1 Executive Summary

This report presents the results of our engagement with Idle Finance to review Idle Dynamic Tranches.

The review was conducted by Nicholas Ward and Shayan Eskandari over the course of 20 person-days in June & July 2021.

2 Scope

The original review of 10 person-days began with commit hash d94ee7194e8cb17db13b16c338f3e780b62f5435 and incorporated commit hash 26d190539dec83c603edc9b5a903ce9b29b33a07, which provided a fix for an issue discovered independently by the development team. The complete list of files in scope for the initial review can be found in the Appendix. Due to the limited time available for the review, this was a best effort code review and does not cover the full extent of the codebase.

Note that many of the contracts in the scope call functions in the idleToken contracts which are out of the scope of the audit. We briefly reviewed the implementation of the Idle governance token to better understand the system.

Due to complexity of many of the calls (e.g. harvest(), flashloan(), etc) and the integration of many external DeFi projects(e.g. Compound, Uniswap, etc) the validity of the calculations and the code flow using purely manual review is close to impossible. We suggest an extensive integration and fuzzing test suites as an addition to the findings and recommendations in this report.

A second 10 person-day review focused largely on the IdleCDO contract.

This review began with commit 1cf2b76bcda56807a35162ef4a65bcba0b6250e0 and incorporated commit ff0b69380828657f16df8683c35703b325a6b656.

A Mythx analysis report can be viewed here.

3 System Overview

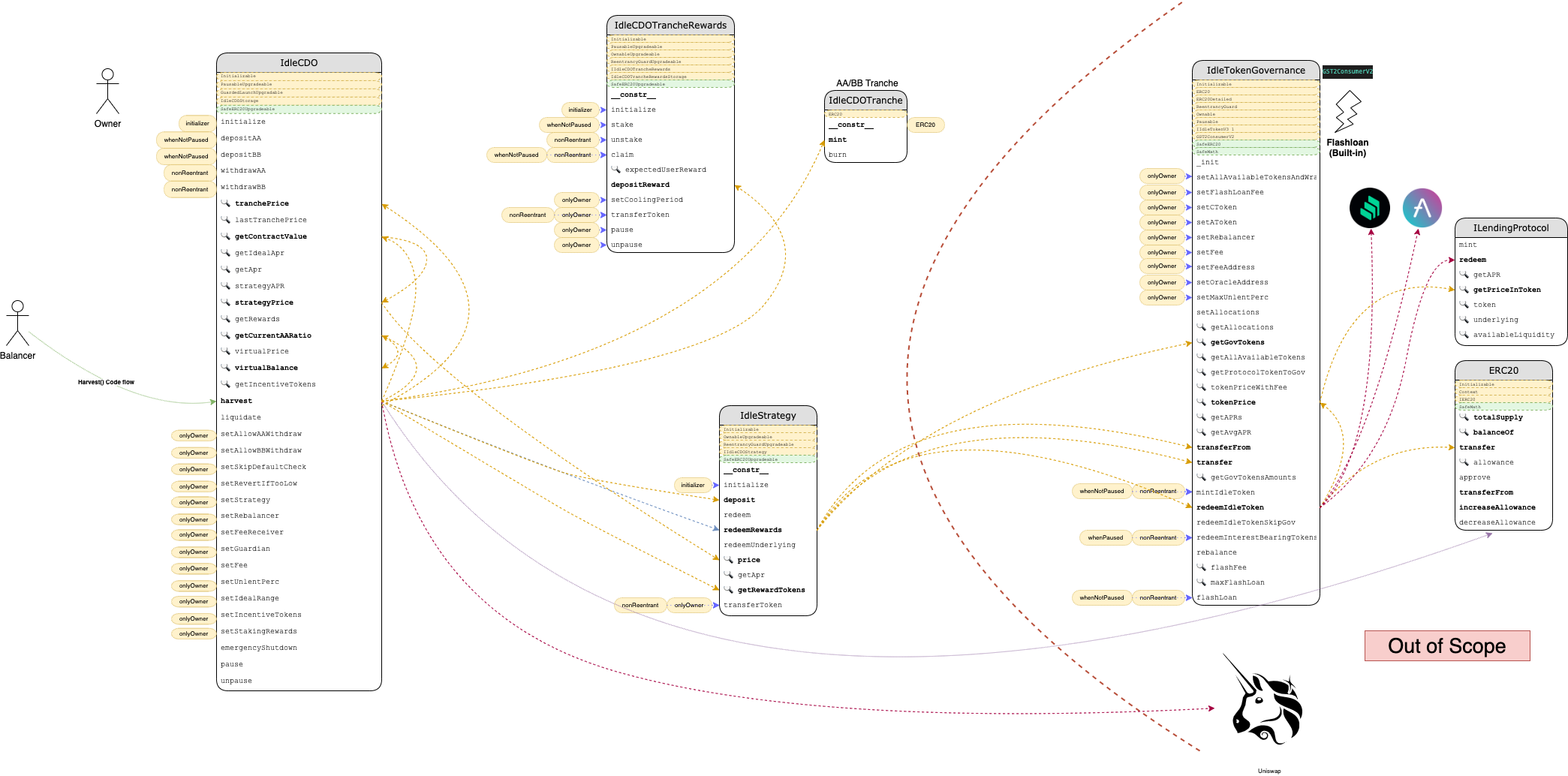

Idle finance is comprised of many modules surrounding the main contract IdleCDO.sol. This includes ERC20 contracts for the Tranches and the interfaces for reward tokens, as well as Strategy contracts which will interact with different lending protocols. Many of the core functionality calls into IdleTokenGovernance.sol implementation, such as pricing and Idle token functionality.

The following is an overview of the Idle Finance contracts. The harvest() method was used to illustrate some of the contract interactions involved.

System Overview

Contracts are depicted as boxes. Public reachable interface methods are outlined as rows in the box. The 🔍 icon indicates that a method is declared as non-state-changing (view/pure) while other methods may change state. A yellow dashed row at the top of the contract shows inherited contracts. A green dashed row at the top of the contract indicates that the contract is used in a usingFor declaration. Modifiers used as ACL are connected as yellow bubbles in front of methods.

4 Recommendations

4.1 Prevent initialization of implementation contracts

Resolution

f389c0a0d1ce0f245a8b82ac36767bfc0771a149.

Description

The contracts IdleCDO, IdleCDOTrancheRewards, and IdleStrategy all inherit from OpenZeppelin’s Initializable contract and are intended to be used via a delegatecall proxy. In general, implementation contracts should always be initialized on deployment or otherwise prevented from initialization by a malicious actor.

Recommendation

Add a constructor to every Initializable contract that sets _initialized = true. This constructor will be executed on deployment of implementation contracts, but will still allow proxy contracts that delegatecall to the implementation to use the initialize() method as before.

4.2 Clearly communicate admin capabilities

Description

With the exception of the internally-deployed IdleCDOTranche contracts, all of the contracts reviewed are intended to be used via delegatecall proxy. This allows the contract owner to upgrade to an arbitrary implementation at any time, potentially even front-running user calls to a contract with a change to the semantics of particular methods.

Additionally, the IdleCDO contract includes a function transferTokens() that allows the contract owner to withdraw any and all tokens held by the contract to the governanceRecoveryFund address.

code/contracts/GuardedLaunchUpgradable.sol:L54-L59

/// @notice Emergency method, tokens gets transferred to the governanceRecoveryFund address

/// @param _token address of the token to transfer

/// @param _value amount to transfer

function transferToken(address _token, uint256 _value) external onlyOwner nonReentrant {

IERC20Upgradeable(_token).safeTransfer(governanceRecoveryFund, _value);

}

Further more, functionalities that can halt the system such as emergencyShutdown and Pausable contracts should be mentioned in a visible disclaimer.

Recommendation

Clearly communicate to users the trust model of the system, and use timelocked multisig contracts for controlling admin privileges.

4.3 Documentation for formulas and price/reward calculations

Resolution

e36b08e25fddb1195d774969e5c1da1d04507ea3 and 0cbe4fdb3bb17ba48dd42d0cd2cead4aaf9a7466.

Description

Many of the calculations in the codebase uses nested function calls that are hard to read and verify. It is recommended to use inline documentation to indicate what the final formula should represent.

The complexity of these formulas reduces readability and maintainability of the code base. Other than proper documentation, It is critical to have full tests for these formulas (including happy path, edge cases, possible emergency functionalities, etc).

Examples

code/contracts/IdleCDO.sol:L145-L146

return (_contractTokenBalance(_strategyToken) * strategyPrice() / (10**(strategyTokenDecimals))) + _contractTokenBalance(token);

}

code/contracts/IdleCDO.sol:L222-L224

function virtualBalance(address _tranche) public view returns (uint256) {

return IdleCDOTranche(_tranche).totalSupply() * virtualPrice(_tranche) / ONE_TRANCHE_TOKEN;

}

5 Security Specification

This section describes, from a security perspective, the expected behavior of the system under audit. It is not a substitute for documentation. The purpose of this section is to identify specific security properties that were validated by the audit team.

5.1 Actors

The relevant actors are listed below with their respective abilities:

-

Owner

- (Deployer) upgrade all smart contracts (

GuardedLaunchUpgradable:SafeERC20Upgradeable,ReentrancyGuardUpgradeable,OwnableUpgradeable) - Set flags to allow withdrawals for AA/BB tranches

- Set flags to allow

setSkipDefaultCheckandsetRevertIfTooLowto change the system checks for default strategy and enable the check if redeemed amount during liquidations is enough - Can set strategy contracts to update the strategy used and potentially changing the lending protocol used

- Change the guardian, rebalancer, fee reciever addresses

- Change the fee, and unlent percentages

- Change the Ideal range defining the range for AA/BB rewards

- Change the incentive tokens used in the system

- Change the tranche Rewards contract addresses

- Can call

emergencyShutdown()to pause deposits and redeems for all classes of tranches - Can pause and unpause the contracts

- Can call

harvest()to lend user funds in the lending provider through the IIdleCDOStrategy and update tranches incentives - Can call

liquidate()to redeem underlyings from the lending provider - Transfer all “left over” tokens in the contracts (Strategy, TrencheRewards) to any address

- Can set the

coolingPeriodthat a user needs to wait since his last stake before the unstake will be possible

- (Deployer) upgrade all smart contracts (

-

Guardian

- Can call

emergencyShutdown() - Can transfer funds to

governanceRecoveryFundaddress - Can pause and unpause the contracts

- Can call

-

Rebalancer

- Can call

harvest() - Can call

liquidate()

- Can call

-

IdleCDO AA/BB Tranche Token holders

- Withdraw AA or BB tokens (if allowed by owner), which burns their tranche token and redeems their principal + interest

- Can stake in the Tranche Reward contract. Note that if a user adds more stake later on, the

coolingPeriodwill restart - Can unstake if

coolingPeriodis passed. If the contract is paused, “unstake” will skip the claim of the rewards - Can claim all the expected rewards

-

underlying tokenholders- Deposit tokens and mint AA or BB Tranche Tokens

-

feeReceiver

- Receives fees through

_depositFees()at harvest

- Receives fees through

6 Findings

Each issue has an assigned severity:

- Minor issues are subjective in nature. They are typically suggestions around best practices or readability. Code maintainers should use their own judgment as to whether to address such issues.

- Medium issues are objective in nature but are not security vulnerabilities. These should be addressed unless there is a clear reason not to.

- Major issues are security vulnerabilities that may not be directly exploitable or may require certain conditions in order to be exploited. All major issues should be addressed.

- Critical issues are directly exploitable security vulnerabilities that need to be fixed.

6.1 IdleCDO._deposit() allows re-entrancy from hookable tokens. Medium

Resolution

5fbdc0506c94a172abbd4122276ed2bd489d1964. This change has not been reviewed by the audit team.

Description

The function IdleCDO._deposit() updates the system’s internal accounting and mints shares to the caller, then transfers the deposited funds from the user. Some token standards, such as ERC777, allow a callback to the source of the funds before the balances are updated in transferFrom(). This callback could be used to re-enter the protocol while already holding the minted tranche tokens and at a point where the system accounting reflects a receipt of funds that has not yet occurred.

While an attacker could not interact with IdleCDO.withdraw() within this callback because of the _checkSameTx() restriction, they would be able to interact with the rest of the protocol.

code/contracts/IdleCDO.sol:L230-L245

function _deposit(uint256 _amount, address _tranche) internal returns (uint256 _minted) {

// check that we are not depositing more than the contract available limit

_guarded(_amount);

// set _lastCallerBlock hash

_updateCallerBlock();

// check if strategyPrice decreased

_checkDefault();

// interest accrued since last depositXX/withdrawXX/harvest is splitted between AA and BB

// according to trancheAPRSplitRatio. NAVs of AA and BB are updated and tranche

// prices adjusted accordingly

_updateAccounting();

// mint tranche tokens according to the current tranche price

_minted = _mintShares(_amount, msg.sender, _tranche);

// get underlyings from sender

IERC20Detailed(token).safeTransferFrom(msg.sender, address(this), _amount);

}

Recommendation

Move the transferFrom() action in _deposit() to immediately after _updateCallerBlock().

6.2 IdleCDO.virtualPrice() and _updatePrices() yield different prices in a number of cases Medium

Resolution

The development team implemented a new version of both functions using a third method, virtualPricesAux(), to perform the primary price calculation. Additionally, _updatePrices() was renamed to _updateAccounting().

This change was incorporated in commit ff0b69380828657f16df8683c35703b325a6b656.

Description

The function IdleCDO.virtualPrice() is used to determine the current price of a tranche. Similarly, IdleCDO._updatePrices() is used to store the latest price of a tranche, as well as update other parts of the system accounting. There are a number of cases where the prices yielded by these two functions differ. While these are primarily corner cases that are not obviously exploitable in practice, potential violations of key accounting invariants should always be considered serious.

Additionally, the use of two separate implementations of the same calculation suggest the potential for more undiscovered discrepancies, possibly of higher consequence.

As an example, in _updatePrices() the precision loss from splitting the strategy returns favors BB tranche holders. In virtualPrice() both branches of the price calculation incur precision loss, favoring the IdleCDO contract itself.

_updatePrices()

code/contracts/IdleCDO.sol:L331-L341

if (BBTotSupply == 0) {

// if there are no BB holders, all gain to AA

AAGain = gain;

} else if (AATotSupply == 0) {

// if there are no AA holders, all gain to BB

BBGain = gain;

} else {

// split the gain between AA and BB holders according to trancheAPRSplitRatio

AAGain = gain * trancheAPRSplitRatio / FULL_ALLOC;

BBGain = gain - AAGain;

}

virtualPrice()

code/contracts/IdleCDO.sol:L237-L245

if (_tranche == AATranche) {

// calculate gain for AA tranche

// trancheGain (AAGain) = gain * trancheAPRSplitRatio / FULL_ALLOC;

trancheNAV = lastNAVAA + (gain * _trancheAPRSplitRatio / FULL_ALLOC);

} else {

// calculate gain for BB tranche

// trancheGain (BBGain) = gain * (FULL_ALLOC - trancheAPRSplitRatio) / FULL_ALLOC;

trancheNAV = lastNAVBB + (gain * (FULL_ALLOC - _trancheAPRSplitRatio) / FULL_ALLOC);

}

Recommendation

Implement a single method that determines the current price for a tranche, and use this same implementation anywhere the price is needed.

6.3 IdleCDO.harvest() allows price manipulation in certain circumstances Medium

Resolution

5341a9391f9c42cadf26d72c9f804ca75a15f0fb. This change has not been reviewed by the audit team.

Description

The function IdleCDO.harvest() uses Uniswap to liquidate rewards earned by the contract’s strategy, then updates the relevant positions and internal accounting. This function can only be called by the contract owner or the designated rebalancer address, and it accepts an array which indicates the minimum buy amounts for the liquidation of each reward token.

The purpose of permissioning this method and specifying minimum buy amounts is to prevent a sandwiching attack from manipulating the reserves of the Uniswap pools and forcing the IdleCDO contract to incur loss due to price slippage.

However, this does not effectively prevent price manipulation in all cases. Because the contract sells it’s entire balance of redeemed rewards for the specified minimum buy amount, this approach does not enforce a minimum price for the executed trades. If the balance of IdleCDO or the amount of claimable rewards increases between the submission of the harvest() transaction and its execution, it may be possible to perform a profitable sandwiching attack while still satisfying the required minimum buy amounts.

The viability of this exploit depends on how effectively an attacker can increase the amount of rewards tokens to be sold without incurring an offsetting loss. The strategy contracts used by IdleCDO are expected to vary widely in their implementations, and this manipulation could potentially be done either through direct interaction with the protocol or as part of a flashbots bundle containing a large position adjustment from an honest user.

code/contracts/IdleCDO.sol:L564-L565

function harvest(bool _skipRedeem, bool _skipIncentivesUpdate, bool[] calldata _skipReward, uint256[] calldata _minAmount) external {

require(msg.sender == rebalancer || msg.sender == owner(), "IDLE:!AUTH");

code/contracts/IdleCDO.sol:L590-L599

// approve the uniswap router to spend our reward

IERC20Detailed(rewardToken).safeIncreaseAllowance(address(_uniRouter), _currentBalance);

// do the uniswap trade

_uniRouter.swapExactTokensForTokensSupportingFeeOnTransferTokens(

_currentBalance,

_minAmount[i],

_path,

address(this),

block.timestamp + 1

);

Recommendation

Update IdleCDO.harvest() to enforce a minimum price rather than a minimum buy amount. One method of doing so would be taking an additional array parameter indicating the amount of each token to sell in exchange for the respective buy amount.

6.4 Prevent zero amount transfers/minting Minor

Resolution

a72747da8c0ca71274f3a1506c6faf724cf82dd2. This change has not been reviewed by the audit team.

Description

Many of the functions in the system can be called with amount = 0. This is not a security issue, however a “defense in depth” approach in this and similar cases may prevent an undiscovered bug from being exploitable. Most of the functionalities that were reviewed in this audit won’t create an exploitable state transition in these cases, however they will trigger a 0 token transfer or minting.

Examples

-

depositAA()

-

depositBB()

-

stake()

-

unstake()

Recommendation

Check and return early (or revert) on requests with zero amount.

6.5 Missing Sanity checks Minor

Resolution

a1d5dac0ad5f562d4c75bff99e770d92bcc2a72f. This change has not been reviewed by the audit team.

Description

The implementation of initialize() functions are missing some sanity checks. The proper checks are implemented in some of the setter functions but missing in some others.

Examples

- Missing sanity check for

!= address(0)

code/contracts/IdleCDO.sol:L54-L57

token = _guardedToken;

strategy = _strategy;

strategyToken = IIdleCDOStrategy(_strategy).strategyToken();

rebalancer = _rebalancer;

code/contracts/IdleCDO.sol:L84-L84

guardian = _owner;

code/contracts/IdleCDO.sol:L672-L673

address _currAAStaking = AAStaking;

address _currBBStaking = BBStaking;

code/contracts/IdleCDOTrancheRewards.sol:L50-L53

idleCDO = _idleCDO;

tranche = _trancheToken;

rewards = _rewards;

governanceRecoveryFund = _governanceRecoveryFund;

Recommendation

Add sanity checks before assigning system variables.

6.6 IdleCDO.virtualPrice() & _updatePrices() too complicated to verify Minor

Resolution

These methods were revisited in the continuation of the original review and more time was allotted to them than was possible previously. Some refactoring also occurred during that time (see 6.2). However, the development team elected to maintain the general approach used in these functions.

The primary challenge in verifying their correctness remains, which is their heavy reliance on external interactions with contracts whose expected semantics are poorly defined.

Description

IdleCDO.virtualPrice() and _updatePrices() functions are used for many important functionality in the Idle system. They also have nested external calls to many other contracts (e.g. IdleTokenGovernance, IdleCDOStrategy and strategy token, IdleCDOTranche on both Tranche tokens, etc). This level of complexity for a vital function is not recommended and is considered dangerous implementation.

Examples

Recommendation

Consider refactoring the code to use less complicated logic and code flow.

Appendix 1 - Files in Scope

This audit covered the following files:

| File Name | SHA-1 Hash |

|---|---|

| GuardedLaunchUpgradable.sol | 5b2172e1874fa404f5dee86a4d0f05ed6a40287e |

| IdleCDO.sol | cf45736ad52997f1bd5795abc57cbc461975cbb2 |

| IdleCDOStorage.sol | 31c8ab77e4a0139080c4be4f6396ccf192d3ab7f |

| IdleCDOTranche.sol | 4712775665bf393cb81e2950f8bc00658bcc38a5 |

| IdleCDOTrancheRewards.sol | eaedc50169a341f1d533a3d3873d199ced67805b |

| IdleCDOTrancheRewardsStorage.sol | 426f1f1705cdc494eae5d67e394bb8f0f223e286 |

| interfaces/IIdleCDOStrategy.sol | bf623f6153c2a5c1889b24fcd630f2b0d618fa76 |

| interfaces/IERC20Detailed.sol | b9faf29bb63e91308ee3152e0d2fb9bb9091fa5a |

| interfaces/IIdleCDOTrancheRewards.sol | 97844b2e0df71e4f96f00eb4936ddd0cbfd00084 |

Appendix 2 - Disclosure

ConsenSys Diligence (“CD”) typically receives compensation from one or more clients (the “Clients”) for performing the analysis contained in these reports (the “Reports”). The Reports may be distributed through other means, including via ConsenSys publications and other distributions.

The Reports are not an endorsement or indictment of any particular project or team, and the Reports do not guarantee the security of any particular project. This Report does not consider, and should not be interpreted as considering or having any bearing on, the potential economics of a token, token sale or any other product, service or other asset. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. No Report provides any warranty or representation to any Third-Party in any respect, including regarding the bugfree nature of code, the business model or proprietors of any such business model, and the legal compliance of any such business. No third party should rely on the Reports in any way, including for the purpose of making any decisions to buy or sell any token, product, service or other asset. Specifically, for the avoidance of doubt, this Report does not constitute investment advice, is not intended to be relied upon as investment advice, is not an endorsement of this project or team, and it is not a guarantee as to the absolute security of the project. CD owes no duty to any Third-Party by virtue of publishing these Reports.

PURPOSE OF REPORTS The Reports and the analysis described therein are created solely for Clients and published with their consent. The scope of our review is limited to a review of code and only the code we note as being within the scope of our review within this report. Any Solidity code itself presents unique and unquantifiable risks as the Solidity language itself remains under development and is subject to unknown risks and flaws. The review does not extend to the compiler layer, or any other areas beyond specified code that could present security risks. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. In some instances, we may perform penetration testing or infrastructure assessments depending on the scope of the particular engagement.

CD makes the Reports available to parties other than the Clients (i.e., “third parties”) – on its website. CD hopes that by making these analyses publicly available, it can help the blockchain ecosystem develop technical best practices in this rapidly evolving area of innovation.

LINKS TO OTHER WEB SITES FROM THIS WEB SITE You may, through hypertext or other computer links, gain access to web sites operated by persons other than ConsenSys and CD. Such hyperlinks are provided for your reference and convenience only, and are the exclusive responsibility of such web sites’ owners. You agree that ConsenSys and CD are not responsible for the content or operation of such Web sites, and that ConsenSys and CD shall have no liability to you or any other person or entity for the use of third party Web sites. Except as described below, a hyperlink from this web Site to another web site does not imply or mean that ConsenSys and CD endorses the content on that Web site or the operator or operations of that site. You are solely responsible for determining the extent to which you may use any content at any other web sites to which you link from the Reports. ConsenSys and CD assumes no responsibility for the use of third party software on the Web Site and shall have no liability whatsoever to any person or entity for the accuracy or completeness of any outcome generated by such software.

TIMELINESS OF CONTENT The content contained in the Reports is current as of the date appearing on the Report and is subject to change without notice. Unless indicated otherwise, by ConsenSys and CD.