Mata Capital: Blockchain Case Study on Real Estate Investment Management

French asset manager promotes trust, transparency and efficiency for real estate investors by tokenizing ownership of a Paris hotel.

Abstract

French real estate fund management company, Mata Capital, looked to blockchain technology in 2019 to modernize and optimize the processes of distributing fund shares and maintaining its investor registry.

With asset tokenization, Mata Capital aims to enable greater participation in real estate investment by decreasing the costs associated with investor registration, investor onboarding, and subscription operation. The long-term vision is to reduce minimum investor subscription amounts from €100,000 to €1. With the reduced costs and increased digital functionality of blockchain, Mata Capital seeks to attract a wider and more diverse pool of investors to real estate asset investments.

To achieve this goal, Mata Capital partnered with Consensys Codefi to issue security tokens for three separate funds worth a combined total of €350m.

The first of these tokenization projects entailed ownership of a planned 11-story hotel currently under construction on the outskirts of Paris. The resulting €26m issuance is the among the largest real estate tokenization projects in Europe.

The Pain Points

Today, the real estate asset management industry suffers from the following pain points:

Cumbersome and costly fund creation, asset distribution, and registry maintenance

Substantial administration costs especially for small investment tickets for KYC and registration activities, resulting in high minimum investment subscription amounts

Investors have limited access to secondary markets. They are unable to easily trade assets, even when required by portfolio allocation strategy

Asset managers like Mata Capital rely on paper to manage the investor registry. Digitizing this process would enable Mata Capital to save costs, ensure accuracy and achieve better oversight for its investors.

The Solution

To efficiently manage investment in the hotel building in compliance with regulatory requirements, Mata Capital needed to control who could invest, and define the shares owned and transaction rules.

In contrast to the traditional approach of managing compliance requirements, investor eligibility and share issuance as dissociated manual processes, Codefi Assets’s Ethereum-based platform, powered by AWS cloud, uses smart contracts to describe the real estate asset, define its compliance requirements, validate the investor Know-Your-Customer (KYC) profile, and issue corresponding fund shares to each verified investor.

The usual burden on Mata Capital to research investors’ eligibility and risk profile was alleviated by inviting potential investors to create accounts, fill in a KYC compliance form and upload all required documents to the platform. These documents were then processed off the Ethereum chain by Mata Capital, the issuer. Those eligible to purchase tokens to invest in the fund were then whitelisted, validating their credentials within the platform.

Leveraging the precision and automation capabilities of Ethereum, the solution allowed eligible investors to define the nature and number of shares they would purchase, make the payment via wire transfer and receive the shares upon payment validation. Behind the scenes, this involved the issuer authorizing the transfer of tokens to whitelisted investors through a certificate signed using its private key.

Upon completion, investors received a receipt of the sale detailing its characteristics (i.e. issuers, investors, number of tokens bought), and a link to the transaction on the Ethereum blockchain.

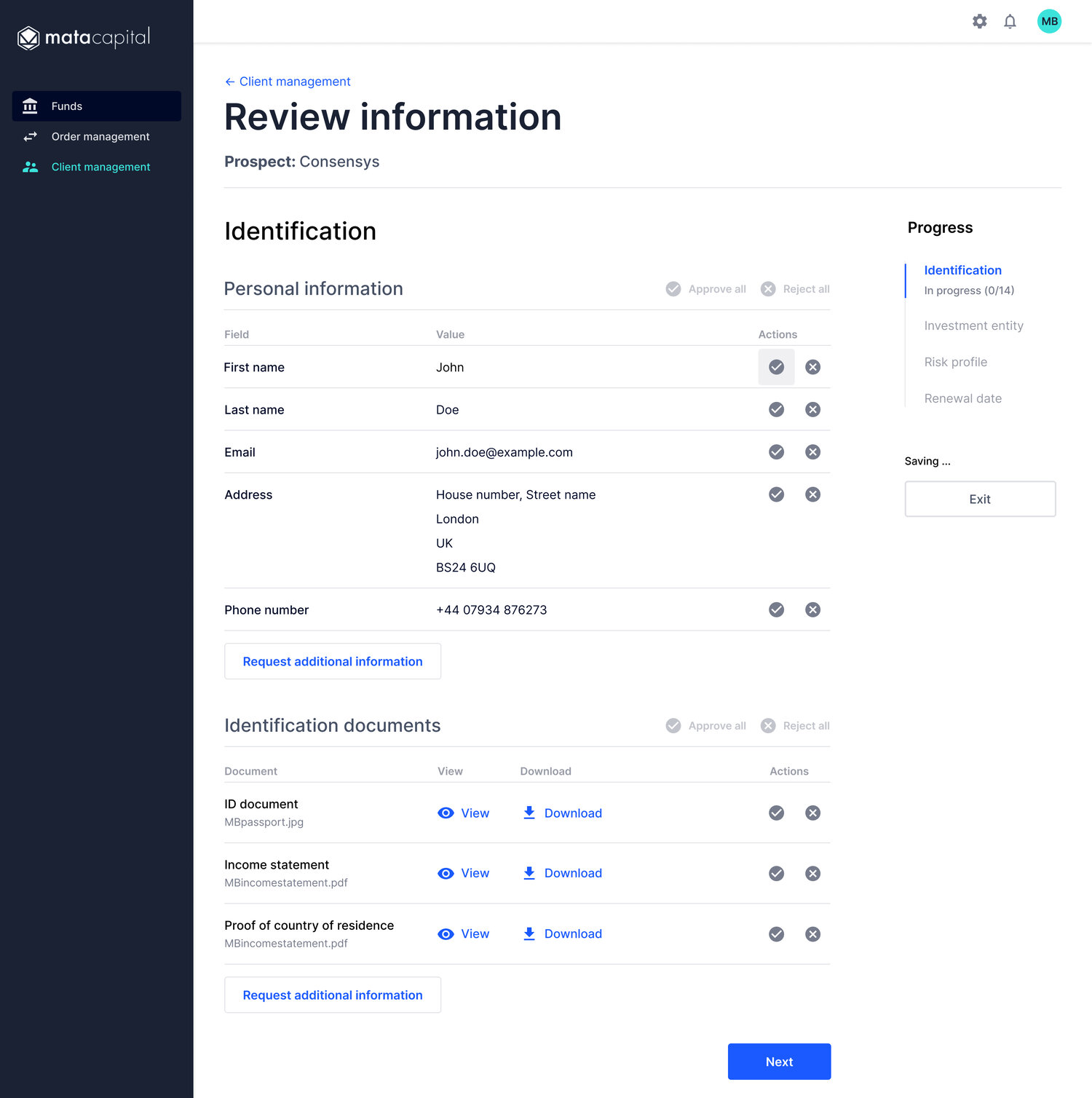

Diagram 1: Issuer Interface

Diagram 2: Investor Interface

KYC Compliance and Whitelisting

Diagram 3: Transaction Processing and Payment Tracking

“This first step marks the beginning of a radical transformation of the Real Estate Asset Management sector,” says Codefi Asset’s product lead Matthieu Bouchaud. “With the Codefi Assets platform, we enable our clients to move from the age of experimentation to one of industrial growth, allowing them to issue and manage their funds units in a much more efficient way.”

Smart Contracts: Technicals

Codefi Assets enables the easy creation and deployment of smart contracts on the Ethereum mainnet based on the ERC1400 standard, among others. The ERC1400 standard was specially created by the Ethereum community and ConsenSys to represent financial assets on the blockchain. These highly configurable smart contracts and security tokens have the following features:

Security tokens support force transfers, burns and mints by an administrator

Security tokens support trade restrictions through off-chain certificate generation. Token transfers are conditioned upon the validity of the certificate, offering the issuer robust control capabilities over their financial assets across both primary and secondary markets

Security tokens support partial-fungibility (i.e. the ability to create different classes of assets)

All smart contracts used were audited by ConsenSys Diligence

The Results

For Mata Capital, the aims for its tokenized issuance included time- and cost-savings, greater flexibility for customising products, and providing access to new classes of investors. It was also looking for more secure and efficient transaction processing along with a “single source of truth” between all participants and third-parties— to improve transparency and immutability of information, and also to streamline reporting efforts.

With Codefi’s platform, the investor registry is automatically updated and maintained in one place, ensuring accuracy, transparency and security of the information.

“Innovation is at the heart of Mata Capital’s strategy, as illustrated by the recent implementation of an operational platform to secure all of our subscribers’ information,” says Souleymane-Jean Galadima, director of innovation and digital business at Mata Capital.

Digitising the investment process on Ethereum also provides Mata Capital opportunities to distribute more globally, since international investors can access the platform just as easily as domestic investors, with both KYC and distribution of tokens being processed on the blockchain.

As a broader objective, Mata Capital expects to attract more retail investors who will take advantage of the ease at which they can invest in a complex financial product. In time, the transparency and accessibility of information about financial assets represented on the blockchain will increase the trust investors have in Mata Capital’s products.

Baptiste Saint-Martin, product development manager at Mata Capital, adds: “Tokenization will allow us to provide better liquidity to our investors, especially in the secondary market.”

Tokenizing Real Estate Assets

Among the varied roles blockchain could play in the real estate sector – from smart contracts for property transactions to data management for property listings – the most viable and widespread application is through tokenizing assets, according to research by real estate services firm Cushman & Wakfield. In line with Mata Capital’s aim to enable greater participation in real estate investment, the report predicts that tokenization will help the commercial real estate market open up to a greater range of retail investors due to lower minimum tickets, greater transparency and more liquidity.

The opportunity to tokenize financial assets is set to reach $2 trillion in the next two years, according to the World Economic Forum, with half of that originating from alternative assets including real estate. The timeframe to realise this potential is generally thought to be much sooner for real estate compared to other asset classes, with early examples of implementing real estate tokenization, like Mata Capital, already making headway.

But this opportunity relies on the development and uptake of solutions which can reduce the operational complexity and regulatory risk around blockchain and tokenization. The results achieved by Mata Capital with Codefi Assets’s platform demonstrates that tokenization can offer real estate funds greater efficiency, transparency and risk management without compromising the institutional standards that are fundamental to both investors and asset managers.