Summary

Covalent is a decentralized data infrastructure that enables users to seamlessly access blockchain data that is otherwise inaccessible. While blockchain data is public, querying it is time-consuming, computationally intensive, and requires a technical skillset. Covalent has indexed entire blockchain histories and has transformed these data in a way that is standardized and truly interoperable. Users can leverage a unified API to query virtually any data on a given blockchain.

Overview

Blockchain data is deep, granular, and historical. One of its most powerful features, however, is that it is publicly available and anyone can audit it. Despite this openness, blockchain data is prohibitively difficult to access and generally requires significant technical skills. Even when users are able to navigate a pathway to this data, accessing it in a performant, detailed manner is extremely difficult. Querying blockchains directly is time-consuming and computationally intensive. Once the data is able to be queried, the process of cleaning, refining and transforming the data in a way that makes it readable adds another layer of complexity. This presents significant challenges to end users. Overall, the Web3 data access experience has significant shortcomings compared with the way that end users are accustomed to accessing data in traditional Web2.

The key challenges can be thought of in terms of cost of access, speed, completeness, and tooling. Accessing historical EVM data is labor intensive and expensive. For instance, running a “full archive mode” requires special hardware provisions and uses hundreds of gigabytes of storage.The speed at which users can access this data is suboptimal, particularly given that traditional methods of accessing blockchain data utilize a JSON-RPC layer. This layer typically works by way of a “point-query” interface, in which users query an object, such as a block or transaction, and then the data is relayed back to them. However, this interface limits queries to a single object at a time. So users are unable to query multiple objects at once and cannot batch export the data. This adds significant time to the overall process. Moreover, the data structures within the contract state are incredibly difficult, and usually impossible, to reconstruct through the JSON-RPC layer. The problem is that these data structures tend to be he most interesting and pertinent data. Finally, the differences in tooling between interfaces can vary and involve niche querying languages. So users must not only familiarze themselves with a new interface and API, but often need to learn the querying language being used by the interface.

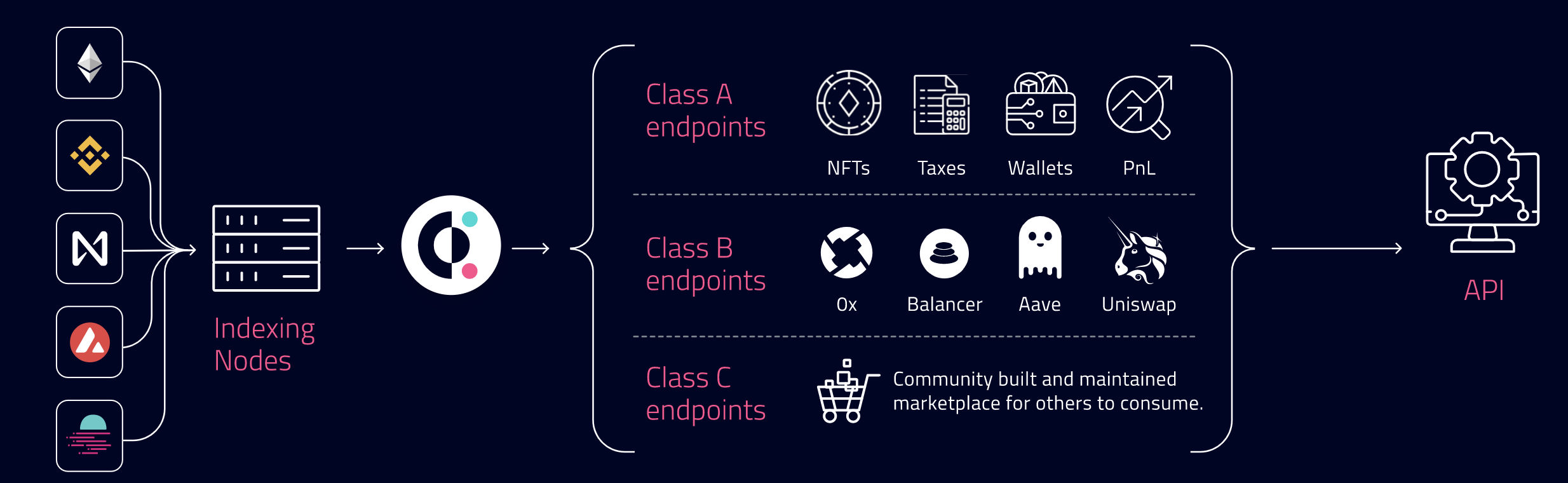

Covalent has developed a decentralized blockchain data infrastructure that resolves many of these issues. Their design enables high speed access to data in an easily accessible way and without the need for specialized hardware or large stores of memory. Covalent has actively indexed the entire Ethereum blockchain, including every contract state and every transaction, into a proprietary database and has transformed the data into a format that is standardized, interoperable, and easy to use. This infrastructure can supply robust blockchain data accurately and reliably through a unified API and in a truly enterprise-grade manner. Covalent's interface also uses standard SQL, which allows it to be an out-of-box solution that anyone can use.

Deeper Dive: a Decentralized Network of Blockchain Data

Covalent’s data model provides a unified, comprehensive, and canonical analytical representation of all blockchain data that is imported into it. The model normalizes data into a single representation and every data point on the blockchain (e.g each block, transaction) is included. In addition, this data model works for any blockchain so it is entirely chain agnostic. This is one of its most powerful features. The result is a system in which every blockchain type is ultimately transformed into a single polymorphic representation. The reason why this is important is that it allows theoretically any blockchain to be cross-queried. Other interfaces typically involve internal storage schemes that are slightly different for each blockchain, preventing them to be composable. Covalent's approach, however, enables cross-chain querying so the same query can be used for fundamentally different blockchain types. For instance, it enables the identical queries to be used on a Proof-of-Work and Proof-of-Stake transactions.

Currently, the Covalent team is responsible for building and bootstrapping this database. The problem with this approach, however, is that the success of the database relies entirely on the Covalent team to continue to move these efforts further. It also presents centralization risks and scaling limitations. In order to efficiently scale and to ensure no single point of failure for the centralized Covalent database, they are shifting to a decentralized model, the Covalent Network This also helps preserve maximum uptime and the lowest latency possible. The Covalent Network will resemble a virtual, global co-operative for blockchain data and will be governed by the protocol's native token, Covalent Query Token (CQT). This will enable the community to manage the Network in a decentralized manner and propose and submit upgrades that will ensure the longterm health of the protocol.

Mechanism Design and Tokenomics

$CQT (Covalent Query Token) is the native token of the Covalent Network and has governance and utility functionality. In general, there are three primary ways that the token be used. The first is limited governance. Token holders can submit proposals and vote to change the system parameters such as determining which data sources to include, indexing new networks like Optimism, or updating data modeling requirements. Token holders cannot, however, vote to change the protocol itself. The second application of $CQT is staking. Node validators can stake $CQT to participate in the Covalent network and earn fees for fulfilling queries in a performant manner. Moreover, token holders can delegate their stake if they do not want to run a node themselves. Finally, $CQT can function as a network access token that enables users to pay for services with it.

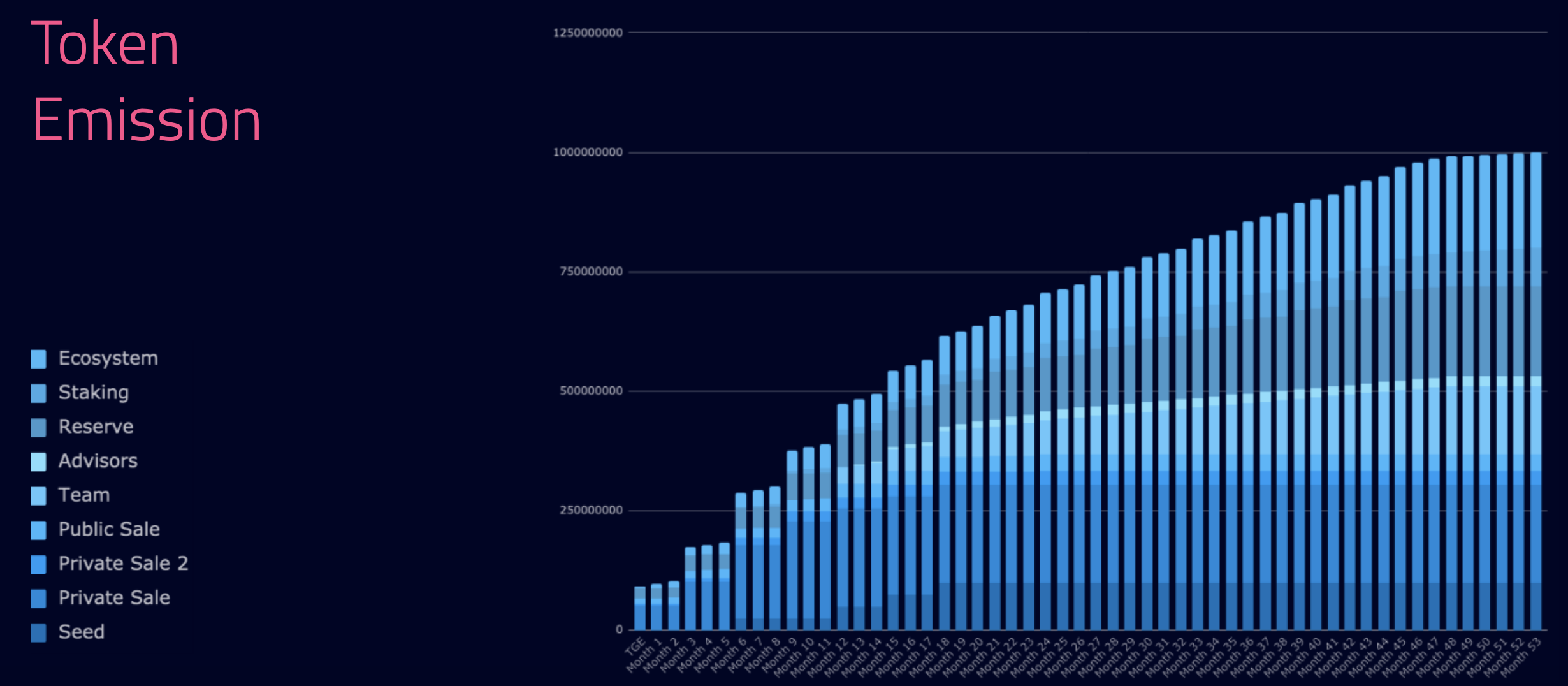

Users can earn 3%-20% APY from staking, depending upon the amount currently staked in the network. This design incentivizes upward pressure on node validator participation, as the rewards for joining increase as participation declines. Node validators can charge a commission fee to users that delegate their tokens to them. This further incentivizes users for running nodes and helps boost their total reward. To ensure network integrity, Covalent implements a system of bonding and slashing. Any node validator that acts maliciously can have their bond slashed. Overall, there are 1,000,000,000 total tokens at genesis mint. In terms of the token allocation, roughly 25% has been reserved for private sale, while 20% are reserved for ecosystem building and 20% are reserved for the core team and advisors.

Token emissions follow a 54-month schedule as follows:

Macro View

Currently the marketcap is approximately $44M, with a daily trading volume of $1.3M and a circulating supply of 310M tokens.

While the decentralization of the network is encouraged, Covalent must ensure that participants are properly incentivized to maintain it and to further develop it. Adding more blockchains to the database will be paramount to the protocol's longterm success, so this should be a high priority. In addition, there must be tight controls around curation to ensure the correctness of data and prevent erroneous or malicious data from entering the database. Developing a third-party actor that functions as a watchtower could be an effective way of proactively monitoring data integrity. A system of slashing may also help facilitate this end, whereby a watchtower agent could receive the bond of a node that provided incorrect data, whether intentionally or not.

In addition, utilizing $CQT as both a staking and revenue-functioning token helps create a close-looped economy and mitigate leakages from the system, as users do not have an alternative way of paying for services and node operators earn rewards in the form of tokens. A challenge with this approach, however, is allowing users of different networks to be able to acquire $CQT tokens without friction. Ultimately, a native Avalanche user ought to be able to pay for Covalent services as seamlessly as a native Ethereum user. One final consideration is opening the network to Web2 participants to gain wider adoption. This requires a system that optimizes fiat payment conversions while carefully maintaining the core utility functions of the token.

Further Reading and Resources

https://www.covalenthq.com/static/documents/Covalent%20Whitepaper%20Apr%202021%20v1%20Branded.pdf

https://www.covalenthq.com/blog/beginners-guide-to-covalent/

https://www.covalenthq.com/docs/network/covalent-query-token/covalent-network-staking/

Cryptofunds, market makers, and trading desks can interact with these DeFi protocols with MetaMask Institutional

MetaMask Institutional offers unrivalled access to the DeFi ecosystem without compromising on institution-required security, operational efficiency, or compliance. We enable funds to trade, stake, borrow, lend, invest, and interact with over 17,000 DeFi protocols and applications.

Learn more about MetaMask Institutional

Found this research useful? Connect with the Consensys Cryptoeconomic Research team at [email protected]

Return to the Cryptoeconomic Research Library

Consensys Software Inc. is not a registered or licensed advisor or broker. This report is for general informational purposes only. It does not constitute or contain any individual investment advice and is made without any regard to the recipient's objectives, financial situation, or means. It is not an offer to buy or sell, or a solicitation of any offer to buy, any token or other investment, nor is it intended to be used for marketing purposes to anyone in any jurisdiction. Consensys does not intend for any person or entity to rely on any facts, opinions, or ideas, and any financial or economic commentary expressed in this report may not be relied upon. Consensys makes no representations as to the accuracy, completeness, or timeliness of the information or opinions in this report and, along with its employees, does not assume any responsibility for any loss to any person or entity that may result from any act or omission based upon this report. This report is subject to correction, completion, and amendment without notice; however, Consensys has no obligation to do so.