1 Executive Summary

This report presents the results of our engagement with EigenLabs to review a subset of their EigenLayer smart contracts, a system that enables restaking of assets to secure new services.

The review was conducted over three weeks, from March 22, 2023, to April 11, 2023, by Dominik Muhs and Heiko Fisch. A total of 30 person-days were spent.

During the first week, we familiarized ourselves with the in-scope components of the system and studied the exhaustive EigenLayer documentation. Basic checks regarding security best practices and the implementation’s consistency were performed.

During the second week, we focused on individual components and internal functions such as transfers of ETH, contract interdependencies, and potential business logic vulnerabilities.

During the third week, we focused on business logic contained in libraries, functions of concentrated risk, and summarizing the audit’s findings.

It is worth noting that while the StrategyBase contract is in scope, its expressiveness and security rely on user-defined strategy behavior, which is not yet present at the time of this engagement. Since isolated contracts in the inheritance hierarchy do not guarantee the eventual component’s behavior, we advise taking the audit results regarding strategies and their related functionalities with a grain of salt. We recommend incorporating rigorous review processes on EigenLayer’s strategies to minimize the risk introduced by potentially malicious or faulty contracts or contract upgrades.

The EigenLabs team has acknowledged all findings in this report and would like us to include their response to each finding to keep readers of this document informed. It is our pleasure to include these comments, but it should be noted that we have not reviewed the fixes or, in general, assessed the validity of the responses.

2 Scope

Our review focused on the commit hash 0aa1dc7b65f3a7a7b718d6c8bd847612cbf2ae08. The list of files in scope can be found in the Appendix.

2.1 Objectives

Together with the EigenLayer product team, we identified the following priorities for our review:

- Correctness of the implementation, consistent with the intended functionality and without unintended edge cases.

- Identify known vulnerabilities particular to smart contract systems, as outlined in our Smart Contract Best Practices, and the Smart Contract Weakness Classification Registry.

- Any attack vectors resulting in the loss of user funds or actions defeating safeguards protecting user funds.

- Validate the correctness of the native restaking flow.

- Identify potential privilege escalation points across roles and components in the in-scope system.

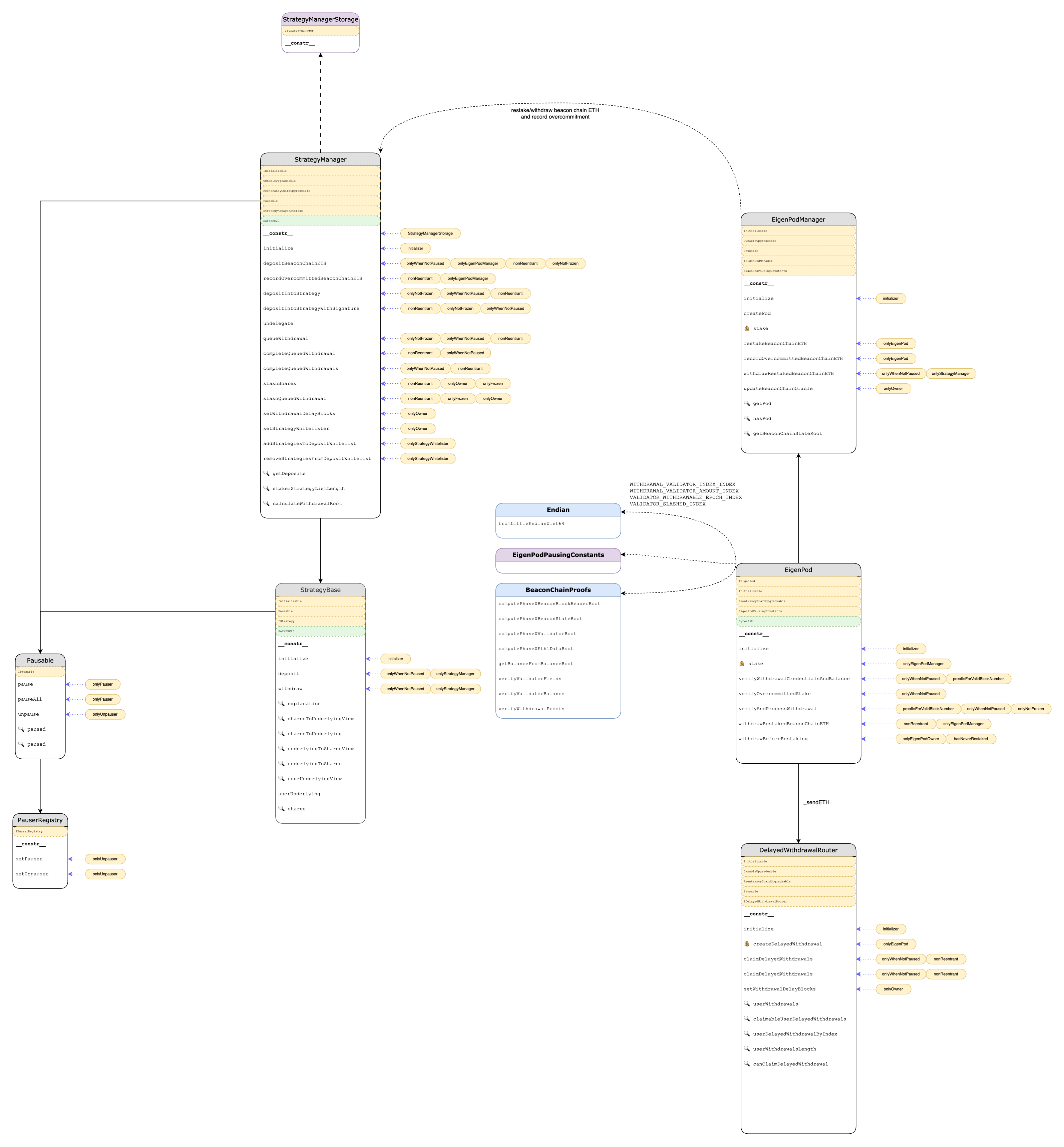

3 System Overview

4 Findings

Each issue has an assigned severity:

- Minor issues are subjective in nature. They are typically suggestions around best practices or readability. Code maintainers should use their own judgment as to whether to address such issues.

- Medium issues are objective in nature but are not security vulnerabilities. These should be addressed unless there is a clear reason not to.

- Major issues are security vulnerabilities that may not be directly exploitable or may require certain conditions in order to be exploited. All major issues should be addressed.

- Critical issues are directly exploitable security vulnerabilities that need to be fixed.

4.1 Potential Reentrancy Into Strategies Medium

Resolution

EigenLabs Quick Summary: The StrategyBase contract may be vulnerable to a token contract that employs some sort of callback to a function like sharesToUnderlyingView, before the balance change is reflected in the contract. The shares have been decremented, which would lead to an incorrect return value from sharesToUnderlyingView.

EigenLabs Response: As noted in the report, this is not an issue if the token contract being used does not allow for reentrancy. For now, we will make it clear both in the contracts as well as the docs that our implementation of StrategyBase.sol does not support tokens with reentrancy. Because of the way our system is designed, anyone can choose to design a strategy with this in mind!

Description

The StrategyManager contract is the entry point for deposits into and withdrawals from strategies. More specifically, to deposit into a strategy, a staker calls depositIntoStrategy (or anyone calls depositIntoStrategyWithSignature with the staker’s signature), and then the asset is transferred from the staker to the strategy contract. After that, the strategy’s deposit function is called, followed by some bookkeeping in the StrategyManager. For withdrawals (and slashing), the StrategyManager calls the strategy’s withdraw function, which transfers the given amount of the asset to the given recipient. Both token transfers are a potential source of reentrancy if the token allows it.

The StrategyManager uses OpenZeppelin’s ReentrancyGuardUpgradeable as reentrancy protection, and the relevant functions have a nonReentrant modifier. The StrategyBase contract – from which concrete strategies should be derived – does not have reentrancy protection. However, the functions deposit and withdraw can only be called from the StrategyManager, so reentering these is impossible.

Nevertheless, other functions could be reentered, for example, sharesToUnderlyingView and underlyingToSharesView, as well as their (supposedly) non-view counterparts.

Let’s look at the withdraw function in StrategyBase. First, the amountShares shares are burnt, and at the end of the function, the equivalent amount of token is transferred to the depositor:

src/contracts/strategies/StrategyBase.sol:L108-L143

function withdraw(address depositor, IERC20 token, uint256 amountShares)

external

virtual

override

onlyWhenNotPaused(PAUSED_WITHDRAWALS)

onlyStrategyManager

{

require(token == underlyingToken, "StrategyBase.withdraw: Can only withdraw the strategy token");

// copy `totalShares` value to memory, prior to any decrease

uint256 priorTotalShares = totalShares;

require(

amountShares <= priorTotalShares,

"StrategyBase.withdraw: amountShares must be less than or equal to totalShares"

);

// Calculate the value that `totalShares` will decrease to as a result of the withdrawal

uint256 updatedTotalShares = priorTotalShares - amountShares;

// check to avoid edge case where share rate can be massively inflated as a 'griefing' sort of attack

require(updatedTotalShares >= MIN_NONZERO_TOTAL_SHARES || updatedTotalShares == 0,

"StrategyBase.withdraw: updated totalShares amount would be nonzero but below MIN_NONZERO_TOTAL_SHARES");

// Actually decrease the `totalShares` value

totalShares = updatedTotalShares;

/**

* @notice calculation of amountToSend *mirrors* `sharesToUnderlying(amountShares)`, but is different since the `totalShares` has already

* been decremented. Specifically, notice how we use `priorTotalShares` here instead of `totalShares`.

*/

uint256 amountToSend;

if (priorTotalShares == amountShares) {

amountToSend = _tokenBalance();

} else {

amountToSend = (_tokenBalance() * amountShares) / priorTotalShares;

}

underlyingToken.safeTransfer(depositor, amountToSend);

}

If we assume that the token contract has a callback to the recipient of the transfer before the actual balance changes take place, then the recipient could reenter the strategy contract, for example, in sharesToUnderlyingView:

src/contracts/strategies/StrategyBase.sol:L159-L165

function sharesToUnderlyingView(uint256 amountShares) public view virtual override returns (uint256) {

if (totalShares == 0) {

return amountShares;

} else {

return (_tokenBalance() * amountShares) / totalShares;

}

}

The crucial point is: If the callback is executed before the actual balance change, then sharesToUnderlyingView will report a bad result because the shares have already been burnt but the token balance has not been updated yet.

For deposits, the token transfer to the strategy happens first, and the shares are minted after that:

src/contracts/core/StrategyManager.sol:L643-L652

function _depositIntoStrategy(address depositor, IStrategy strategy, IERC20 token, uint256 amount)

internal

onlyStrategiesWhitelistedForDeposit(strategy)

returns (uint256 shares)

{

// transfer tokens from the sender to the strategy

token.safeTransferFrom(msg.sender, address(strategy), amount);

// deposit the assets into the specified strategy and get the equivalent amount of shares in that strategy

shares = strategy.deposit(token, amount);

src/contracts/strategies/StrategyBase.sol:L69-L99

function deposit(IERC20 token, uint256 amount)

external

virtual

override

onlyWhenNotPaused(PAUSED_DEPOSITS)

onlyStrategyManager

returns (uint256 newShares)

{

require(token == underlyingToken, "StrategyBase.deposit: Can only deposit underlyingToken");

/**

* @notice calculation of newShares *mirrors* `underlyingToShares(amount)`, but is different since the balance of `underlyingToken`

* has already been increased due to the `strategyManager` transferring tokens to this strategy prior to calling this function

*/

uint256 priorTokenBalance = _tokenBalance() - amount;

if (priorTokenBalance == 0 || totalShares == 0) {

newShares = amount;

} else {

newShares = (amount * totalShares) / priorTokenBalance;

}

// checks to ensure correctness / avoid edge case where share rate can be massively inflated as a 'griefing' sort of attack

require(newShares != 0, "StrategyBase.deposit: newShares cannot be zero");

uint256 updatedTotalShares = totalShares + newShares;

require(updatedTotalShares >= MIN_NONZERO_TOTAL_SHARES,

"StrategyBase.deposit: updated totalShares amount would be nonzero but below MIN_NONZERO_TOTAL_SHARES");

// update total share amount

totalShares = updatedTotalShares;

return newShares;

}

That means if there is a callback in the token’s transferFrom function and it is executed after the balance change, a reentering call to sharesToUnderlyingView (for example) will again return a wrong result because shares and token balances are not “in sync.”

In addition to the reversed order of token transfer and shares update, there’s another vital difference between withdraw and deposit: For withdrawals, the call to the token contract originates in the strategy, while for deposits, it is the strategy manager that initiates the call to the token contract (before calling into the strategy). That’s a technicality that has consequences for reentrancy protection: Note that for withdrawals, it is the strategy contract that is reentered, while for deposits, there is not a single contract that is reentered; instead, it is the contract system that is in an inconsistent state when the reentrancy happens. Hence, reentrancy protection on the level of individual contracts is not sufficient.

Finally, we want to discuss through which functions in the strategy contract the system could be reentered. As mentioned, deposit and withdraw can only be called by the strategy manager, so these two can be ruled out. For the examples above, we considered sharesToUnderlyingView, which (as the name suggests) is a view function. As such, it can’t change the state of the contract, so reentrancy through a view function can only be a problem for other contracts that use this function and rely on its return value. However, there is also a potentially state-changing variant, sharesToUnderlying, and similar potentially state-changing functions, such as underlyingToShares and userUnderlying. Currently, these functions are not actually state-changing, but the idea is that they could be and, in some concrete strategy implementations that inherit from StrategyBase, will be. In such cases, these functions could make wrong state changes due to state inconsistency during reentrancy.

The examples above assume that the token contract allows reentrancy through its transfer function before the balance change has been made or in its transferFrom function after. It might be tempting to argue that tokens which don’t fall into this category are safe to use. While the examples discussed above are the most interesting attack vectors we found, there might still be others: To illustrate this point, assume a token contract that allows reentrancy through transferFrom only before any state change in the token takes place. The token transfer is the first thing that happens in StrategyManager._depositIntoStrategy, and the state changes (user shares) and calling the strategy’s deposit function occur later, so this might look safe. However, if the deposit happens via StrategyManager.depositIntoStrategyWithSignature, then it can be seen, for example, that the staker’s nonce is updated before the internal _depositIntoStrategy function is called:

src/contracts/core/StrategyManager.sol:L244-L286

function depositIntoStrategyWithSignature(

IStrategy strategy,

IERC20 token,

uint256 amount,

address staker,

uint256 expiry,

bytes memory signature

)

external

onlyWhenNotPaused(PAUSED_DEPOSITS)

onlyNotFrozen(staker)

nonReentrant

returns (uint256 shares)

{

require(

expiry >= block.timestamp,

"StrategyManager.depositIntoStrategyWithSignature: signature expired"

);

// calculate struct hash, then increment `staker`'s nonce

uint256 nonce = nonces[staker];

bytes32 structHash = keccak256(abi.encode(DEPOSIT_TYPEHASH, strategy, token, amount, nonce, expiry));

unchecked {

nonces[staker] = nonce + 1;

}

bytes32 digestHash = keccak256(abi.encodePacked("\x19\x01", DOMAIN_SEPARATOR, structHash));

/**

* check validity of signature:

* 1) if `staker` is an EOA, then `signature` must be a valid ECSDA signature from `staker`,

* indicating their intention for this action

* 2) if `staker` is a contract, then `signature` must will be checked according to EIP-1271

*/

if (Address.isContract(staker)) {

require(IERC1271(staker).isValidSignature(digestHash, signature) == ERC1271_MAGICVALUE,

"StrategyManager.depositIntoStrategyWithSignature: ERC1271 signature verification failed");

} else {

require(ECDSA.recover(digestHash, signature) == staker,

"StrategyManager.depositIntoStrategyWithSignature: signature not from staker");

}

shares = _depositIntoStrategy(staker, strategy, token, amount);

}

Hence, querying the staker’s nonce in reentrancy would still give a result based on an “incomplete state change.” It is, for example, conceivable that the staker still has zero shares, and yet their nonce is already 1. This particular situation is most likely not an issue, but the example shows that reentrancy can be subtle.

Recommendation

This is fine if the token doesn’t allow reentrancy in the first place. As discussed above, among the tokens that do allow reentrancy, some variants of when reentrancy can happen in relation to state changes in the token seem more dangerous than others, but we have also argued that this kind of reasoning can be dangerous and error-prone. Hence, we recommend employing comprehensive and defensive reentrancy protection based on reentrancy guards such as OpenZeppelin’s ReentrancyGuardUpgradeable, which is already used in the StrategyManager.

Unfortunately, securing a multi-contract system against reentrancy can be challenging, but we hope the preceding discussion and the following pointers will prove helpful:

- External functions in strategies that should only be callable by the strategy manager (such as

depositandwithdraw) should have theonlyStrategyManagermodifier. This is already the case in the current codebase and is listed here only for completeness. - External functions in strategies for which item 1 doesn’t apply (such as

sharesToUnderlyingandunderlyingToShares) should query the strategy manager’s reentrancy lock and revert if it is set. - In principle, the restrictions above also apply to

publicfunctions, but if apublicfunction is also used internally, checks against reentrancy can cause problems (if used in an internal context) or at least be redundant. In the context of reentrancy protection, it is often easier to split public functions into aninternaland anexternalone. - If

viewfunctions are supposed to give reliable results (either internally – which is typically the case – or for other contracts), they have to be protected too. - The previous item also applies to the

StrategyManager:viewfunctions that have to provide correct results should query the reentrancy lock and revert if it is set. - Solidity automatically generates getters for

publicstate variables. Again, if these (external view) functions must deliver correct results, the same measures must be taken as for explicitviewfunctions. In practice, the state variable has to becomeinternalorprivate, and the getter function must be hand-written. - The

StrategyBasecontract provides some basic functionality. Concrete strategy implementations can inherit from this contract, meaning that some functions may be overridden (and might or might not call the overridden version viasuper), and new functions might be added. While the guidelines above should be helpful, derived contracts must be reviewed and assessed separately on a case-by-case basis. As mentioned before, reentrancy protection can be challenging, especially in a multi-contract system.

4.2 StrategyBase – Inflation Attack Prevention Can Lead to Stuck Funds Minor

Resolution

EigenLabs Quick Summary: The StrategyBase contract sets a minimum initial deposit amount of 1e9. This is to mitigate ERC-4626 related inflation attacks, where an attacker can front-run a deposit, inflating the exchange rate between tokens and shares. A consequence of that protection is that any amount less than 1e9 is not withdrawable.

EigenLabs Response: We recognize that this may be notable for tokens such as USDC, where the smallest unit of which is 1e-6. For now, we will make it clear both in the contracts as well as the docs that our implementation of StrategyBase.sol makes this assumption about the tokens being used in the strategy.

Description

As a defense against what has come to be known as inflation or donation attack in the context of ERC-4626, the StrategyBase contract – from which concrete strategy implementations are supposed to inherit – enforces that the amount of shares in existence for a particular strategy is always either 0 or at least a certain minimum amount that is set to 10^9. This mitigates inflation attacks, which require a small total supply of shares to be effective.

src/contracts/strategies/StrategyBase.sol:L92-L95

uint256 updatedTotalShares = totalShares + newShares;

require(updatedTotalShares >= MIN_NONZERO_TOTAL_SHARES,

"StrategyBase.deposit: updated totalShares amount would be nonzero but below MIN_NONZERO_TOTAL_SHARES");

src/contracts/strategies/StrategyBase.sol:L123-L127

// Calculate the value that `totalShares` will decrease to as a result of the withdrawal

uint256 updatedTotalShares = priorTotalShares - amountShares;

// check to avoid edge case where share rate can be massively inflated as a 'griefing' sort of attack

require(updatedTotalShares >= MIN_NONZERO_TOTAL_SHARES || updatedTotalShares == 0,

"StrategyBase.withdraw: updated totalShares amount would be nonzero but below MIN_NONZERO_TOTAL_SHARES");

This particular approach has the downside that, in the worst case, a user may be unable to withdraw the underlying asset for up to 10^9 - 1 shares. While the extreme circumstances under which this can happen might be unlikely to occur in a realistic setting and, in many cases, the value of 10^9 - 1 shares may be negligible, this is not ideal.

Recommendation

It isn’t easy to give a good general recommendation. None of the suggested mitigations are without a downside, and what’s the best choice may also depend on the specific situation. We do, however, feel that alternative approaches that can’t lead to stuck funds might be worth considering, especially for a default implementation.

One option is internal accounting, i.e., the strategy keeps track of the number of underlying tokens it owns. It uses this number for conversion rate calculation instead of its balance in the token contract. This avoids the donation attack because sending tokens directly to the strategy will not affect the conversion rate. Moreover, this technique helps prevent reentrancy issues when the EigenLayer state is out of sync with the token contract’s state. The downside is higher gas costs and that donating by just sending tokens to the contract is impossible; more specifically, if it happens accidentally, the funds are lost unless there’s some special mechanism to recover them.

An alternative approach with virtual shares and assets is presented here, and the document lists pointers to more discussions and proposed solutions.

4.3 StrategyWrapper – Functions Shouldn’t Be virtual (Out of Scope) Minor

Resolution

EigenLabs Quick Summary: The documentation assumes that StrategyWrapper.sol shouldn’t be inheritable, and yet its functions are marked “virtual”. It should be noted that this contract was not audited beyond this issue which was noticed accidentally.

EigenLabs Response: This fix was acknowledged and fixed in the following commit: 053ee9d.

Description

The StrategyWrapper contract is a straightforward strategy implementation and – as its NatSpec documentation explicitly states – is not designed to be inherited from:

src/contracts/strategies/StrategyWrapper.sol:L8-L17

/**

* @title Extremely simple implementation of `IStrategy` interface.

* @author Layr Labs, Inc.

* @notice Simple, basic, "do-nothing" Strategy that holds a single underlying token and returns it on withdrawals.

* Assumes shares are always 1-to-1 with the underlyingToken.

* @dev Unlike `StrategyBase`, this contract is *not* designed to be inherited from.

* @dev This contract is expressly *not* intended for use with 'fee-on-transfer'-type tokens.

* Setting the `underlyingToken` to be a fee-on-transfer token may result in improper accounting.

*/

contract StrategyWrapper is IStrategy {

However, all functions in this contract are virtual, which only makes sense if inheriting from StrategyWrapper is possible.

Recommendation

Assuming the NatSpec documentation is correct, and no contract should inherit from StrategyWrapper, remove the virtual keyword from all function definitions. Otherwise, fix the documentation.

Remark

This contract is out of scope, and this finding is only included because we noticed it accidentally. This does not mean we have reviewed the contract or other out-of-scope files.

4.4 StrategyBase – Inheritance-Related Issues Minor

Resolution

EigenLabs Quick Summary: There were two sub-issues identified here:

A. sharesToUnderlying and underlyingToShares are intended to allow state changes and yet they are marked as “view”.

B. The initialize function in StrategyBase.sol is not virtual which means inheriting contracts will not be able to define an initialize function.

EigenLabs Response:

A. For now, we will keep the the view modifier to silence compiler warnings (since our implementations of sharesToUnderlying and underlyingToShares are not actually state changing). We can look at rectifying this if users begin deploying strategies that would like to inherit from our implementation of StrategyBase.sol.

B. We now define an internal _initializeStrategyBase which implements the StrategyBase initialization logic and is now called by an initialize function that is overridable. Changes implemented in this commit: 60141d8.

Description

A. The StrategyBase contract defines view functions that, given an amount of shares, return the equivalent amount of tokens (sharesToUnderlyingView) and vice versa (underlyingToSharesView). These two functions also have non-view counterparts: sharesToUnderlying and underlyingToShares, and their NatSpec documentation explicitly states that they should be allowed to make state changes. Given the scope of this engagement, it is unclear if these non-view versions are needed, but assuming they are, this does currently not work as intended.

First, the interface IStrategy declares underlyingToShares as view (unlike sharesToUnderlying). This means overriding this function in derived contracts is impossible without the view modifier. Hence, in StrategyBase – which implements the IStrategy interface – this (virtual) function is (and has to be) view. The same applies to overridden versions of this function in contracts inherited from StrategyBase.

src/contracts/interfaces/IStrategy.sol:L39-L45

/**

* @notice Used to convert an amount of underlying tokens to the equivalent amount of shares in this strategy.

* @notice In contrast to `underlyingToSharesView`, this function **may** make state modifications

* @param amountUnderlying is the amount of `underlyingToken` to calculate its conversion into strategy shares

* @dev Implementation for these functions in particular may vary signifcantly for different strategies

*/

function underlyingToShares(uint256 amountUnderlying) external view returns (uint256);

src/contracts/strategies/StrategyBase.sol:L192-L200

/**

* @notice Used to convert an amount of underlying tokens to the equivalent amount of shares in this strategy.

* @notice In contrast to `underlyingToSharesView`, this function **may** make state modifications

* @param amountUnderlying is the amount of `underlyingToken` to calculate its conversion into strategy shares

* @dev Implementation for these functions in particular may vary signifcantly for different strategies

*/

function underlyingToShares(uint256 amountUnderlying) external view virtual returns (uint256) {

return underlyingToSharesView(amountUnderlying);

}

As mentioned above, the sharesToUnderlying function does not have the view modifier in the interface IStrategy. However, the overridden (and virtual) version in StrategyBase does, which means again that overriding this function in contracts inherited from StrategyBase is impossible without the view modifier.

src/contracts/strategies/StrategyBase.sol:L167-L175

/**

* @notice Used to convert a number of shares to the equivalent amount of underlying tokens for this strategy.

* @notice In contrast to `sharesToUnderlyingView`, this function **may** make state modifications

* @param amountShares is the amount of shares to calculate its conversion into the underlying token

* @dev Implementation for these functions in particular may vary signifcantly for different strategies

*/

function sharesToUnderlying(uint256 amountShares) public view virtual override returns (uint256) {

return sharesToUnderlyingView(amountShares);

}

B. The initialize function in the StrategyBase contract is not virtual, which means the name will not be available in derived contracts (unless with different parameter types). It also has the initializer modifier, which is unavailable in concrete strategies inherited from StrategyBase.

Recommendation

A. If state-changing versions of the conversion functions are needed, the view modifier has to be removed from IStrategy.underlyingToShares, StrategyBase.underlyingToShares, and StrategyBase.sharesToUnderlying. They should be removed entirely from the interface and base contract if they’re not needed.

B. Consider making the StrategyBase contract abstract, maybe give the initialize function a more specific name such as _initializeStrategyBase, change its visibility to internal, and use the onlyInitializing modifier instead of initializer.

4.5 StrategyManager - Cross-Chain Replay Attacks After Chain Split Due to Hard-Coded DOMAIN_SEPARATOR Minor

Resolution

EigenLabs Quick Summary:

A. For the implementation of EIP-712 signatures, the domain separator is set in the initialization of the contract, which includes the chain ID. In the case of a chain split, this ID is subject to change. Thus the domain separator must be recomputed.

B. The domain separator is calculated using bytes("EigenLayer") – the EIP-712 spec requires a keccak256 hash, i.e. keccak256(bytes("EigenLayer")).

C. The EIP712Domain does not include a version string.

EigenLabs Response:

A. We have modified our implementation to dynamically check for the chain ID. If we detect a change since initialization, we recompute the domain separator. If not, we use the precomputed value.

B. We changed our computation to use keccak256(bytes("EigenLayer")).

C. We decided that we would forgo this change for the time being.

Changes in A. and B. implemented in this commit: 714dbb6.

Description

A. The StrategyManager contract allows stakers to deposit into and withdraw from strategies. A staker can either deposit themself or have someone else do it on their behalf, where the latter requires an EIP-712-compliant signature. The EIP-712 domain separator is computed in the initialize function and stored in a state variable for later retrieval:

src/contracts/core/StrategyManagerStorage.sol:L23-L24

/// @notice EIP-712 Domain separator

bytes32 public DOMAIN_SEPARATOR;

src/contracts/core/StrategyManager.sol:L149-L153

function initialize(address initialOwner, address initialStrategyWhitelister, IPauserRegistry _pauserRegistry, uint256 initialPausedStatus, uint256 _withdrawalDelayBlocks)

external

initializer

{

DOMAIN_SEPARATOR = keccak256(abi.encode(DOMAIN_TYPEHASH, bytes("EigenLayer"), block.chainid, address(this)));

Once set in the initialize function, the value can’t be changed anymore. In particular, the chain ID is “baked into” the DOMAIN_SEPARATOR during initialization. However, it is not necessarily constant: In the event of a chain split, only one of the resulting chains gets to keep the original chain ID, and the other should use a new one. With the current approach to compute the DOMAIN_SEPARATOR during initialization, store it, and then use the stored value for signature verification, a signature will be valid on both chains after a split – but it should not be valid on the chain with the new ID. Hence, the domain separator should be computed dynamically.

B. The name in the EIP712Domain is of type string:

src/contracts/core/StrategyManagerStorage.sol:L18-L19

bytes32 public constant DOMAIN_TYPEHASH =

keccak256("EIP712Domain(string name,uint256 chainId,address verifyingContract)");

What’s encoded when the domain separator is computed is bytes("EigenLayer"):

src/contracts/core/StrategyManager.sol:L153

DOMAIN_SEPARATOR = keccak256(abi.encode(DOMAIN_TYPEHASH, bytes("EigenLayer"), block.chainid, address(this)));

According to EIP-712,

The dynamic values

bytesandstringare encoded as akeccak256hash of their contents.

Hence, bytes("EigenLayer") should be replaced with keccak256(bytes("EigenLayer")).

C. The EIP712Domain does not include a version string:

src/contracts/core/StrategyManagerStorage.sol:L18-L19

bytes32 public constant DOMAIN_TYPEHASH =

keccak256("EIP712Domain(string name,uint256 chainId,address verifyingContract)");

That is allowed according to the specification. However, given that most, if not all, projects, as well as OpenZeppelin’s EIP-712 implementation, do include a version string in their EIP712Domain, it might be a pragmatic choice to do the same, perhaps to avoid potential incompatibilities.

Recommendation

Individual recommendations have been given above. Alternatively, you might want to utilize OpenZeppelin’s EIP712Upgradeable library, which will take care of these issues. Note that some of these changes will break existing signatures.

4.6 StrategyManagerStorage – Miscalculated Gap Size Minor

Resolution

EigenLabs Quick Summary: Gap size in StrategyManagerStorage is set to 41 even though 10 slots are utilized. General convention is to have 50 total slots available for storage.

EigenLabs Response: Storage gap size fixed, changed from 41 to 40. This is possible as we aren’t storing anything after the gap. Commit hash: d249641.

Description

Upgradeable contracts should have a “gap” of unused storage slots at the end to allow for adding state variables when the contract is upgraded. The convention is to have a gap whose size adds up to 50 with the used slots at the beginning of the contract’s storage.

In StrategyManagerStorage, the number of consecutively used storage slots is 10:

DOMAIN_SEPARATORnoncesstrategyWhitelisterwithdrawalDelayBlocksstakerStrategySharesstakerStrategyListwithdrawalRootPendingnumWithdrawalsQueuedstrategyIsWhitelistedForDepositbeaconChainETHSharesToDecrementOnWithdrawal

However, the gap size in the storage contract is 41:

src/contracts/core/StrategyManagerStorage.sol:L84

uint256[41] private __gap;

Recommendation

If you don’t have to maintain compatibility with an existing deployment, we recommend reducing the storage gap size to 40. Otherwise, we recommend adding a comment explaining that, in this particular case, the gap size and the used storage slots should add up to 51 instead of 50 and that this invariant has to be maintained in future versions of this contract.

4.7 Unnecessary Usage of BytesLib Minor

Resolution

EigenLabs Quick Summary: Several contracts import BytesLib.sol and yet do not use it.

EigenLabs Response: Removed all imports of BytesLib.sol and switched to an explicit conversion of _podWithdrawalCredentials() to bytes32 in EigenPod.sol. Commit hash: 6164a12.

Description

Various contracts throughout the codebase import BytesLib.sol without actually using it. It is only utilized once in EigenPod to convert a bytes array of length 32 to a bytes32.

src/contracts/pods/EigenPod.sol:L189-L190

require(validatorFields[BeaconChainProofs.VALIDATOR_WITHDRAWAL_CREDENTIALS_INDEX] == _podWithdrawalCredentials().toBytes32(0),

"EigenPod.verifyCorrectWithdrawalCredentials: Proof is not for this EigenPod");

However, this can also be achieved with an explicit conversion to bytes32, and means provided by the language itself should usually be preferred over external libraries.

Recommendation

Remove the import of BytesLib.sol and the accompanying using BytesLib for bytes; when the library is unused. Consider replacing the single usage in EigenPod with an explicit conversion to bytes32, and consequentially removing the import and using statements.

4.8 DelayedWithdrawalRouter – Anyone Can Claim Earlier Than Intended on Behalf of Someone Else

Resolution

EigenLabs Quick Summary: DelayedWithdrawalRouter implements a claiming function that allows for a provided recipient address. This function is not permissioned and thus can be called at any time (potentially a griefing attack vector with something like taxes).

EigenLabs Response: For now we have decided to leave this function as is and have added a note/warning about the noted behavior.

Description

The DelayedWithdrawalRouter has two functions to claim delayed withdrawals: one the recipient can call themself (i.e., the recipient is msg.sender) and one to claim on behalf of someone else (i.e., the recipient is given as a parameter):

src/contracts/pods/DelayedWithdrawalRouter.sol:L84-L94

/**

* @notice Called in order to withdraw delayed withdrawals made to the caller that have passed the `withdrawalDelayBlocks` period.

* @param maxNumberOfDelayedWithdrawalsToClaim Used to limit the maximum number of delayedWithdrawals to loop through claiming.

*/

function claimDelayedWithdrawals(uint256 maxNumberOfDelayedWithdrawalsToClaim)

external

nonReentrant

onlyWhenNotPaused(PAUSED_DELAYED_WITHDRAWAL_CLAIMS)

{

_claimDelayedWithdrawals(msg.sender, maxNumberOfDelayedWithdrawalsToClaim);

}

src/contracts/pods/DelayedWithdrawalRouter.sol:L71-L82

/**

* @notice Called in order to withdraw delayed withdrawals made to the `recipient` that have passed the `withdrawalDelayBlocks` period.

* @param recipient The address to claim delayedWithdrawals for.

* @param maxNumberOfDelayedWithdrawalsToClaim Used to limit the maximum number of delayedWithdrawals to loop through claiming.

*/

function claimDelayedWithdrawals(address recipient, uint256 maxNumberOfDelayedWithdrawalsToClaim)

external

nonReentrant

onlyWhenNotPaused(PAUSED_DELAYED_WITHDRAWAL_CLAIMS)

{

_claimDelayedWithdrawals(recipient, maxNumberOfDelayedWithdrawalsToClaim);

}

An attacker can not control where the funds are sent, but they can control when the funds are sent once the withdrawal becomes claimable. It is unclear whether this can become a problem. It is, for example, conceivable that there are negative tax implications if funds arrive earlier than intended at a particular address: For instance, disadvantages for the recipient can arise if funds arrive before the new year starts or before some other funds were sent to the same address (e.g., in case the FIFO principle is applied for taxes).

The downside of allowing only the recipient to claim their withdrawals is that contract recipients must be equipped to make the claim.

Recommendation

If these points haven’t been considered yet, we recommend doing so.

4.9 Consider Using Custom Errors

Resolution

EigenLabs Quick Summary: Suggestion to use custom errors in Solidity.

EigenLabs Response: For now we will continue to use standard error messages for the upcoming deployment.

Description and Recommendation

Custom errors were introduced in Solidity version 0.8.4 and have some advantages over the traditional string-based errors: They are usually more gas-efficient, especially regarding deployment costs, and it is easier to include dynamic information in error messages.

4.10 StrategyManager - Immediate Settings Changes Can Have Unintended Side Effects

Resolution

EigenLabs Quick Summary: StrategyManager contract allows for setWithdrawalDelayBlocks() to be called such that a user attempting to call completeQueuedWithdrawal() may be prevented from withdrawing.

EigenLabs Response: We have decided to leave this concern unaddressed.

Description

Withdrawal delay blocks can be changed immediately:

src/contracts/core/StrategyManager.sol:L570-L572

function setWithdrawalDelayBlocks(uint256 _withdrawalDelayBlocks) external onlyOwner {

_setWithdrawalDelayBlocks(_withdrawalDelayBlocks);

}

Allows owner to sandwich e.g. completeQueuedWithdrawal function calls to prevent users from withdrawing their stake due to the following check:

src/contracts/core/StrategyManager.sol:L749-L753

require(queuedWithdrawal.withdrawalStartBlock + withdrawalDelayBlocks <= block.number

|| queuedWithdrawal.strategies[0] == beaconChainETHStrategy,

"StrategyManager.completeQueuedWithdrawal: withdrawalDelayBlocks period has not yet passed"

);

Recommendation

We recommend introducing a simple delay for settings changes to prevent sandwiching attack vectors. It is worth noting that this finding has been explicitly raised because it allows authorized personnel to target individual transactions and users by extension.

4.11 StrategyManager - Unused Modifier

Resolution

EigenLabs Quick Summary: StrategyManager contract defines an onlyEigenPod modifier which is not used.

EigenLabs Response: We have removed that modifier. Commit hash: 50bb6a8.

Description

The StrategyManager contract defines an onlyEigenPod modifier, but it is never used.

src/contracts/core/StrategyManager.sol:L113-L116

modifier onlyEigenPod(address podOwner, address pod) {

require(address(eigenPodManager.getPod(podOwner)) == pod, "StrategyManager.onlyEigenPod: not a pod");

_;

}

Recommendation

The modifier can be removed.

4.12 Inconsistent Data Types for Block Numbers

Resolution

EigenLabs Quick Summary: Across our contracts we use both uint32 and uint64 to represent blockNumber values.

EigenLabs Response: We have concluded that usages of blockNumber as uint32 vs uint64 do not overlap. Uint64 block numbers are used in all EigenPod-related code (BeaconChainOracle.sol, EigenPod.sol and EigenPodManager.sol). All uint32 representations of block numbers are used in our “Middleware” contracts (BLSRegistry.sol, BLSSignatureChecker.sol, RegistryBase.sol).

Description

The block number attribute is declared using uint32 and uint64. This usage should be more consistent.

Examples

uint32

src/contracts/interfaces/IEigenPod.sol:L30-L35

struct PartialWithdrawalClaim {

PARTIAL_WITHDRAWAL_CLAIM_STATUS status;

// block at which the PartialWithdrawalClaim was created

uint32 creationBlockNumber;

// last block (inclusive) in which the PartialWithdrawalClaim can be fraudproofed

uint32 fraudproofPeriodEndBlockNumber;

src/contracts/core/StrategyManager.sol:L393

withdrawalStartBlock: uint32(block.number),

src/contracts/pods/DelayedWithdrawalRouter.sol:L62-L65

DelayedWithdrawal memory delayedWithdrawal = DelayedWithdrawal({

amount: withdrawalAmount,

blockCreated: uint32(block.number)

});

uint64

src/contracts/pods/EigenPod.sol:L175-L176

function verifyWithdrawalCredentialsAndBalance(

uint64 oracleBlockNumber,

src/contracts/pods/EigenPodManager.sol:L216

function getBeaconChainStateRoot(uint64 blockNumber) external view returns(bytes32) {

Recommendation

Use one data type consistently to minimize the risk of conversion errors or truncation during casts. This is a measure aimed at future-proofing the code base.

4.13 EigenPod – Stray nonReentrant Modifier

Resolution

EigenLabs Quick Summary: There is a stray nonReentrant modifier in EigenPod.sol.

EigenLabs Response: Modifier has been removed. Commit hash: 9f45837.

Description

There is a stray nonReentrant modifier in EigenPod:

src/contracts/pods/EigenPod.sol:L432-L453

/**

* @notice Transfers `amountWei` in ether from this contract to the specified `recipient` address

* @notice Called by EigenPodManager to withdrawBeaconChainETH that has been added to the EigenPod's balance due to a withdrawal from the beacon chain.

* @dev Called during withdrawal or slashing.

* @dev Note that this function is marked as non-reentrant to prevent the recipient calling back into it

*/

function withdrawRestakedBeaconChainETH(

address recipient,

uint256 amountWei

)

external

onlyEigenPodManager

nonReentrant

{

// reduce the restakedExecutionLayerGwei

restakedExecutionLayerGwei -= uint64(amountWei / GWEI_TO_WEI);

emit RestakedBeaconChainETHWithdrawn(recipient, amountWei);

// transfer ETH from pod to `recipient`

_sendETH(recipient, amountWei);

}

src/contracts/pods/EigenPod.sol:L466-L468

function _sendETH(address recipient, uint256 amountWei) internal {

delayedWithdrawalRouter.createDelayedWithdrawal{value: amountWei}(podOwner, recipient);

}

It should be noted that the _sendEth function – at the end of withdrawRestakedBeaconChainETH – does not transfer Ether to the recipient. Instead, it creates a delayed withdrawal in the withdrawal router, and the EigenLayer contract system is not left during a call to withdrawRestakedBeaconChainETH. As this is also the only function in EigenPod with a nonReentrant modifier, removing it will not make a difference.

This modifier is likely a leftover from an earlier version of the contract in which Ether was sent directly.

Recommendation

Remove the ineffective modifier for more readable code and reduced gas usage. The import of ReentrancyGuardUpgradeable.sol and the inheritance from ReentrancyGuardUpgradeable can also be removed. Also, consider giving the _sendEth function a more appropriate name.

Remark

The two nonReentrant modifiers in DelayedWithdrawalRouter are neither strictly needed. Still, they look considerably less “random” than the one in EigenPod, and could be warranted by a defense-in-depth approach.

Appendix 1 - Files in Scope

This audit covered the following files:

| File | SHA-1 hash |

|---|---|

| src/contracts/core/StrategyManager.sol | 7c1327710f2342142c2db9bdb242e9bdcaf75425 |

| src/contracts/core/StrategyManagerStorage.sol | 84e57fb5a0899dd07ecac37725ac0c1cf8432dd2 |

| src/contracts/libraries/BeaconChainProofs.sol | ee3a74416646c6beb54594b95cc4f1c8bdc8c7cd |

| src/contracts/libraries/Endian.sol | 5bd82847b77f9d3319f5538c4cbb33c0aaa79dba |

| src/contracts/permissions/Pausable.sol | 1b69bd1fb22643ffc159d871cb786472aa114f2d |

| src/contracts/permissions/PauserRegistry.sol | 3bd17044d62d11c31d4242ba6afc02a3fad788ff |

| src/contracts/pods/DelayedWithdrawalRouter.sol | 939e39579adc7ac35f6b60b3f192c1d003e9e783 |

| src/contracts/pods/EigenPod.sol | 54355ae987453d41d968b5061fdcb7a0858c9302 |

| src/contracts/pods/EigenPodManager.sol | 88f7e928779805297e8c8f5fa39c047224789548 |

| src/contracts/pods/EigenPodPausingConstants.sol | 5412f325c4cd92b1edf448bab624a9a16c81a4d4 |

| src/contracts/strategies/StrategyBase.sol | f3b1eb44d88e8edb01da59151e4a206a8fcf0cd6 |

Appendix 2 - Disclosure

ConsenSys Diligence (“CD”) typically receives compensation from one or more clients (the “Clients”) for performing the analysis contained in these reports (the “Reports”). The Reports may be distributed through other means, including via ConsenSys publications and other distributions.

The Reports are not an endorsement or indictment of any particular project or team, and the Reports do not guarantee the security of any particular project. This Report does not consider, and should not be interpreted as considering or having any bearing on, the potential economics of a token, token sale or any other product, service or other asset. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. No Report provides any warranty or representation to any Third-Party in any respect, including regarding the bugfree nature of code, the business model or proprietors of any such business model, and the legal compliance of any such business. No third party should rely on the Reports in any way, including for the purpose of making any decisions to buy or sell any token, product, service or other asset. Specifically, for the avoidance of doubt, this Report does not constitute investment advice, is not intended to be relied upon as investment advice, is not an endorsement of this project or team, and it is not a guarantee as to the absolute security of the project. CD owes no duty to any Third-Party by virtue of publishing these Reports.

PURPOSE OF REPORTS The Reports and the analysis described therein are created solely for Clients and published with their consent. The scope of our review is limited to a review of code and only the code we note as being within the scope of our review within this report. Any Solidity code itself presents unique and unquantifiable risks as the Solidity language itself remains under development and is subject to unknown risks and flaws. The review does not extend to the compiler layer, or any other areas beyond specified code that could present security risks. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. In some instances, we may perform penetration testing or infrastructure assessments depending on the scope of the particular engagement.

CD makes the Reports available to parties other than the Clients (i.e., “third parties”) – on its website. CD hopes that by making these analyses publicly available, it can help the blockchain ecosystem develop technical best practices in this rapidly evolving area of innovation.

LINKS TO OTHER WEB SITES FROM THIS WEB SITE You may, through hypertext or other computer links, gain access to web sites operated by persons other than ConsenSys and CD. Such hyperlinks are provided for your reference and convenience only, and are the exclusive responsibility of such web sites’ owners. You agree that ConsenSys and CD are not responsible for the content or operation of such Web sites, and that ConsenSys and CD shall have no liability to you or any other person or entity for the use of third party Web sites. Except as described below, a hyperlink from this web Site to another web site does not imply or mean that ConsenSys and CD endorses the content on that Web site or the operator or operations of that site. You are solely responsible for determining the extent to which you may use any content at any other web sites to which you link from the Reports. ConsenSys and CD assumes no responsibility for the use of third party software on the Web Site and shall have no liability whatsoever to any person or entity for the accuracy or completeness of any outcome generated by such software.

TIMELINESS OF CONTENT The content contained in the Reports is current as of the date appearing on the Report and is subject to change without notice. Unless indicated otherwise, by ConsenSys and CD.