Recently featured in Forbes’s Blockchain 50 list, the Ethereum-based komgo platform is being adopted by a growing number of global banks, commodity traders, energy corporates, and other key players in the trade finance ecosystem who are determined to bring the industry into the 21st century. From digitized letters of credit to tamper-resistant data sharing, the platform is helping to simplify, secure, and standardize operations across the traditional trade finance industry, supporting the use case for blockchain for global trade.

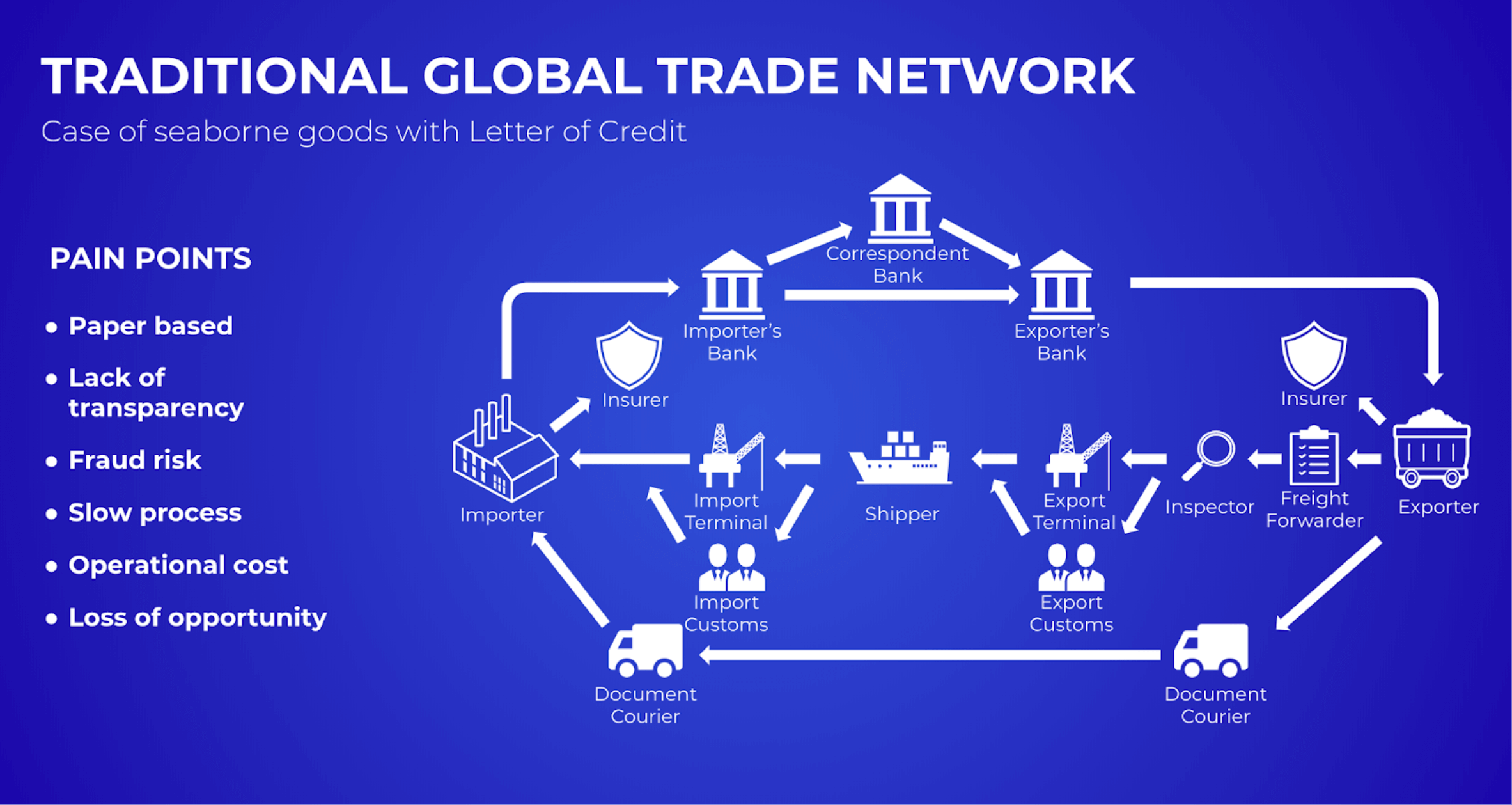

komgo was launched in 2018 after 15 of some of the world’s largest banks, trading companies, and oil giants came together in partnership with Consensys to address challenges such as paper-based processing, delayed transaction settlement, potentially costly invoice factoring, and fragmented record-tracking in trade finance. The platform is the first blockchain-based solution for the commodity trade ecosystem.

Since its launch, komgo has surpassed $1B USD of financing on the platform and reduced the time to issue a digital letter of credit from an average of 10 days to 1 hour. In 2019, the platform rolled out Receivables Discounting and Standby Letters of Credit and onboarded multinational finance and energy institutions beyond the initial shareholder group such as TOTSA Oil Trading SA, SMBC, and Lloyds Bank.

komgo is continuing to work in partnership with Consensys to accelerate development and simplify adoption for other institutional players in the commodity trading market. We recently sat down with Kris Van Broekhoven, Global Head of Commodity Trade Finance at Citi, one of the founder investors of komgo, to discuss the benefits of blockchain in trade finance, the motivations behind Citi’s investment, and his vision for the komgo platform in 2020 and beyond.

[embed]https://www.youtube.com/watch?v=OzVB_QXhpn8[/embed]

How would you describe the komgo platform?

komgo is a new company dedicated to building a fully decentralized digital platform for end-to-end financing of trade in the commodities industry. Through komgo, buyers and sellers of commodities, as well as their banks and service providers, will be able to communicate and exchange data in an electronic manner. The backbone infrastructure leverages blockchain technology to help provide greater trust and security. The platform is built for integration and easy interoperability with many back-office systems of its users, as well as other existing platforms. The goal is to develop a one-stop shop for commodity trade finance offering speed, efficiencies, and a first-class user experience to the industry.

What problem is komgo trying to solve?

komgo strives to go beyond merely turning the existing commodity trade finance process into a digital one. To convince users to adopt a new way of communicating and, to make a difference, we need to address real pain points for users on all sides of a transaction. This can come in various forms, including the removal of manual touchpoints. In turn, this helps to speed up turnaround times, improve data reconciliation, and reduce the risk of fraud and human error.

komgo has been working on a number of exciting features that are intended to drastically improve the user experience. komgo’s initial focus has been on Letters of Credit, Account Receivables financing, and KYC. Other features such as inventory financing and auto-matching of electronic documents will be added later on.

“komgo strives to go beyond merely turning the existing commodity trade finance process into a digital one … komgo helps to speed up turnaround times, improve data reconciliation, and reduce the risk of fraud and human error.”

How is Citi involved in komgo?

Citi is one of the founding investors of komgo. We first invested in the company when it was established in early 2018, and recently topped up our equity to allow the company to continue developing. Since Citi’s global trade business is managing the investment, I am directly involved in partnering with komgo. We did that to help maximise the value we can bring to komgo in the early stage of product development and user engagement. Citi, similar to other supporting banks and corporates, contributes time and resources to product development workshops, IT and security reviews, and shares user feedback. We even started integrating our trade processing system with komgo so we can already start to see reduced turnaround times and capture the benefits that komgo brings.

Why did Citi choose to join komgo?

Citi prides itself on being a leading digital bank, and blockchain technology is offering tremendous opportunities to help improve the way banks and clients operate today. As one of the top global trade banks in the world, we take trade digitization very seriously. For more than 100 years, the industry has been heavily dependent on the exchange and manual processing of paper documents. Now blockchain technology serves as a catalyst to disrupt the industry towards the processing of electronic data. Banks and clients want a simple and elegant user experience that comes with digital tools. And those same banks and corporates need to find efficiencies in order to aid in reducing costs, speeding up turnaround times, and reducing fraud. At Citi, we are very proactive about adopting digitization and our clients expect us to be one of the driving forces in this process of change.

As other banks are striving towards this similar goal, we realized early on that this would be much stronger if we band together and co-create with komgo. By working to bring the market together and developing a solution along with other banks and corporate users, we strive to achieve more. That is exactly what makes komgo so interesting: it is one of the only consortiums that combines banks and corporates as founders. The initial group includes some of the largest banks and corporates active in commodity trading. This way we help to ensure that the features that komgo develops really address the pain points of a wide variety of users—beyond banks—and the platform has a number of institutions behind it that commit to transacting on the platform.

“For more than 100 years, the industry has been heavily dependent on the exchange and manual processing of paper documents. Now blockchain technology serves as a catalyst to disrupt the industry towards the processing of electronic data.”

How has being a member of komgo benefited Citi and its clients?

In a world that is very global, the market continues to look for efficiencies in order to continue to provide value to shareholders. Given our financial power, our broad set of solutions and worldwide access to clients, Citi is ideally placed to guide our clients through periods of change and digitization. Our involvement in komgo has triggered a lot of interest from our clients. Digitization is a top priority in many of our client conversations, and frankly, you have to be directly involved to really understand what is going on, and to have a meaningful dialogue on the subject. That is what komgo has already brought to Citi. We learned a lot about blockchain, about what drives users to change their behaviour, and how we can help solve pain points not only for ourselves but for the wider ecosystem.

What KPIs are you tracking?

In the first year, we spent a fair amount of time and energy on refining the IT setup and security. A year later, we are now looking to start tracking KPIs on komgo’s progress. We monitor the platform investment costs to ensure it has the financial capabilities to keep doing what we set out to do, and we monitor the progress on user onboarding and client feedback to track adoption rates so we can adjust for optimal results.

What has komgo accomplished so far? What are next steps?

In the last four years, there has been a lot of noise around pilots involving digitization and blockchain. Questions have been raised about blockchain being just a buzzword. I am more patient in this respect than some others. When you are directly involved, you realize it takes time. It is not that difficult to list the potential benefits of distributed ledgers and the use of electronic data. We have also learned it is not even that hard to organise pilots and prove that the processing of digital data is much faster and more efficient than the manual processing of paper documents. We have reached the stage where it seems most market players understand what blockchain is about and the benefits it can bring. But it is a giant leap to go from POC to a live production platform.

komgo was established in 2018. It took about a year to build and test the IT infrastructure and develop a first set of features that appealed to users. 12 months to develop the infrastructure is very fast and a fantastic achievement. Now that the platform is up and running, the focus is shifting to user onboarding. This is when it will really get interesting. As users start to interact with the new digital platform, we look forward to gathering new insights from active users so we can further develop and refine the features in order to better solve their pain points. As new users sign up, we anticipate the platform will gain traction and we should see a fast ramp-up of deals being processed. As with anything new, it often takes a few early movers to give direction to the rest of the market, and we are prepared to play our part in that.

The world of tomorrow will be very different than what we have today. New technology is creating new possibilities, and our daily interaction with smartphones and social media creates raised expectations. While there are many ideas and proofs of concept for technology, many will not make it into production. But I do believe that in three to five years time, the market will form a new ecosystem where users communicate digitally with each other directly or via platforms, and data may be exchanged between separate but connected platforms. In the world of commodity finance, this new ecosystem is already emerging on komgo’s open financing platform, as well as on Vakt, the Covantis’ post-trade execution platform for agricultural commodities, and other initiatives around shipping and insurance. All together, these full-stack integrations should bring the increased efficiencies and the user experience that we dream of today.

Read our free komgo case study

Learn more about the world's first blockchain-based platform for the commodity trade ecosystem.