BLOCKCHAIN IN FINANCE

komgo: Blockchain Case Study for Commodity Trade Finance

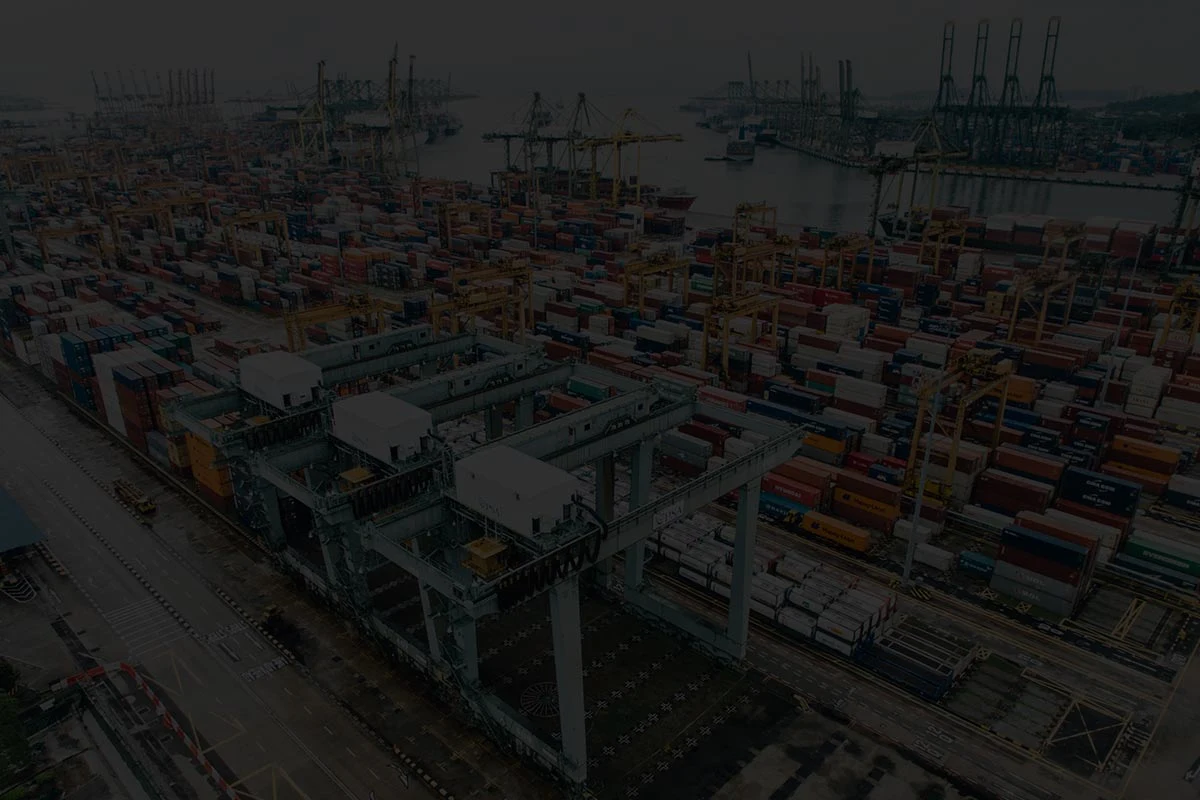

A blockchain-based open platform that is bringing commodity trade finance into the 21st century by optimizing financing processes and accelerating industry operations with digitized transactions and a trusted source of documents to reduce fraud.

Catalyzing the Global Trade and Commodities Finance Network with Blockchain

The world’s first blockchain-based platform for the commodity trade ecosystem.

komgo acts as a single source of truth, allowing traders, carriers, banks, and other authorized participants to securely transact in a highly efficient, digitized way, resulting in industry-wide simplification of operations and standardized documentation.

Just one year after its public launch, komgo supports close to 1 billion USD of financing channeled by network members. komgo is backed by 15 of the world’s largest global banks, trading companies, and oil giants, and is adding new members at a rapid rate.

The Challenge

Rapid globalization has outpaced the trade finance industry’s ability to standardize and digitize its system of record-tracking. The exchange of commodities—each with its unique regulations, shipping specifications, and certification requirements—is currently managed across various borders and jurisdictions using an ineffective, issue-prone, antiquated paper-based system of record tracking.

Among these issues are miscommunication and fraud, security vulnerabilities, manual, repetitive tasks, long verification times, and losses due to transaction fees, invoice factoring, and delayed payment methods. It has been historically challenging to make significant technological improvements in trade finance operations for various reasons, including the number of diverse stakeholders located across the globe and the complexity and volume of business transactions. Fractured processes and regulation dissonance contribute to the $1.5 trillion-dollar supply-demand gap in global trade finance.

See Citi’s Global Head of Commodity Trade Finance explain how some of the world’s largest institutions are coming together to build an end-to-end blockchain solution for commodities trade financing.

The Enterprise Ethereum Solution

komgo is a blockchain-based trade financing platform and network-based on JP Morgan’s Quorum. It is connected to another live Ethereum platform, VAKT, a blockchain-based post-trade processing platform for commodities. The komgo platform has a proprietary document transfer system called Kite that allows secure transfer without revealing the contents to komgo. This framework utilizes distributed ledger technology to tackle fraud, increase efficiency, and digitize trade.

The komgo platform facilitates significantly increased transparency, while its “privacy by design” architecture permits private peer-to-peer transactions. This design model radically enhances trust and accelerates access to trade finance by reducing operational procedures and lowering the risks of failures and fraud across the industry. Authorized parties include banks, commodity traders, energy corporates, inspection companies, and the broader ecosystem of participants.

komgo partnered with Consensys and Kaleido to develop their blockchain solution and ‘productize’ itself for a large number of participants at an accelerated pace. Enterprise blockchain enables a tamper-proof KYC record that meets Anti-Money Laundering (AML) regulations; it uses a shared ledger to improve access to accurate information across the ecosystem, and it provides private data exchange based on permissions.

In a few short months, komgo was able to deploy a secure digital platform where authorized parties can store data, exchange transactions, and send messages based on permissions.

Cost-saving: komgo brings an estimated 30-40% increase in cash-flow gains across the entire production chain due to streamlined operations. The platform is expected to facilitate a 20-50% reduction in operational cost pending industry-wide adoption. Increased gains projected as the project matures.

Simplicity: The komgo network allows banks, traders, and other participants to all transact off the same secure software, resulting in industry-wide simplification of operations and communication on a scale never before possible.

Efficiency: The komgo network is a decentralized solution to information sharing. Documentation and data are shared directly between transacting participants with immutable, transparent timestamps, thus removing the lag-time involved with third parties.

Security: komgo’s blockchain-based software ensures that data cannot be tampered with, manipulated, or misplaced. Additionally, access to particular information is tightly controlled, assuring that only chosen participants can view relevant documentation.

komgo is backed by 15 of the world’s largest commodity trade and finance companies: ABN-AMRO, BNP Paribas, Credit Agricole, Citi, Gunvor, ING, Koch Supply & Trading, Macquarie, Mercuria, MUFG Bank, Natixis, Rabobank, SGS, Shell, Societe Generale.

“The launch of Komgo SA highlights a shared vision for industry innovation and underlines the ongoing commitment among members to build a truly open and more efficient network within commodity trading.”

Souleima Baddi

CEO of komgo

Goals Achieved

20 December 2018: komgo launched in production 4 months after its incorporation

21 December 2018: The first letter of credit was issued on the platform. This marked a world-first for the commodity trade finance industry.

14 June 2019: komgo announces two new features: Receivable Discount and Standby Letters of Credit.

16 August 2019: ING successfully completed its first commodity transaction on komgo. The Geneva branch executed an oil trade deal with a Letter of Credit issued on behalf of Mercuria Energy Trading SA.

September 2019: TOTSA Total Oil Trading SA joined komgo, the first client to onboard from outside the initial shareholder group.

25 September 2019: Lloyds Bank became the first UK bank to join komgo.

14 October 2019: komgo surpassed USD700m of financing on the platform.

23 October 2019: Rabobank transacted it’s first commodity trade on komgo— a Standby Letter of Credit was issued over the platform for the purchase of biofuel.

99.58% reduction in time to issue a digital letter of credit – from 10 days to 1 hour.