1 Executive Summary

This report presents the results of our engagement with DeFi Saver to review DeFi Saver V3 architecture, which is the new version of smart contracts that are used for their dashboard.

The review was conducted over two weeks, from March 22, 2021 to April 2, 2021 by Shayan Eskandari and David Oz Kashi. A total of 20 person-days were spent.

2 Scope

Our review focused on the commit hash cb29669a84c2d6fffaf2231c0938eb407c060919. The list of files in scope can be found in the Appendix.

Note that functionalities regarding Strategy and Subscriptions were not in the scope of this audit.

3 System Overview

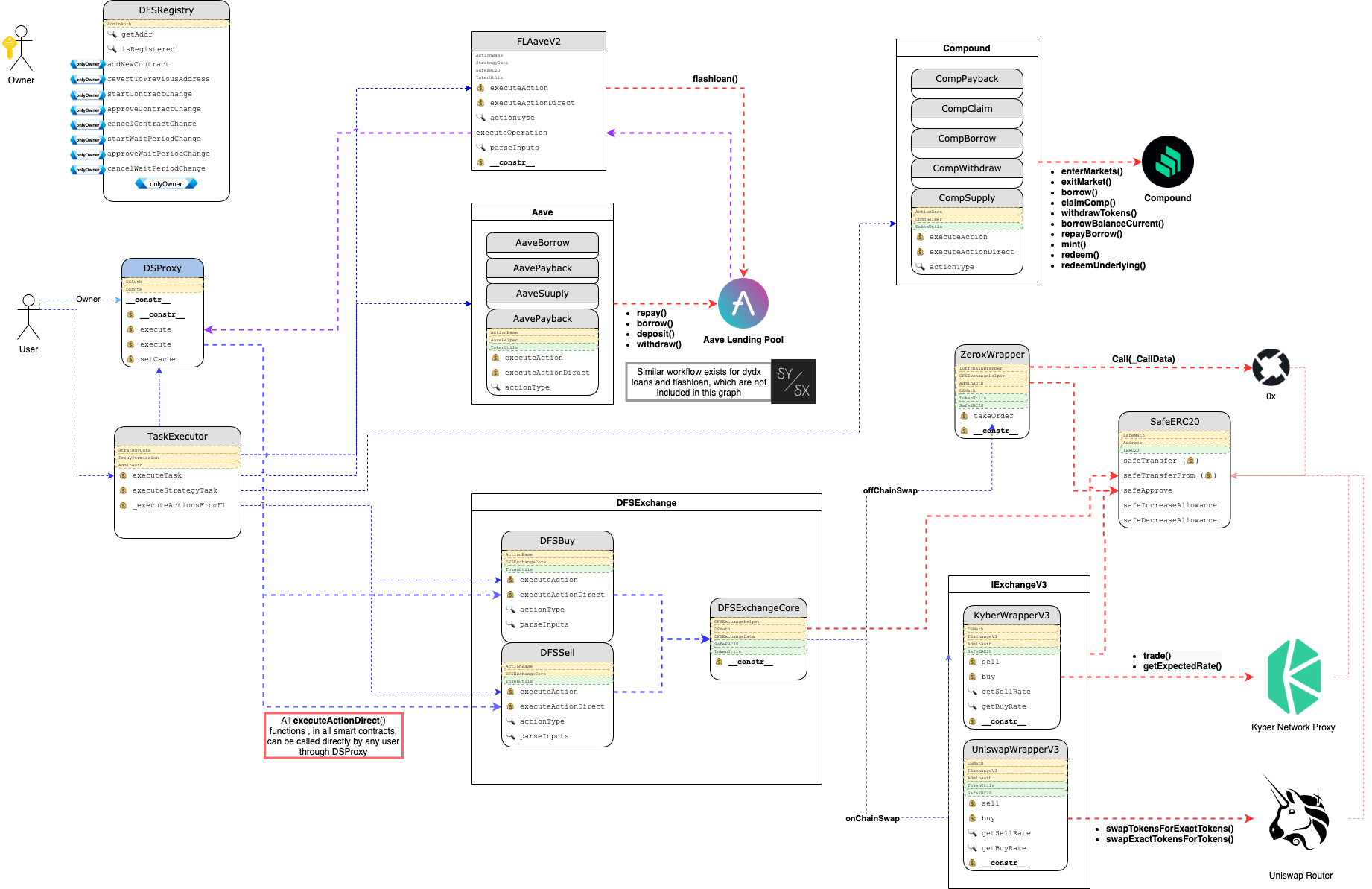

DeFi Saver acts as a proxy (dashboard) for users to interact with DeFi protocols. Users can chain actions (create recipes) and run multiple actions in one transaction.

Here is an overview of the DeFi Saver smart contract system:

4 Security Specification

This section describes, from a security perspective, the expected behavior of the system under audit. It is not a substitute for documentation.

4.1 Actors

The relevant actors are listed below with their respective abilities:

-

Owner

- Add new contracts to the DeFi Saver system (Registry)

- Swap any contract in the registry.

- Note that in the code base there is a

WaitPerioddefined for changes in the contracts. However owner can set this wait time to 0 and consequently change the modules/contracts in DeFi Saver registry.

- Note that in the code base there is a

- Add or Remove wrapper contracts. Wrappers are used to interact with other DeFi protocols, such as 0x, Uniswap, etc

- Add and change the proxies used in the system

- Change Fee wallet address

- Set 0x Addresses

-

Admin

- withdrawStuckFunds - Based on the design no user funds may be kept in DeFi Saver contracts. Although if by accident that happens, Admin will be able to withdraw them to their own address

-

User

4.2 Trust Model

In any system, it’s important to identify what trust is expected/required between various actors. For this audit, we established the following trust model:

- Many functionalities of DeFi Saver dashboard, uses constructed CallData to execute different actions in the smart contract systems, hence the UI has control over the function executed in the smart contracts. This is essential to the security of the system. Note that due to the way the transactions are crafted on the front-end, it’s not possible for the wallet (e.g. MetaMask) to show the user the exact actions that the transaction will be taking (User sees a blob of data), this increases the risk of the attack going unnoticeable until after the fact. The attack can be done with simple change in the outgoing address at the end of the recipe or more sophisticated crafted transaction to steal user funds (e.g. Approve Tokens for attackers address).

- As mentioned in the Actors section, owner has the ability to change the underlying contracts without any waiting period.

- There is no allowlist for tokens that are supported in DeFi Saver. Although implicitly the allowlist for other DeFi platforms are applied when interacting with that specific protocol(e.g tokens supported by Aave when interactive with Aave), but still a maliciously-crafted token implementation can be used within DeFi Saver platform.

- The usage of the

DSProxypattern provides an environment that is protected from outsider access by design.

5 Findings

Each issue has an assigned severity:

- Minor issues are subjective in nature. They are typically suggestions around best practices or readability. Code maintainers should use their own judgment as to whether to address such issues.

- Medium issues are objective in nature but are not security vulnerabilities. These should be addressed unless there is a clear reason not to.

- Major issues are security vulnerabilities that may not be directly exploitable or may require certain conditions in order to be exploited. All major issues should be addressed.

- Critical issues are directly exploitable security vulnerabilities that need to be fixed.

5.1 Random task execution Critical ✓ Fixed

Resolution

478e9cd by adding ReentrancyGuard to the executeOperation function.

Description

In a scenario where user takes a flash loan, _parseFLAndExecute() gives the flash loan wrapper contract (FLAaveV2, FLDyDx) the permission to execute functions on behalf of the user’s DSProxy. This execution permission is revoked only after the entire recipe execution is finished, which means that in case that any of the external calls along the recipe execution is malicious, it might call executeAction() back and inject any task it wishes (e.g. take user’s funds out, drain approved tokens, etc)

Examples

code/contracts/actions/flashloan/FLAaveV2.sol:L105-L136

function executeOperation(

address[] memory _assets,

uint256[] memory _amounts,

uint256[] memory _fees,

address _initiator,

bytes memory _params

) public returns (bool) {

require(msg.sender == AAVE_LENDING_POOL, ERR_ONLY_AAVE_CALLER);

require(_initiator == address(this), ERR_SAME_CALLER);

(Task memory currTask, address proxy) = abi.decode(_params, (Task, address));

// Send FL amounts to user proxy

for (uint256 i = 0; i < _assets.length; ++i) {

_assets[i].withdrawTokens(proxy, _amounts[i]);

}

address payable taskExecutor = payable(registry.getAddr(TASK_EXECUTOR_ID));

// call Action execution

IDSProxy(proxy).execute{value: address(this).balance}(

taskExecutor,

abi.encodeWithSelector(CALLBACK_SELECTOR, currTask, bytes32(_amounts[0] + _fees[0]))

);

// return FL

for (uint256 i = 0; i < _assets.length; i++) {

_assets[i].approveToken(address(AAVE_LENDING_POOL), _amounts[i] + _fees[i]);

}

return true;

}

Recommendation

A reentrancy guard (mutex) that covers the entire content of FLAaveV2.executeOperation/FLDyDx.callFunction should be used to prevent such attack.

5.2 Tokens with more than 18 decimal points will cause issues Major ✓ Fixed

Resolution

de22007 by using SafeMath.sub to revert on tokens with Decimal > 18

Description

It is assumed that the maximum number of decimals for each token is 18. However uncommon, but it is possible to have tokens with more than 18 decimals, as an Example YAMv2 has 24 decimals. This can result in broken code flow and unpredictable outcomes (e.g. an underflow will result with really high rates).

Examples

contracts/exchangeV3/wrappersV3/KyberWrapperV3.sol

function getSellRate(address _srcAddr, address _destAddr, uint _srcAmount, bytes memory) public override view returns (uint rate) {

(rate, ) = KyberNetworkProxyInterface(KYBER_INTERFACE)

.getExpectedRate(IERC20(_srcAddr), IERC20(_destAddr), _srcAmount);

// multiply with decimal difference in src token

rate = rate * (10**(18 - getDecimals(_srcAddr)));

// divide with decimal difference in dest token

rate = rate / (10**(18 - getDecimals(_destAddr)));

}

code/contracts/views/AaveView.sol: also used ingetLoanData()

Recommendation

Make sure the code won’t fail in case the token’s decimals is more than 18.

5.3 Error codes of Compound’s Comptroller.enterMarket, Comptroller.exitMarket are not checked Major ✓ Fixed

Resolution

7075e49 by reverting in the case the return value is non zero.

Description

Compound’s enterMarket/exitMarket functions return an error code instead of reverting in case of failure.

DeFi Saver smart contracts never check for the error codes returned from Compound smart contracts, although the code flow might revert due to unavailability of the CTokens, however early on checks for Compound errors are suggested.

Examples

code/contracts/actions/compound/helpers/CompHelper.sol:L26-L37

function enterMarket(address _cTokenAddr) public {

address[] memory markets = new address[](1);

markets[0] = _cTokenAddr;

IComptroller(COMPTROLLER_ADDR).enterMarkets(markets);

}

/// @notice Exits the Compound market

/// @param _cTokenAddr CToken address of the token

function exitMarket(address _cTokenAddr) public {

IComptroller(COMPTROLLER_ADDR).exitMarket(_cTokenAddr);

}

Recommendation

Caller contract should revert in case the error code is not 0.

5.4 Reversed order of parameters in allowance function call Medium ✓ Fixed

Resolution

8b5657b by swapping the order of function call parameters.

Description

When trying to pull the maximum amount of tokens from an approver to the allowed spender, the parameters that are used for the allowance function call are not in the same order that is used later in the call to safeTransferFrom.

Examples

code/contracts/utils/TokenUtils.sol:L26-L44

function pullTokens(

address _token,

address _from,

uint256 _amount

) internal returns (uint256) {

// handle max uint amount

if (_amount == type(uint256).max) {

uint256 allowance = IERC20(_token).allowance(address(this), _from);

uint256 balance = getBalance(_token, _from);

_amount = (balance > allowance) ? allowance : balance;

}

if (_from != address(0) && _from != address(this) && _token != ETH_ADDR && _amount != 0) {

IERC20(_token).safeTransferFrom(_from, address(this), _amount);

}

return _amount;

}

Recommendation

Reverse the order of parameters in allowance function call to fit the order that is in the safeTransferFrom function call.

5.5 Full test suite is recommended Medium Pending

Description

The test suite at this stage is not complete and many of the tests fail to execute. For complicated systems such as DeFi Saver, which uses many different modules and interacts with different DeFi protocols, it is crucial to have a full test coverage that includes the edge cases and failed scenarios. Especially this helps with safer future development and upgrading each modules.

As we’ve seen in some smart contract incidents, a complete test suite can prevent issues that might be hard to find with manual reviews.

Some issues such as issue 5.4 could be caught by a full coverage test suite.

5.6 Kyber getRates code is unclear Minor

Description

In contracts/exchangeV3/wrappersV3/KyberWrapperV3.sol the function names don’t reflect their true functionalities, and the code uses some undocumented assumptions.

Examples

getSellRatecan be converted into one function to get the rates, which then for buy or sell can swap input and output tokensgetBuyRateuses a 3% slippage that is not documented.

function getSellRate(address _srcAddr, address _destAddr, uint _srcAmount, bytes memory) public override view returns (uint rate) {

(rate, ) = KyberNetworkProxyInterface(KYBER_INTERFACE)

.getExpectedRate(IERC20(_srcAddr), IERC20(_destAddr), _srcAmount);

// multiply with decimal difference in src token

rate = rate * (10**(18 - getDecimals(_srcAddr)));

// divide with decimal difference in dest token

rate = rate / (10**(18 - getDecimals(_destAddr)));

}

/// @notice Return a rate for which we can buy an amount of tokens

/// @param _srcAddr From token

/// @param _destAddr To token

/// @param _destAmount To amount

/// @return rate Rate

function getBuyRate(address _srcAddr, address _destAddr, uint _destAmount, bytes memory _additionalData) public override view returns (uint rate) {

uint256 srcRate = getSellRate(_destAddr, _srcAddr, _destAmount, _additionalData);

uint256 srcAmount = wmul(srcRate, _destAmount);

rate = getSellRate(_srcAddr, _destAddr, srcAmount, _additionalData);

// increase rate by 3% too account for inaccuracy between sell/buy conversion

rate = rate + (rate / 30);

}

Recommendation

Refactoring the code to separate getting rate functionality with getSellRate and getBuyRate. Explicitly document any assumptions in the code ( slippage, etc)

5.7 Missing check in IOffchainWrapper.takeOrder implementation Minor

Description

IOffchainWrapper.takeOrder wraps an external call that is supposed to perform a token swap. As for the two different implementations ZeroxWrapper and ScpWrapper this function validates that the destination token balance after the swap is greater than the value before. However, it is not sufficient, and the user-provided minimum amount for swap should be taken in consideration as well. Besides, the external contract should not be trusted upon, and SafeMath should be used for the subtraction operation.

Examples

code/contracts/exchangeV3/offchainWrappersV3/ZeroxWrapper.sol:L42-L50

uint256 tokensBefore = _exData.destAddr.getBalance(address(this));

(success, ) = _exData.offchainData.exchangeAddr.call{value: _exData.offchainData.protocolFee}(_exData.offchainData.callData);

uint256 tokensSwaped = 0;

if (success) {

// get the current balance of the swaped tokens

tokensSwaped = _exData.destAddr.getBalance(address(this)) - tokensBefore;

require(tokensSwaped > 0, ERR_TOKENS_SWAPED_ZERO);

}

code/contracts/exchangeV3/offchainWrappersV3/ScpWrapper.sol:L43-L51

uint256 tokensBefore = _exData.destAddr.getBalance(address(this));

(success, ) = _exData.offchainData.exchangeAddr.call{value: _exData.offchainData.protocolFee}(_exData.offchainData.callData);

uint256 tokensSwaped = 0;

if (success) {

// get the current balance of the swaped tokens

tokensSwaped = _exData.destAddr.getBalance(address(this)) - tokensBefore;

require(tokensSwaped > 0, ERR_TOKENS_SWAPED_ZERO);

}

5.8 Unused code present in the codebase Minor

Resolution

61b0c09.

Description

There are a few instances of unused code (dead code) in the code base, that is suggested to be removed .

Examples

-

DFSExchange.solcontract is not used -

/contracts/utils/ZrxAllowlist.solthese functions are not used in the codebase:nonPayableAddrsmapping- addNonPayableAddr()

- removeNonPayableAddr()

- isNonPayableAddr()

-

DSProxy.execute(bytes memory _code, bytes memory _data)is not intended to used.

There might be more instances of unused code in the codebase.

5.9 Return values not used for DFSExchangeCore.onChainSwap Minor

Description

Return values from DFSExchangeCore.onChainSwap are not used.

Examples

code/contracts/exchangeV3/DFSExchangeCore.sol:L37-L73

function _sell(ExchangeData memory exData) internal returns (address, uint256) {

uint256 amountWithoutFee = exData.srcAmount;

address wrapper = exData.offchainData.wrapper;

bool offChainSwapSuccess;

uint256 destBalanceBefore = exData.destAddr.getBalance(address(this));

// Takes DFS exchange fee

exData.srcAmount -= getFee(

exData.srcAmount,

exData.user,

exData.srcAddr,

exData.dfsFeeDivider

);

// Try 0x first and then fallback on specific wrapper

if (exData.offchainData.price > 0) {

(offChainSwapSuccess, ) = offChainSwap(exData, ExchangeActionType.SELL);

}

// fallback to desired wrapper if 0x failed

if (!offChainSwapSuccess) {

onChainSwap(exData, ExchangeActionType.SELL);

wrapper = exData.wrapper;

}

uint256 destBalanceAfter = exData.destAddr.getBalance(address(this));

uint256 amountBought = sub(destBalanceAfter, destBalanceBefore);

// check slippage

require(amountBought >= wmul(exData.minPrice, exData.srcAmount), ERR_SLIPPAGE_HIT);

// revert back exData changes to keep it consistent

exData.srcAmount = amountWithoutFee;

return (wrapper, amountBought);

}

code/contracts/exchangeV3/DFSExchangeCore.sol:L79-L117

function _buy(ExchangeData memory exData) internal returns (address, uint256) {

require(exData.destAmount != 0, ERR_DEST_AMOUNT_MISSING);

uint256 amountWithoutFee = exData.srcAmount;

address wrapper = exData.offchainData.wrapper;

bool offChainSwapSuccess;

uint256 destBalanceBefore = exData.destAddr.getBalance(address(this));

// Takes DFS exchange fee

exData.srcAmount -= getFee(

exData.srcAmount,

exData.user,

exData.srcAddr,

exData.dfsFeeDivider

);

// Try 0x first and then fallback on specific wrapper

if (exData.offchainData.price > 0) {

(offChainSwapSuccess, ) = offChainSwap(exData, ExchangeActionType.BUY);

}

// fallback to desired wrapper if 0x failed

if (!offChainSwapSuccess) {

onChainSwap(exData, ExchangeActionType.BUY);

wrapper = exData.wrapper;

}

uint256 destBalanceAfter = exData.destAddr.getBalance(address(this));

uint256 amountBought = sub(destBalanceAfter, destBalanceBefore);

// check slippage

require(amountBought >= exData.destAmount, ERR_SLIPPAGE_HIT);

// revert back exData changes to keep it consistent

exData.srcAmount = amountWithoutFee;

return (wrapper, amountBought);

}

Recommendation

The return value can be used for verification of the swap or used in the event data.

5.10 Return value is not used for TokenUtils.withdrawTokens Minor ✓ Fixed

Resolution

37dabff by storing the return value locally and use its value throughout the execution.

Description

The return value of TokenUtils.withdrawTokens which represents the actual amount of tokens that were transferred is never used throughout the repository. This might cause discrepancy in the case where the original value of _amount was type(uint256).max.

Examples

code/contracts/actions/aave/AaveBorrow.sol:L70-L97

function _borrow(

address _market,

address _tokenAddr,

uint256 _amount,

uint256 _rateMode,

address _to,

address _onBehalf

) internal returns (uint256) {

ILendingPoolV2 lendingPool = getLendingPool(_market);

// defaults to onBehalf of proxy

if (_onBehalf == address(0)) {

_onBehalf = address(this);

}

lendingPool.borrow(_tokenAddr, _amount, _rateMode, AAVE_REFERRAL_CODE, _onBehalf);

_tokenAddr.withdrawTokens(_to, _amount);

logger.Log(

address(this),

msg.sender,

"AaveBorrow",

abi.encode(_market, _tokenAddr, _amount, _rateMode, _to, _onBehalf)

);

return _amount;

}

code/contracts/utils/TokenUtils.sol:L46-L53

function withdrawTokens(

address _token,

address _to,

uint256 _amount

) internal returns (uint256) {

if (_amount == type(uint256).max) {

_amount = getBalance(_token, address(this));

}

Recommendation

The return value can be used to validate the withdrawal or used in the event emitted.

5.11 Missing access control for DefiSaverLogger.Log

Description

DefiSaverLogger is used as a logging aggregator within the entire dapp, but anyone can create logs.

Examples

code/contracts/utils/DefisaverLogger.sol:L14-L21

function Log(

address _contract,

address _caller,

string memory _logName,

bytes memory _data

) public {

emit LogEvent(_contract, _caller, _logName, _data);

}

6 Recommendations

6.1 Use a single file for all system-wide constants

Description

There are many addresses and constants using in the system. It is suggested to put the most used ones in one file (e.g. constants.sol and use inheritance to access these values. This will help with the readability and easier maintenance for future changes. As some of these hardcoded values are admin addresses, this also helps with any possible incident response.

Examples

Logger:

- DFSRegistry

- TaskExecutor

- ActionBase

DefisaverLogger public constant logger = DefisaverLogger(

0x5c55B921f590a89C1Ebe84dF170E655a82b62126

);

Admin Vault:

- AdminAuth

AdminVault public constant adminVault = AdminVault(0xCCf3d848e08b94478Ed8f46fFead3008faF581fD);

REGISTRY_ADDR

- SubscriptionProxy

- StrategyExecutor

- TaskExecutor

- ActionBase

address public constant REGISTRY_ADDR = 0xB0e1682D17A96E8551191c089673346dF7e1D467;

Any other constant in the system also can be moved to this contract.

Recommendation

Use constants.sol and import this file in the contracts that require access to these values. This is just a recommendation, as discussed with the team, on some use cases this might result in higher gas usage on deployment.

6.2 Code quality & Styling

Description

Here are some examples that the code style does not follow the best practices:

Examples

- Public/external function names should not be prefixed with

_

code/contracts/core/TaskExecutor.sol:L56

function _executeActionsFromFL(Task memory _currTask, bytes32 _flAmount) public payable {

- Function parameters are being overriden

code/contracts/exchangeV3/DFSExchange.sol:L24-L37

function sell(ExchangeData memory exData, address payable _user) public payable {

exData.dfsFeeDivider = SERVICE_FEE;

exData.user = _user;

// Perform the exchange

(address wrapper, uint destAmount) = _sell(exData);

// send back any leftover ether or tokens

sendLeftover(exData.srcAddr, exData.destAddr, _user);

// log the event

logger.Log(address(this), msg.sender, "ExchangeSell", abi.encode(wrapper, exData.srcAddr, exData.destAddr, exData.srcAmount, destAmount));

}

MAX_SERVICE_FEEshould beMIN_SERVICE_FEE

code/contracts/utils/Discount.sol:L28-L33

function setServiceFee(address _user, uint256 _fee) public {

require(msg.sender == owner, "Only owner");

require(_fee >= MAX_SERVICE_FEE || _fee == 0, "Wrong fee value");

serviceFees[_user] = CustomServiceFee({active: true, amount: _fee});

}

- Functions with a

getprefix should not modify state

code/contracts/exchangeV3/DFSExchangeCore.sol:L182-L206

function getFee(

uint256 _amount,

address _user,

address _token,

uint256 _dfsFeeDivider

) internal returns (uint256 feeAmount) {

if (_dfsFeeDivider != 0 && Discount(DISCOUNT_ADDRESS).isCustomFeeSet(_user)) {

_dfsFeeDivider = Discount(DISCOUNT_ADDRESS).getCustomServiceFee(_user);

}

if (_dfsFeeDivider == 0) {

feeAmount = 0;

} else {

feeAmount = _amount / _dfsFeeDivider;

// fee can't go over 10% of the whole amount

if (feeAmount > (_amount / 10)) {

feeAmount = _amount / 10;

}

address walletAddr = feeRecipient.getFeeAddr();

_token.withdrawTokens(walletAddr, feeAmount);

}

}

- Protocol fee value should be validated against

msg.valueand not against contract’s balance

code/contracts/exchangeV3/offchainWrappersV3/ZeroxWrapper.sol:L25-L31

function takeOrder(

ExchangeData memory _exData,

ExchangeActionType _type

) override public payable returns (bool success, uint256) {

// check that contract have enough balance for exchange and protocol fee

require(_exData.srcAddr.getBalance(address(this)) >= _exData.srcAmount, ERR_SRC_AMOUNT);

require(TokenUtils.ETH_ADDR.getBalance(address(this)) >= _exData.offchainData.protocolFee, ERR_PROTOCOL_FEE);

- Remove deprecation warning (originated in OpenZeppelin’s implementation) in comment, as the issue has been solved

code/contracts/utils/SafeERC20.sol:L33-L44

/**

* @dev Deprecated. This function has issues similar to the ones found in

* {ERC20-approve}, and its usage is discouraged.

*/

function safeApprove(

IERC20 token,

address spender,

uint256 value

) internal {

_callOptionalReturn(token, abi.encodeWithSelector(token.approve.selector, spender, 0));

_callOptionalReturn(token, abi.encodeWithSelector(token.approve.selector, spender, value));

}

- Typo

RECIPIE_FEEinstead ofRECIPE_FEE

code/contracts/actions/exchange/DfsSell.sol:L15

uint internal constant RECIPIE_FEE = 400;

- Code duplication :

sendLeftOveris identical both inUniswapWrapperV3and inKyberWrapperV3, and thus can be shared in a base class.

code/contracts/exchangeV3/wrappersV3/KyberWrapperV3.sol:L127-L133

function sendLeftOver(address _srcAddr) internal {

msg.sender.transfer(address(this).balance);

if (_srcAddr != KYBER_ETH_ADDRESS) {

IERC20(_srcAddr).safeTransfer(msg.sender, IERC20(_srcAddr).balanceOf(address(this)));

}

}

-

Code duplication :

sliceUintfunction is identical both inDFSExchangeHelperand inDFSPrices -

DFSPricesV3.getBestPrice,DFSPricesV3.getExpectedRateshould be view functions -

Fix the code comments from

User borrows tokens totoUser borrows tokens from

code/contracts/actions/aave/AaveBorrow.sol:L63-L77

/// @notice User borrows tokens to the Aave protocol

/// @param _market Address provider for specific market

/// @param _tokenAddr The address of the token to be borrowed

/// @param _amount Amount of tokens to be borrowed

/// @param _rateMode Send 1 for stable rate and 2 for variable

/// @param _to The address we are sending the borrowed tokens to

/// @param _onBehalf From what user we are borrow the tokens, defaults to proxy

function _borrow(

address _market,

address _tokenAddr,

uint256 _amount,

uint256 _rateMode,

address _to,

address _onBehalf

) internal returns (uint256) {

code/contracts/actions/compound/CompBorrow.sol:L51-L59

/// @notice User borrows tokens to the Compound protocol

/// @param _cTokenAddr Address of the cToken we are borrowing

/// @param _amount Amount of tokens to be borrowed

/// @param _to The address we are sending the borrowed tokens to

function _borrow(

address _cTokenAddr,

uint256 _amount,

address _to

) internal returns (uint256) {

-

IExchangeV3.sell,IExchangeV3.buyshould not be payable -

TaskExecutor._executeActionshould not forward contract’s balance within theIDSProxy.executecall, as the funds are being sent to the same contract.

code/contracts/core/TaskExecutor.sol:L90-L105

function _executeAction(

Task memory _currTask,

uint256 _index,

bytes32[] memory _returnValues

) internal returns (bytes32 response) {

response = IDSProxy(address(this)).execute{value: address(this).balance}(

registry.getAddr(_currTask.actionIds[_index]),

abi.encodeWithSignature(

"executeAction(bytes[],bytes[],uint8[],bytes32[])",

_currTask.callData[_index],

_currTask.subData[_index],

_currTask.paramMapping[_index],

_returnValues

)

);

}

- Unsafe arithmetic operations

code/contracts/actions/compound/CompClaim.sol:L73

uint256 compClaimed = compBalanceAfter - compBalanceBefore;

code/contracts/actions/compound/CompWithdraw.sol:L84

_amount = tokenBalanceAfter - tokenBalanceBefore;

code/contracts/actions/uniswap/UniSupply.sol:L82-L83

_uniData.tokenA.withdrawTokens(_uniData.to, (_uniData.amountADesired - amountA));

_uniData.tokenB.withdrawTokens(_uniData.to, (_uniData.amountBDesired - amountB));

code/contracts/actions/flashloan/FLAaveV2.sol:L125-L133

IDSProxy(proxy).execute{value: address(this).balance}(

taskExecutor,

abi.encodeWithSelector(CALLBACK_SELECTOR, currTask, bytes32(_amounts[0] + _fees[0]))

);

// return FL

for (uint256 i = 0; i < _assets.length; i++) {

_assets[i].approveToken(address(AAVE_LENDING_POOL), _amounts[i] + _fees[i]);

}

code/contracts/exchangeV3/DFSExchangeCore.sol:L45

exData.srcAmount -= getFee(

code/contracts/exchangeV3/offchainWrappersV3/ZeroxWrapper.sol:L48

tokensSwaped = _exData.destAddr.getBalance(address(this)) - tokensBefore;

6.3 Gas optimization

Description

Use address(this) instead of external call for registry when possible.

Examples

code/contracts/actions/flashloan/FLAaveV2.sol:L82-L102

function _flAaveV2(FLAaveV2Data memory _flData, bytes memory _params) internal returns (uint) {

ILendingPoolV2(AAVE_LENDING_POOL).flashLoan(

payable(registry.getAddr(FL_AAVE_V2_ID)),

_flData.tokens,

_flData.amounts,

_flData.modes,

_flData.onBehalfOf,

_params,

AAVE_REFERRAL_CODE

);

logger.Log(

address(this),

msg.sender,

"FLAaveV2",

abi.encode(_flData.tokens, _flData.amounts, _flData.modes, _flData.onBehalfOf)

);

return _flData.amounts[0];

}

code/contracts/actions/flashloan/dydx/FLDyDx.sol:L76-L107

function _flDyDx(

uint256 _amount,

address _token,

bytes memory _data

) internal returns (uint256) {

address payable receiver = payable(registry.getAddr(FL_DYDX_ID));

ISoloMargin solo = ISoloMargin(SOLO_MARGIN_ADDRESS);

// Get marketId from token address

uint256 marketId = _getMarketIdFromTokenAddress(SOLO_MARGIN_ADDRESS, _token);

uint256 repayAmount = _getRepaymentAmountInternal(_amount);

IERC20(_token).safeApprove(SOLO_MARGIN_ADDRESS, repayAmount);

Actions.ActionArgs[] memory operations = new Actions.ActionArgs[](3);

operations[0] = _getWithdrawAction(marketId, _amount, receiver);

operations[1] = _getCallAction(_data, receiver);

operations[2] = _getDepositAction(marketId, repayAmount, address(this));

Account.Info[] memory accountInfos = new Account.Info[](1);

accountInfos[0] = _getAccountInfo();

solo.operate(accountInfos, operations);

logger.Log(address(this), msg.sender, "FLDyDx", abi.encode(_amount, _token));

return _amount;

}

Appendix 1 - Files in Scope

This audit covered the following files:

| File Name | SHA-1 Hash |

|---|---|

| contracts/auth/AdminVault.sol | 0bcc845ec8e2d927ca7ade0ab31471083cd798a5 |

| contracts/auth/AdminAuth.sol | ebe4c9219e473983df73569bed7b84008d0b0251 |

| contracts/auth/ProxyPermission.sol | cee91dbdd730811837a25ee92868e090ffb5220e |

| contracts/core/TaskExecutor.sol | 1a456a05404bb5b9bffda2ee8d726e62b777c644 |

| contracts/core/DFSRegistry.sol | 19f2678b2d7795f2d579644db14f0e2686792c1c |

| contracts/utils/SafeERC20.sol | 9411f7bd95ba807e0a125219497b9b8be42f0446 |

| contracts/utils/Discount.sol | d9495bfb48bf8251143a1a30bd845593e9488e11 |

| contracts/utils/FeeRecipient.sol | eae0bf0c1b0abc1250be6fa49b96924226669d2e |

| contracts/utils/FLFeeFaucet.sol | 6ff7e59b32e184ff66fdd1c27c5fdc76f721564d |

| contracts/utils/Exponential.sol | aa4098007240494f375dd3533b5d02d5bdd4d8b4 |

| contracts/utils/SafeMath.sol | 4381feeda6079de2addc7e267657a4ef2658dc6c |

| contracts/utils/Address.sol | 24762c686cd3cf849197cd912858226a774b5e6e |

| contracts/utils/ZrxAllowlist.sol | f20a47bb1be3272d5e8954a040c62a89612b5dfc |

| contracts/utils/DFSProxyRegistry.sol | d541d59864694dd6b19187c9e4231286afce961c |

| contracts/utils/DefisaverLogger.sol | d2362e116c43593168d2c00adb7472a916230d63 |

| contracts/utils/TokenUtils.sol | 492839d9ac138304af554933db621c2d5bdf8550 |

| contracts/utils/CarefulMath.sol | 327ed2e92a98e57759da3e8e41e3c28a6128c169 |

| contracts/exchangeV3/DFSExchangeHelper.sol | 19ead7a237a35f86e7cbb5f66b2cf374f2900534 |

| contracts/exchangeV3/wrappersV3/KyberWrapperV3.sol | 294efb5079e81052bcc682062dae28d45096b989 |

| contracts/exchangeV3/offchainWrappersV3/ScpWrapper.sol | 1c3c20a94a49e03829c701e1fa0ae9fb75895449 |

| contracts/exchangeV3/wrappersV3/UniswapWrapperV3.sol | f845341af105f8dc456a03ada15b58119dbd38e0 |

| contracts/exchangeV3/DFSExchangeCore.sol | cf1bb7f3e692300404ac8cde83f9c1fb50e2b594 |

| contracts/exchangeV3/DFSExchangeData.sol | 50cf9d3288b28032878d737040353fc97407976b |

| contracts/exchangeV3/DFSExchange.sol | 424120fc97700cb4046928ec99db3b789bf86199 |

| contracts/exchangeV3/DFSPricesV3.sol | 8d9ea0ac0bd63af56cc53d8f38fdad10f8854c6a |

| contracts/exchangeV3/SaverExchangeRegistry.sol | 79708bca57219b8178a404b9afe18d6a143c648a |

| contracts/exchangeV3/offchainWrappersV3/ZeroxWrapper.sol | bf63611a717b7991fc8d23682fc0688afb8a906e |

| contracts/actions/utils/UnwrapEth.sol | 90ff17831ee096c413af2cae007139fc3730e5cb |

| contracts/actions/utils/PullToken.sol | 4692b288725331186447185cbb5eb1b32485ad10 |

| contracts/actions/utils/SumInputs.sol | edd5622e65882938d9c4f3425b049101c659e70d |

| contracts/actions/exchange/DfsSell.sol | d6e7df7045af542fea38a8a95e4dd443b2be0f64 |

| contracts/actions/flashloan/FLAaveV2.sol | f5383042870d142684a5a78c36046a37b0a73b84 |

| contracts/actions/ActionBase.sol | 86e3425f0160a86d6fbe3b7293fd2220d160721a |

| contracts/actions/exchange/DFSBuy.sol | 57d296223fb587b92dd1bb61aa3d7c931ae41433 |

| contracts/actions/uniswap/UniWithdraw.sol | 6358c7ceec12b52a7d75bd37a2e8ac90dca95da0 |

| contracts/actions/uniswap/UniSupply.sol | 2d670ef9f9a4cc83bdef2ac54bef88a3cfcdefcc |

| contracts/actions/utils/WrapEth.sol | 79ec4b231dac21feedf28d2e8cf2bae8e7a87fe4 |

| contracts/actions/flashloan/dydx/DydxFlashLoanBase.sol | 9a40f771ef6397f97e68335e26f6283403371934 |

| contracts/actions/compound/CompWithdraw.sol | dfadbb93dbb3f0ace1d5ee2eb2247e7ed0d85472 |

| contracts/actions/flashloan/dydx/FLDyDx.sol | 888d35f3a97a003737f93e360ec46ba11facb93b |

| contracts/actions/utils/SendToken.sol | 1aa1d4b8e241e0ffc62dfef14b900f614ab28461 |

| contracts/actions/aave/AaveSupply.sol | 55a00932fd4db3e6778df0cafbfeaa0871db6fc6 |

| contracts/actions/mcd/McdMerge.sol | b04431602f8a4429e38d1a486eb37bb8eab164a1 |

| contracts/actions/aave/AaveWithdraw.sol | 65c8dd23d6076edb4b13194c165c86563408f50e |

| contracts/actions/mcd/McdPayback.sol | b5fe10f2913e6adc4c56e1397fe819574a814a3f |

| contracts/actions/aave/AaveBorrow.sol | 1b43dee1be0a5aee5ab7febd0e85e24f77efe99d |

| contracts/actions/compound/CompBorrow.sol | 170c9e7b40601fcd0389f91803675eb6fbebe616 |

| contracts/actions/compound/CompSupply.sol | 30c45f093217173853b8a09cb97505f8a53eb0ce |

| contracts/actions/aave/AavePayback.sol | a8f56e6bdbd17c6131edc2b7e81c910ba821af03 |

| contracts/actions/compound/CompPayback.sol | 0ac2f420cdb306d0ae2ef9150944d9a719484fdc |

| contracts/actions/mcd/McdGenerate.sol | fad58d9b6de75694dffafa1ebf7d8bba2995d243 |

| contracts/actions/mcd/McdGive.sol | 8e50727a34b43030d928fba26f3183ed594e67d1 |

| contracts/actions/mcd/McdWithdraw.sol | a93b46770994aa900cbb3d8d366bafb6c2607959 |

| contracts/actions/aave/helpers/AaveHelper.sol | 3d299853e11e07aa19f3839c4bb57644781a1838 |

| contracts/actions/mcd/McdSupply.sol | 6f49b4069839834bf643273cbeb64a6b945775ce |

| contracts/actions/mcd/McdOpen.sol | dc8051109bf037f0532f565f7ca139f55bb9fcce |

| contracts/actions/compound/CompClaim.sol | e1621308e26ce316fbfdecdd651cd18243e5b908 |

| contracts/actions/compound/helpers/CompHelper.sol | 6c2699e4dd873ca36c22c1eeeeaacfe3d2d8860f |

| contracts/actions/mcd/helpers/McdHelper.sol | 0ffea9e971bee2cb573ea8f6b344e2feba3fff32 |

The following files were looked at to understand the overall system but are not in the scope:

| File Name | SHA-1 Hash |

|---|---|

| contracts/DS/DSProxyFactoryInterface.sol | f2366ee831535db0216213177b71c591af775dd8 |

| contracts/DS/DSMath.sol | 582030753e6d2682bb1104d175c09ce10a55e217 |

| contracts/DS/DSGuard.sol | 33221642c289acb219b35df3e5c9223ee6c59677 |

| contracts/DS/DSAuthority.sol | af4795dfcdf38101b1d1b5543bf5baa726bbe722 |

| contracts/DS/DSProxy.sol | cbc0b52690cbde8540f411faa1933317116d6e9b |

| contracts/DS/DSNote.sol | d27a91dd0123f3793ec6d437dc40bf1cb66957f5 |

| contracts/DS/DSAuth.sol | 3df0ea67a517b9ac3d60d454a3d3fe77fb80534a |

Appendix 2 - Disclosure

ConsenSys Diligence (“CD”) typically receives compensation from one or more clients (the “Clients”) for performing the analysis contained in these reports (the “Reports”). The Reports may be distributed through other means, including via ConsenSys publications and other distributions.

The Reports are not an endorsement or indictment of any particular project or team, and the Reports do not guarantee the security of any particular project. This Report does not consider, and should not be interpreted as considering or having any bearing on, the potential economics of a token, token sale or any other product, service or other asset. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty. No Report provides any warranty or representation to any Third-Party in any respect, including regarding the bugfree nature of code, the business model or proprietors of any such business model, and the legal compliance of any such business. No third party should rely on the Reports in any way, including for the purpose of making any decisions to buy or sell any token, product, service or other asset. Specifically, for the avoidance of doubt, this Report does not constitute investment advice, is not intended to be relied upon as investment advice, is not an endorsement of this project or team, and it is not a guarantee as to the absolute security of the project. CD owes no duty to any Third-Party by virtue of publishing these Reports.

PURPOSE OF REPORTS The Reports and the analysis described therein are created solely for Clients and published with their consent. The scope of our review is limited to a review of Solidity code and only the Solidity code we note as being within the scope of our review within this report. The Solidity language itself remains under development and is subject to unknown risks and flaws. The review does not extend to the compiler layer, or any other areas beyond Solidity that could present security risks. Cryptographic tokens are emergent technologies and carry with them high levels of technical risk and uncertainty.

CD makes the Reports available to parties other than the Clients (i.e., “third parties”) – on its website. CD hopes that by making these analyses publicly available, it can help the blockchain ecosystem develop technical best practices in this rapidly evolving area of innovation.

LINKS TO OTHER WEB SITES FROM THIS WEB SITE You may, through hypertext or other computer links, gain access to web sites operated by persons other than ConsenSys and CD. Such hyperlinks are provided for your reference and convenience only, and are the exclusive responsibility of such web sites’ owners. You agree that ConsenSys and CD are not responsible for the content or operation of such Web sites, and that ConsenSys and CD shall have no liability to you or any other person or entity for the use of third party Web sites. Except as described below, a hyperlink from this web Site to another web site does not imply or mean that ConsenSys and CD endorses the content on that Web site or the operator or operations of that site. You are solely responsible for determining the extent to which you may use any content at any other web sites to which you link from the Reports. ConsenSys and CD assumes no responsibility for the use of third party software on the Web Site and shall have no liability whatsoever to any person or entity for the accuracy or completeness of any outcome generated by such software.

TIMELINESS OF CONTENT The content contained in the Reports is current as of the date appearing on the Report and is subject to change without notice. Unless indicated otherwise, by ConsenSys and CD.