Consensys Codefi published its Q2 2020 Decentralized Finance Report, a summary and analysis of Ethereum’s DeFi ecosystem this past quarter. Some of the main topics covered in the report include:

Overall DeFi data statistics, summaries, and visualizations.

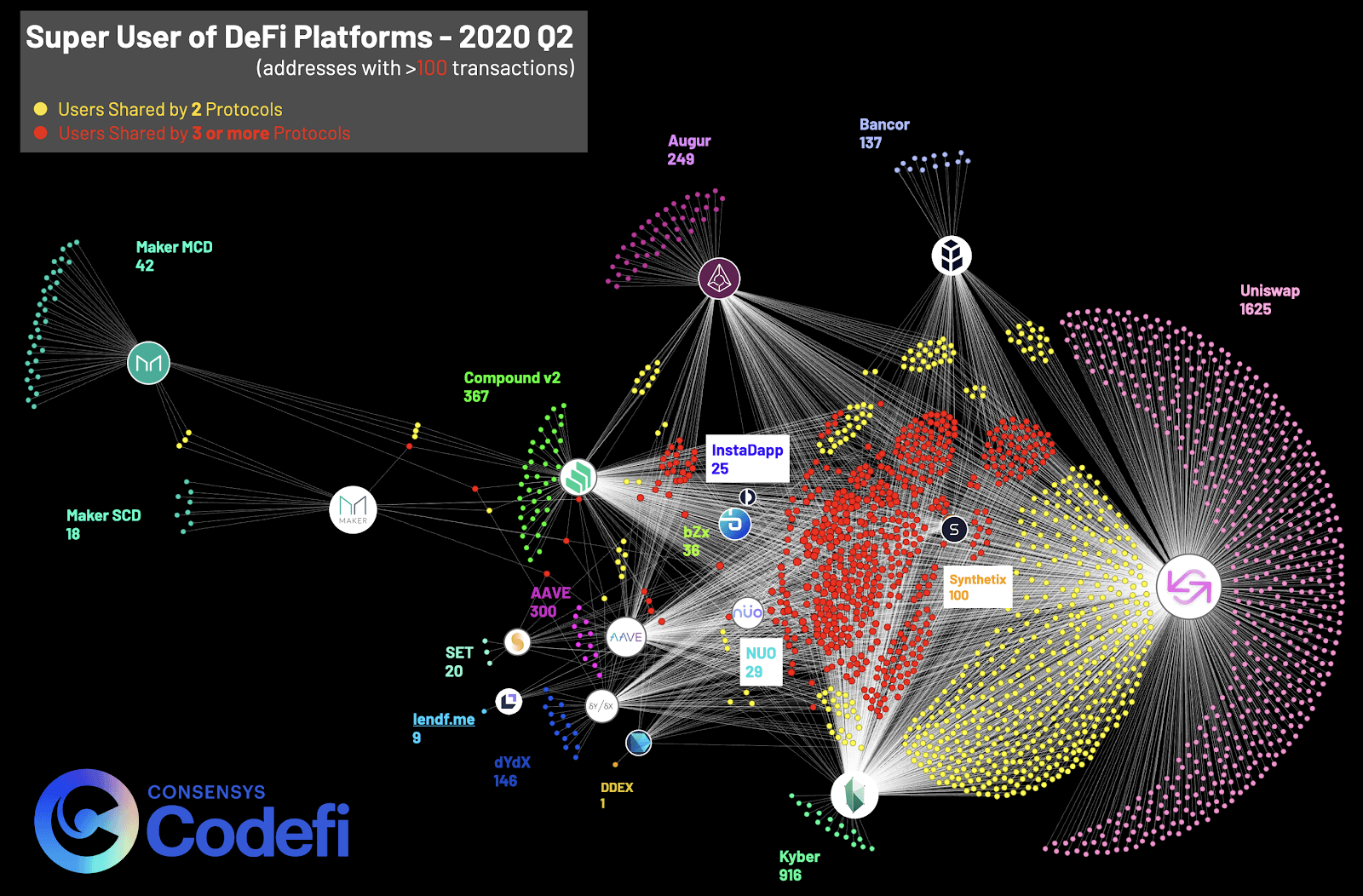

DeFi user behavior and network visualizations of the user relationships between protocols.

COMP, Compound, and Yield Farming.

BTC tokenized on Ethereum.

Major security incidents and the rise of DeFi insurance.

The performance of specific high-profile protocols, including Uniswap, Maker, and Compound.

The state of stablecoins in Ethereum DeFi.

A look towards DeFi in 2020 and beyond.

In this report, we identified the three most important DeFi events in Q2:

1. BTC Tokenized on Ethereum

What happened: In May, the amount of BTC on Ethereum (represented by tokenized BTC such as WBTC) surpassed the amount of BTC on the Lightning Network, Bitcoin’s layer 2 scaling network.

Why it matters: Cross-chain interoperability is anti-maximalist, but is the more likely future of blockchain. The teams enabling the tokenizing of BTC on Ethereum have been embracing this belief, and it is paying off. Also, Ethereum’s DeFi ecosystem has such a strong gravity that even BTC holders have been finding ways to use it.

2. COMP and Yield Farming

What happened: Compound released its governance token COMP in mid-June. Tokens have been rewarded daily to borrowers and lenders on Compound. The result has been that enterprising DeFi users have been maximizing their COMP yield (i.e. “yield farming”) by using DeFi mechanisms to unlock capital and then lending/borrowing on Compound.

Why it matters: Yield farming took the DeFi ecosystem by storm in the last two weeks of the quarter. Crucial metrics like ETH locked and daily active users soared after being fairly stagnant earlier in the quarter. However, data (discussed below) suggests the frenzy did not bring many new users into DeFi, demonstrating that DeFi’s innovation must be paired with education and UX before we see the DeFi community grow beyond its current borders.

3. Three Major Security Incidents

What happened: Uniswap, Lendf.me, and Bancor all had high-profile security incidents this quarter, collectively resulting in $26M USD stolen (most of which was returned, discussed in the report).

Why it matters: Security incidents are inevitable in emerging technology. The DeFi community continues to develop strategies to hedge against it, including: auditing services, security products, and insurance applications. All of this is benefited by the open source nature of DeFi, which allows third parties to monitor DeFi dapps, provide suggestions, and analyze attacks to help protect the entire community in the future.

Download the Q2 Ethereum DeFi Report

Discover emerging network trends and explore the performance of the popular DeFi protocols like Compound, Uniswap, and MakerDAO.