01c6b7a763096cb6c7f0484d763 |

| code/src/Types/Interfaces/IOffRamp.sol | 8dcfeef23ec2e18bda2cb493a2977b3c6f63afb2 |

| code/src/Types/Interfaces/IRateModule.sol | fb9b4c66c875c857ea8463df57f1db8b0df4ac55 |

| code/src/Types/Interfaces/IMinerRegistry.sol | fb68f01e13eefb983ce11f563346347ca227fba1 |

| code/src/Types/Interfaces/IAuth.sol | e01dee1cbc4b6f06138cb7b0cbea8863304eb82f |

| code/src/Types/Interfaces/IAgentFactory.sol | 4f1043dad394f463d83f677dfd8bb1f7fc18407d |

| code/src/Types/Interfaces/IVCVerifier.sol | e0ca19720aba9706ba1b34838d09424c5bd4ead4 |

| code/src/Types/Interfaces/IInfinityPool.sol | eda51ffa1d28a1a74385919e812f78510b574b56 |

| code/src/Types/Interfaces/IPoolTokenPlus.sol | 95bf761a0193943f86c4039c1833c096064cd52c |

| code/src/Types/Interfaces/IAgent.sol | d490fa07cb644d88dbb6df9538a42f0256360e6d |

| code/src/Types/Interfaces/IPoolRegistry.sol | bc9507b8cac85e1b092e1a98e755942b5f5280ab |

| code/src/Types/Interfaces/IAgentPolice.sol | 7cf78393300ccef96c3bbb74dcd22aa5b3a62314 |

| code/src/Types/Interfaces/IAgentDeployer.sol | 0e01ccb2420db5f934870d36900c101f666c9cd1 |

| code/src/Types/Interfaces/IERC20.sol | 3f8f9d66083281998547ead9e2a599f5e3d049f8 |

| code/src/Types/Interfaces/ICredentials.sol | bdda5c48fcbe34ba8d4ab64e87bfaf51873d726e |

| code/src/Types/Structs/Credentials.sol | bdfa1dcec12d187719fe4b02bc4a42e713f2ef6d |

| code/src/Types/Structs/Account.sol | 2bef81b3f52d6f91ef02a8373ea015ca4d33249a |

| code/src/Types/Structs/Beneficiary.sol | 36635042594c7b8b73a80dbabaecd63c7bf423d7 |

Appendix 2 - Disclosure

ConsenSys Diligence (“CD”) typically receives compensation from one or more clients (the “Clients”) for performing the analysis contained in these reports (the “Reports”). The Reports may be distributed through other means, including via ConsenSys publications and other distributions.

The Reports are not an endorsement or indictment of any particular project or team, and the Reports do not guarantee the security of any particular project. This Report does not consider, and should not be interpreted as considering or having any bearing on, the potential economics of a token, token sale or any other product, service or other asset. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. No Report provides any warranty or representation to any Third-Party in any respect, including regarding the bugfree nature of code, the business model or proprietors of any such business model, and the legal compliance of any such business. No third party should rely on the Reports in any way, including for the purpose of making any decisions to buy or sell any token, product, service or other asset. Specifically, for the avoidance of doubt, this Report does not constitute investment advice, is not intended to be relied upon as investment advice, is not an endorsement of this project or team, and it is not a guarantee as to the absolute security of the project. CD owes no duty to any Third-Party by virtue of publishing these Reports.

PURPOSE OF REPORTS The Reports and the analysis described therein are created solely for Clients and published with their consent. The scope of our review is limited to a review of code and only the code we note as being within the scope of our review within this report. Any Solidity code itself presents unique and unquantifiable risks as the Solidity language itself remains under development and is subject to unknown risks and flaws. The review does not extend to the compiler layer, or any other areas beyond specified code that could present security risks. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. In some instances, we may perform penetration testing or infrastructure assessments depending on the scope of the particular engagement.

CD makes the Reports available to parties other than the Clients (i.e., “third parties”) – on its website. CD hopes that by making these analyses publicly available, it can help the blockchain ecosystem develop technical best practices in this rapidly evolving area of innovation.

LINKS TO OTHER WEB SITES FROM THIS WEB SITE You may, through hypertext or other computer links, gain access to web sites operated by persons other than ConsenSys and CD. Such hyperlinks are provided for your reference and convenience only, and are the exclusive responsibility of such web sites’ owners. You agree that ConsenSys and CD are not responsible for the content or operation of such Web sites, and that ConsenSys and CD shall have no liability to you or any other person or entity for the use of third party Web sites. Except as described below, a hyperlink from this web Site to another web site does not imply or mean that ConsenSys and CD endorses the content on that Web site or the operator or operations of that site. You are solely responsible for determining the extent to which you may use any content at any other web sites to which you link from the Reports. ConsenSys and CD assumes no responsibility for the use of third party software on the Web Site and shall have no liability whatsoever to any person or entity for the accuracy or completeness of any outcome generated by such software.

TIMELINESS OF CONTENT The content contained in the Reports is current as of the date appearing on the Report and is subject to change without notice. Unless indicated otherwise, by ConsenSys and CD.